Region:Global

Author(s):Rebecca

Product Code:KRAA1349

Pages:84

Published On:August 2025

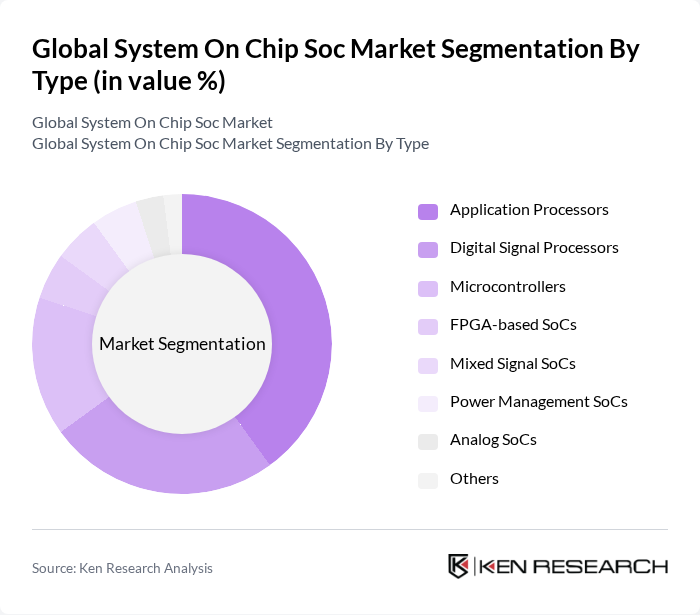

By Type:The SoC market is segmented into various types, including Application Processors, Digital Signal Processors, Microcontrollers, FPGA-based SoCs, Mixed Signal SoCs, Power Management SoCs, Analog SoCs, and Others. Among these, Application Processors lead the market due to their extensive use in smartphones and tablets, driven by the demand for high-performance computing and multimedia capabilities. Digital Signal Processors are also gaining traction, particularly in audio and video processing applications. The increasing integration of AI and machine learning capabilities into SoCs, especially in application processors and microcontrollers, is a notable trend, supporting advanced functionalities in mobile and edge devices.

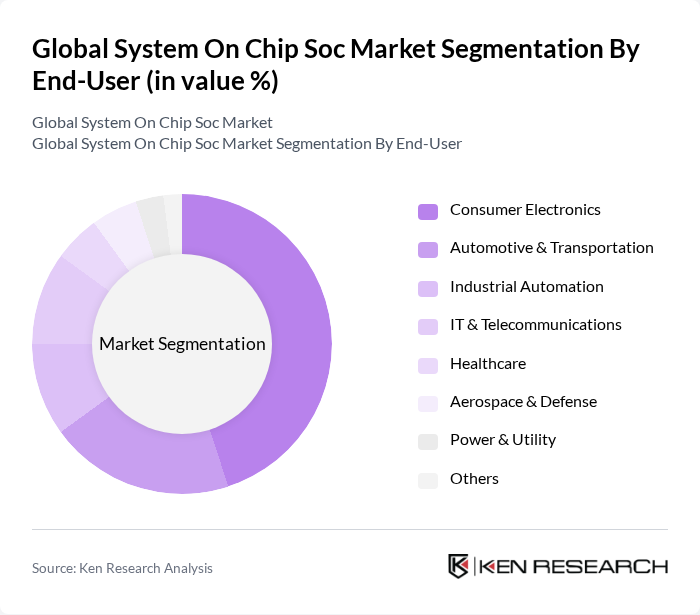

By End-User:The SoC market is also segmented by end-user applications, including Consumer Electronics, Automotive & Transportation, Industrial Automation, IT & Telecommunications, Healthcare, Aerospace & Defense, Power & Utility, and Others. The Consumer Electronics segment dominates the market, driven by the increasing adoption of smart devices and the demand for high-performance computing in smartphones, tablets, and smart home devices. The Automotive sector is also witnessing significant growth due to the rise of electric vehicles, advanced driver-assistance systems (ADAS), and the integration of infotainment and telematics systems. Industrial automation and IT & Telecommunications are further propelling demand as industries adopt IoT, 5G, and edge computing solutions.

The Global System On Chip Soc Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qualcomm Technologies, Inc., Intel Corporation, NVIDIA Corporation, Texas Instruments Incorporated, Broadcom Inc., MediaTek Inc., Samsung Electronics Co., Ltd., STMicroelectronics N.V., Advanced Micro Devices, Inc. (AMD), NXP Semiconductors N.V., Infineon Technologies AG, Renesas Electronics Corporation, Cypress Semiconductor Corporation (now part of Infineon Technologies AG), onsemi (formerly ON Semiconductor Corporation), Analog Devices, Inc., Apple Inc., Marvell Technology, Inc., Realtek Semiconductor Corp., Xilinx, Inc. (now part of AMD), Unisoc (Shanghai Unisoc Technologies Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SoC market appears promising, driven by continuous technological advancements and increasing integration of AI capabilities. As industries increasingly adopt IoT and 5G technologies, the demand for efficient, high-performance SoCs will rise. Furthermore, the automotive sector's shift towards electric and autonomous vehicles will create new opportunities for SoC applications, enhancing overall market growth. Companies that can innovate and adapt to these trends will likely thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Application Processors Digital Signal Processors Microcontrollers FPGA-based SoCs Mixed Signal SoCs Power Management SoCs Analog SoCs Others |

| By End-User | Consumer Electronics Automotive & Transportation Industrial Automation IT & Telecommunications Healthcare Aerospace & Defense Power & Utility Others |

| By Application | Mobile Devices Smart Home Devices Wearable Devices Automotive Systems (ADAS, Infotainment, Autonomous Driving) Industrial Equipment Networking Equipment Medical Devices RF Devices Power Electronic Devices Others |

| By Component | Processors (CPU, GPU, NPU) Memory (RAM, ROM, Flash) Connectivity Modules (Wi-Fi, Bluetooth, 5G) Sensors (IMU, Environmental, Biometric) Power Management Units Radio Modems Others |

| By Sales Channel | Direct Sales Distributors Online Retail Value-Added Resellers Others |

| By Distribution Mode | B2B B2C Others |

| By Price Range | Low-End SoCs Mid-Range SoCs High-End SoCs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics SoC Development | 120 | Product Managers, R&D Engineers |

| Automotive SoC Integration | 90 | Automotive Engineers, Supply Chain Managers |

| IoT Device SoC Applications | 60 | IoT Solutions Architects, Product Development Leads |

| Telecommunications SoC Innovations | 50 | Network Engineers, Technology Strategists |

| Healthcare Device SoC Utilization | 40 | Biomedical Engineers, Regulatory Affairs Specialists |

The Global System On Chip (SoC) market is valued at approximately USD 170 billion, driven by the increasing demand for integrated circuits in consumer electronics, automotive applications, and IoT devices.