Region:Global

Author(s):Dev

Product Code:KRAD0442

Pages:93

Published On:August 2025

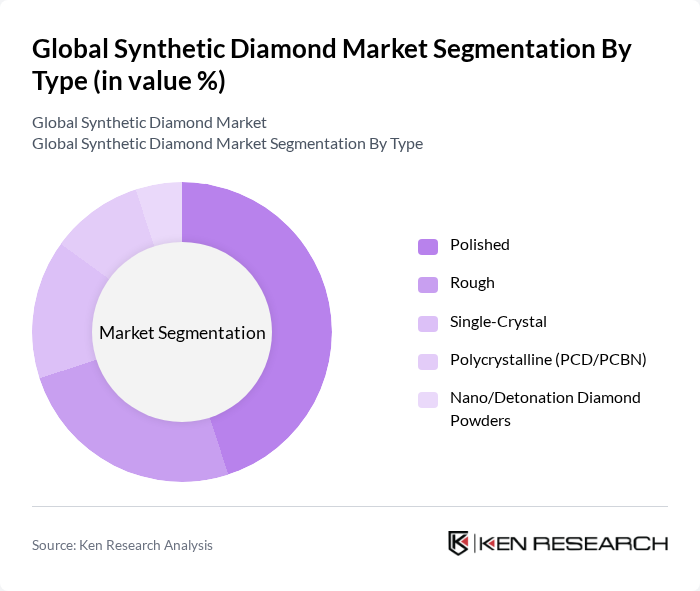

By Type:The market is segmented into various types, including Polished, Rough, Single-Crystal, Polycrystalline (PCD/PCBN), and Nano/Detonation Diamond Powders. Among these, the Polished segment dominates the market due to its extensive use in jewelry and fashion, driven by consumer preferences for aesthetically appealing products. The Rough segment also holds a significant share, primarily used in industrial applications.

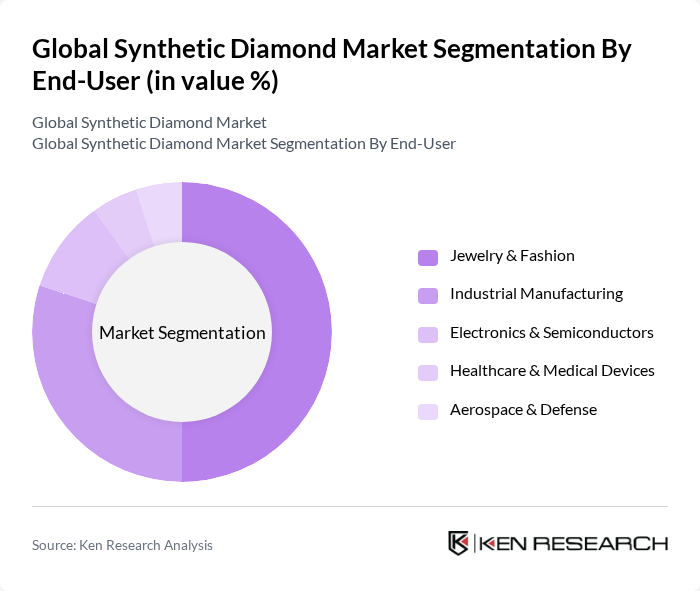

By End-User:The market is segmented into Jewelry & Fashion, Industrial Manufacturing, Electronics & Semiconductors, Healthcare & Medical Devices, and Aerospace & Defense. The Jewelry & Fashion segment is the leading end-user, driven by the growing trend of lab-grown diamonds as a sustainable and ethical alternative to mined diamonds. Industrial Manufacturing also plays a crucial role, utilizing synthetic diamonds for cutting and grinding applications.

The Global Synthetic Diamond Market is characterized by a dynamic mix of regional and international players. Leading participants such as Element Six (De Beers Group), Diamond Foundry Inc. (VRAI), WD Lab Grown Diamonds (WD Advanced Materials), IIa Technologies Pte Ltd, Zhengzhou Sino-Crystal Diamond Co., Ltd., Henan Huanghe Whirlwind Co., Ltd., New Diamond Technology, Alrosa – Technological Innovations (former NDT affiliate operations), ALTR Created Diamonds, Pure Grown Diamonds, Advanced Diamond Technologies (Abrisa/US Synthetic lineage), US Synthetic (A Berkshire Hathaway Company), Hyperion Materials & Technologies, ILJIN Diamond Co., Ltd., Sandvik AB (Diamond tooling), Applied Diamond, Inc., Scio Diamond Technology Corporation, HEYARU Group, Charles & Colvard, Ltd., Swarovski contribute to innovation, geographic expansion, and service delivery in this space.

The future of the synthetic diamond market appears promising, driven by increasing consumer demand for sustainable products and technological advancements in production methods. As more consumers prioritize ethical sourcing, the market is likely to see a shift towards lab-grown diamonds, particularly among younger demographics. Additionally, the rise of e-commerce platforms will facilitate broader access to synthetic diamonds, enhancing market penetration and consumer education about their benefits and quality.

| Segment | Sub-Segments |

|---|---|

| By Type | Polished Rough Single-Crystal Polycrystalline (PCD/PCBN) Nano/Detonation Diamond Powders |

| By End-User | Jewelry & Fashion Industrial Manufacturing Electronics & Semiconductors Healthcare & Medical Devices Aerospace & Defense |

| By Application | Cutting, Drilling, and Grinding Tools Abrasives and Polishing Thermal Management (Heat Spreaders, Sinks) Optical & Quantum (Windows, Lenses, NV Centers) Electronics (Substrates, Sensors) Others |

| By Sales Channel | B2B Direct (OEM/Industrial) Authorized Distributors Jewelry Retail – Online Jewelry Retail – Offline |

| By Manufacturing Process | HPHT (High Pressure High Temperature) CVD (Chemical Vapor Deposition) Hybrid/Other Processes |

| By Price Range (Jewelry-grade) | Budget Mid-range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Jewelry Retail Sector | 120 | Store Managers, Buyers, and Merchandisers |

| Industrial Applications | 100 | Procurement Managers, Operations Directors |

| Research and Development | 80 | Lead Scientists, R&D Managers |

| Consumer Insights | 100 | End-users, Jewelry Designers, and Influencers |

| Market Analysts | 60 | Industry Analysts, Market Researchers |

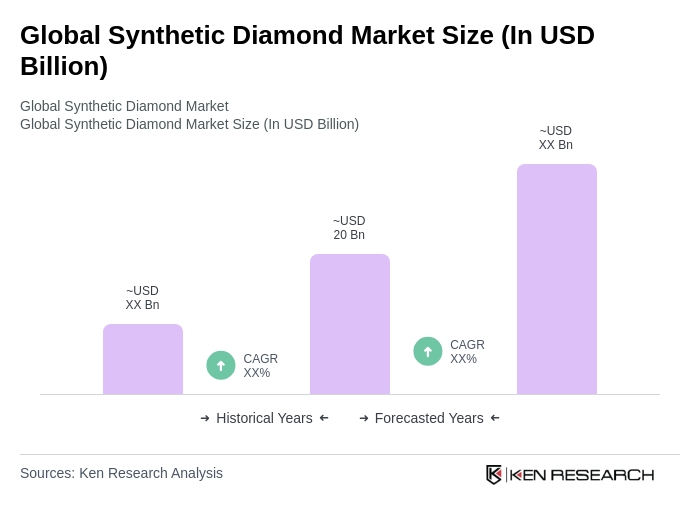

The Global Synthetic Diamond Market is valued at approximately USD 20 billion, driven by advancements in manufacturing technologies like HPHT and CVD, and increasing consumer demand for lab-grown diamonds as ethical and cost-effective alternatives in jewelry.