Region:Global

Author(s):Shubham

Product Code:KRAB0546

Pages:88

Published On:August 2025

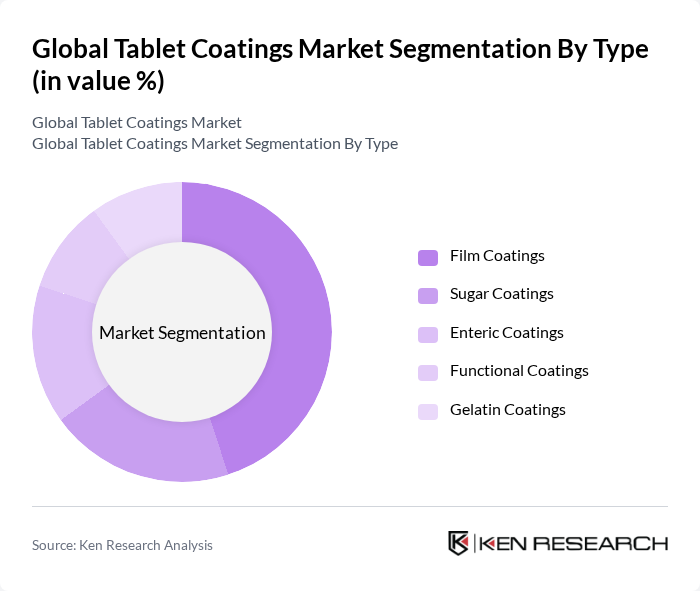

By Type:The tablet coatings market is segmented into various types, including Film Coatings, Sugar Coatings, Enteric Coatings, Functional Coatings (e.g., Sustained/Controlled Release, Moisture Barrier, Odor/Taste Masking), and Gelatin Coatings. Among these, Film Coatings are the most widely used due to their versatility, ease of application, and ability to provide a protective barrier against environmental factors. The demand for Film Coatings is driven by their effectiveness in enhancing the stability and bioavailability of active pharmaceutical ingredients.

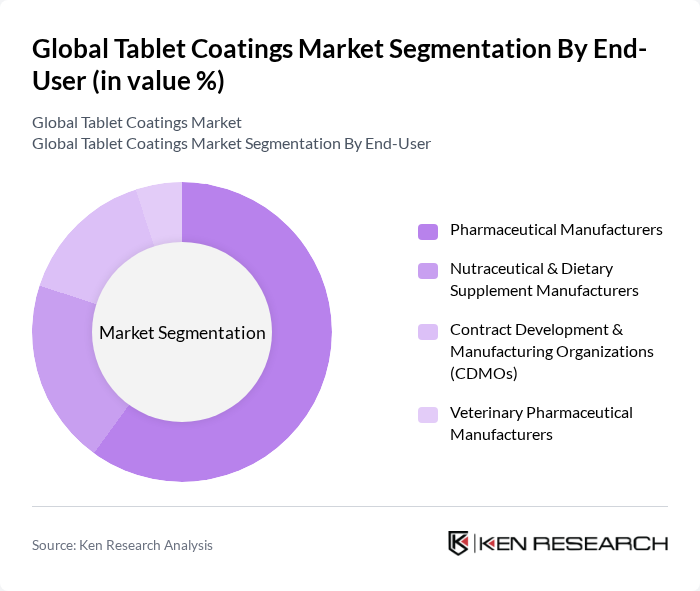

By End-User:The end-user segmentation includes Pharmaceutical Manufacturers, Nutraceutical & Dietary Supplement Manufacturers, Contract Development & Manufacturing Organizations (CDMOs), and Veterinary Pharmaceutical Manufacturers. Pharmaceutical Manufacturers dominate this segment, driven by the increasing demand for innovative drug formulations and the need for effective delivery systems. The rise in chronic diseases and the growing focus on patient-centric therapies further bolster the demand for tablet coatings in this sector.

The Global Tablet Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Colorcon, Inc., Evonik Industries AG, Dow Inc., Ashland Inc., Shin-Etsu Chemical Co., Ltd., HPMC Co., Ltd. (Huzhou Zhanwang Pharmaceutical Co., Ltd.), Ideal Cures Pvt. Ltd., ACG, Sensient Technologies Corporation (Sensient Pharma Colors), Kerry Group plc (via Niacet/IFOAMers for excipients), Roquette Frères, JRS PHARMA (J. Rettenmaier & Söhne), Eastman Chemical Company, Wacker Chemie AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tablet coatings market appears promising, driven by technological advancements and increasing consumer health awareness. The integration of digital technologies in manufacturing processes is expected to enhance efficiency and reduce costs. Additionally, the shift towards personalized medicine will create demand for tailored coating solutions, allowing for improved patient outcomes. As sustainability becomes a priority, eco-friendly coatings will likely gain traction, aligning with global environmental goals and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Film Coatings Sugar Coatings Enteric Coatings Functional Coatings (e.g., Sustained/Controlled Release, Moisture Barrier, Odor/Taste Masking) Gelatin Coatings |

| By End-User | Pharmaceutical Manufacturers Nutraceutical & Dietary Supplement Manufacturers Contract Development & Manufacturing Organizations (CDMOs) Veterinary Pharmaceutical Manufacturers |

| By Application | Immediate-Release Tablets Modified-Release Tablets (Enteric, Delayed, Sustained) Chewable & Orally Disintegrating Tablets (ODTs) Effervescent & Multilayer Tablets |

| By Distribution Channel | Direct Sales to Manufacturers Authorized Distributors Online/B2B Procurement Platforms System Integrators & Equipment OEM Partnerships |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Polymer/Material | Cellulosic Polymers (e.g., HPMC, HPMCAS, HPC) Acrylic Polymers (e.g., Methacrylic Acid Copolymers/Eudragit) Vinyl Derivatives (e.g., PVA, PVdC) Others (e.g., PEG, Polysaccharides, Calcium Carbonate Opacifiers, TiO2-free Systems) |

| By Process Technology | Batch Pan Coating Continuous Coating Aqueous vs. Solvent-Based Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 140 | Production Managers, R&D Directors |

| Coating Material Suppliers | 90 | Sales Managers, Product Development Specialists |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Managers |

| Contract Manufacturing Organizations (CMOs) | 80 | Operations Managers, Quality Control Supervisors |

| Research Institutions | 60 | Research Scientists, Academic Professors |

The Global Tablet Coatings Market is valued at approximately USD 900 million, driven by the increasing demand for pharmaceutical products and advancements in coating technologies, particularly in response to the rising prevalence of chronic diseases.