Region:Global

Author(s):Shubham

Product Code:KRAC0603

Pages:89

Published On:August 2025

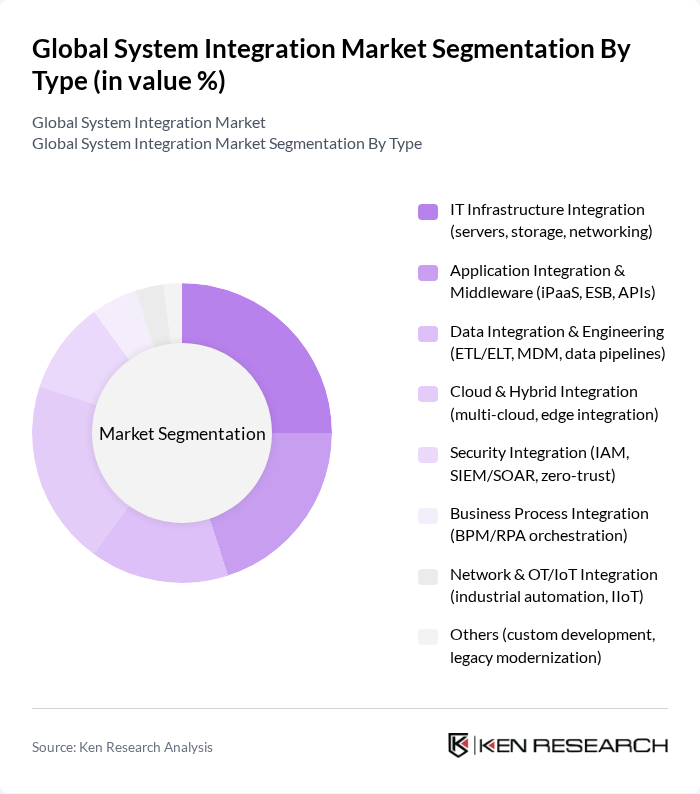

By Type:

The IT Infrastructure Integration segment is currently leading the market due to the increasing need for organizations to modernize their IT environments. This sub-segment encompasses essential components such as servers, storage, and networking, which are critical for supporting digital transformation initiatives. As businesses continue to adopt cloud solutions and enhance their IT capabilities, the demand for robust infrastructure integration services is expected to remain strong. The growing trend of remote work and the need for secure, scalable IT solutions further bolster this segment's dominance .

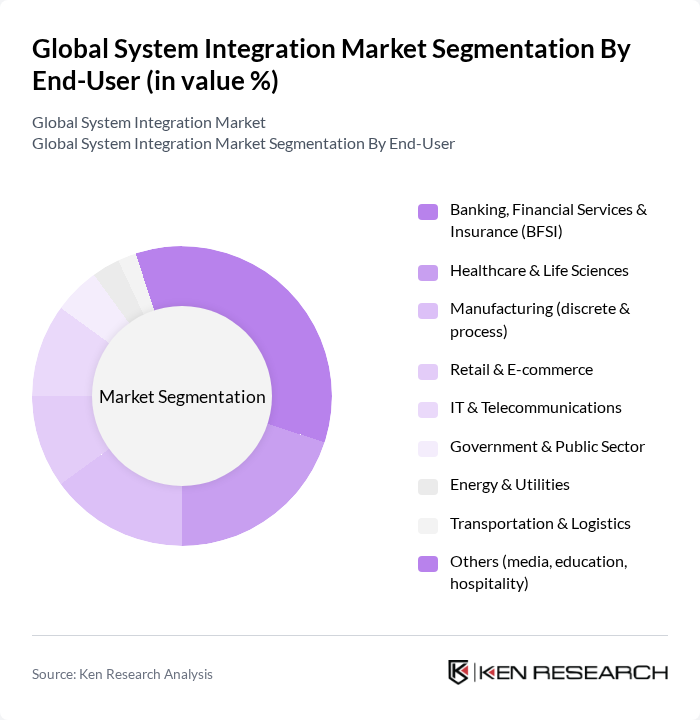

By End-User:

The Banking, Financial Services, and Insurance (BFSI) sector is the leading end-user in the system integration market, driven by the need for secure and efficient transaction processing, regulatory compliance, and enhanced customer experiences. Financial institutions are increasingly adopting integrated solutions to streamline operations, improve data management, and enhance security measures. The growing trend of digital banking and the need for real-time data analytics further contribute to the BFSI sector's dominance in the system integration landscape .

The Global System Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture plc, IBM Corporation, Capgemini SE, Deloitte (Deloitte Touche Tohmatsu Limited), Infosys Limited, Wipro Limited, Tata Consultancy Services (TCS), HCLTech (HCL Technologies Limited), Atos Group, CGI Inc., NTT DATA Corporation, Fujitsu Limited, Tech Mahindra Limited, LTIMindtree Limited, DXC Technology Company, Oracle Corporation (integration & consulting), SAP SE (integration services & partners), Cognizant Technology Solutions, Siemens (Siemens Digital Industries Software), Honeywell (Honeywell Connected Enterprise) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the system integration market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt agile methodologies, the demand for flexible integration solutions will rise. Furthermore, the integration of artificial intelligence and machine learning into systems will enhance decision-making capabilities. Companies will also prioritize sustainability, leading to the development of eco-friendly integration solutions that align with global environmental goals, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Infrastructure Integration (servers, storage, networking) Application Integration & Middleware (iPaaS, ESB, APIs) Data Integration & Engineering (ETL/ELT, MDM, data pipelines) Cloud & Hybrid Integration (multi-cloud, edge integration) Security Integration (IAM, SIEM/SOAR, zero-trust) Business Process Integration (BPM/RPA orchestration) Network & OT/IoT Integration (industrial automation, IIoT) Others (custom development, legacy modernization) |

| By End-User | Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Manufacturing (discrete & process) Retail & E-commerce IT & Telecommunications Government & Public Sector Energy & Utilities Transportation & Logistics Others (media, education, hospitality) |

| By Industry Vertical | Automotive & Aerospace Energy, Oil & Gas, and Utilities Defense & Security Education Pharmaceuticals & Biotechnology Smart Cities & Public Safety Others |

| By Service Type | Consulting & Architecture Implementation & Integration Support, Operations & Maintenance Managed & Outsourced Services Training & Change Management Others |

| By Deployment Mode | On-Premises Cloud Hybrid/Multi-Cloud Edge Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Pricing Model | Fixed-Price Projects Time & Materials Subscription/Managed Services (monthly/annual) Outcome-Based/Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare System Integration | 120 | IT Directors, Healthcare Administrators |

| Manufacturing Automation Solutions | 80 | Operations Managers, Systems Engineers |

| Financial Services Integration | 90 | Chief Technology Officers, Compliance Officers |

| Smart City Infrastructure | 70 | Urban Planners, IT Infrastructure Managers |

| Retail Technology Integration | 85 | Retail Operations Managers, E-commerce Directors |

The Global System Integration Market is valued at approximately USD 460 billion, driven by the increasing demand for automation, digital transformation, and the integration of advanced technologies like IoT and AI across various sectors.