Global Tactical UAV Market Overview

- The Global Tactical UAV Market is valued at USD 5.7 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in drone technology, including the integration of electric propulsion, artificial intelligence, and automation, as well as increasing military expenditure and the rising demand for surveillance and reconnaissance capabilities across defense, border security, and critical infrastructure sectors. The adoption of AI and machine learning has enhanced operational efficiency, enabling real-time data analytics, autonomous mission execution, and improved situational awareness, making tactical UAVs indispensable in both military and select civilian applications .

- Key players in this market include the United States, China, and Israel, which dominate due to their robust defense budgets, technological advancements, and extensive research and development in UAV technologies. The presence of leading manufacturers and a strong focus on innovation in these countries contribute significantly to their market leadership, enabling them to meet both military and commercial demands effectively .

- In 2023, the U.S. government implemented new regulations to streamline the integration of tactical UAVs into national airspace. TheRemote Identification of Unmanned Aircraft Rule (14 CFR Part 89) issued by the Federal Aviation Administration (FAA) in 2021mandates that all UAVs operating in controlled airspace must comply with specific safety and operational standards, including remote identification and real-time tracking capabilities. This regulation enhances airspace security and facilitates the safe operation of UAVs alongside manned aircraft by requiring manufacturers and operators to implement broadcast and network-based identification solutions .

Global Tactical UAV Market Segmentation

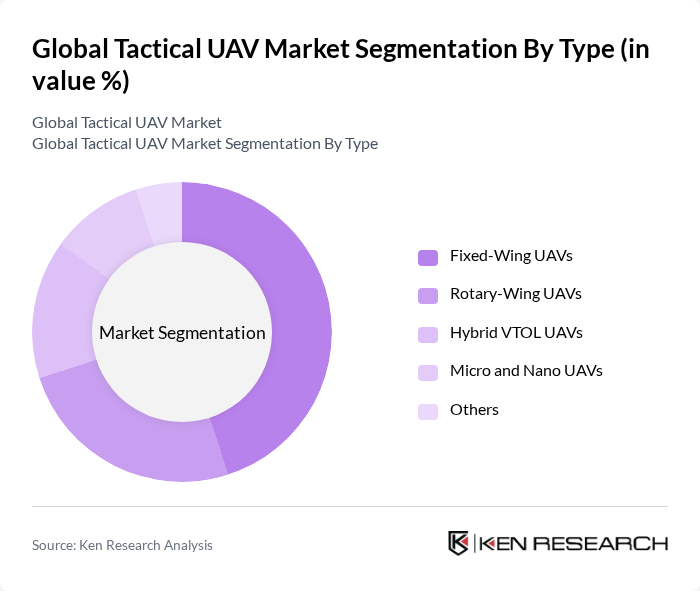

By Type:

The Tactical UAV market is segmented into Fixed-Wing UAVs, Rotary-Wing UAVs, Hybrid VTOL UAVs, Micro and Nano UAVs, and Others. Among these,Fixed-Wing UAVsdominate the market due to their longer flight endurance, greater range, and higher payload capacity, making them ideal for surveillance and reconnaissance missions. Demand for these UAVs is primarily driven by military applications, where extended operational capabilities are crucial. Recent technological advancements, such as improved battery technology and lightweight composite materials, have further enhanced the efficiency and effectiveness of Fixed-Wing UAVs, reinforcing their market leadership .

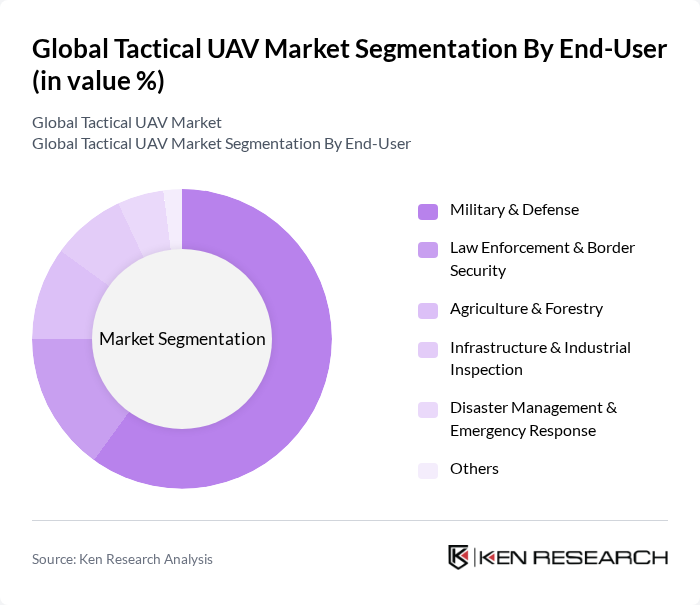

By End-User:

The Tactical UAV market is segmented into Military & Defense, Law Enforcement & Border Security, Agriculture & Forestry, Infrastructure & Industrial Inspection, Disaster Management & Emergency Response, and Others. TheMilitary & Defensesector leads the market, driven by the increasing need for advanced surveillance, target acquisition, and reconnaissance capabilities. The growing focus on unmanned systems in military operations has resulted in significant investments in UAV technology, making it the primary end-user segment in the Tactical UAV market. Additionally, law enforcement and border security agencies are increasingly adopting tactical UAVs for real-time situational awareness and rapid response operations .

Global Tactical UAV Market Competitive Landscape

The Global Tactical UAV Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Atomics Aeronautical Systems, Inc., Northrop Grumman Corporation, Boeing Defense, Space & Security, Lockheed Martin Corporation, Textron Inc., Elbit Systems Ltd., Thales Group, Airbus Defence and Space, Raytheon Technologies Corporation, Insitu Inc., AeroVironment, Inc., Parrot SA, DJI Technology Co., Ltd., BAE Systems plc, Kratos Defense & Security Solutions, Inc., Leonardo S.p.A., Israel Aerospace Industries Ltd., Turkish Aerospace Industries (TAI), Saab AB, Embraer Defense & Security contribute to innovation, geographic expansion, and service delivery in this space.

Global Tactical UAV Market Industry Analysis

Growth Drivers

- Increasing Demand for Surveillance and Reconnaissance:The global tactical UAV market is experiencing heightened demand for surveillance and reconnaissance capabilities, driven by geopolitical tensions and security threats. In future, global military spending is projected to reach approximately $2.2 trillion, with a significant portion allocated to UAV technologies. Countries like the U.S. and China are investing heavily in UAV systems, with the U.S. alone spending over $1.6 billion on tactical UAVs, reflecting the critical need for enhanced situational awareness in defense operations.

- Advancements in UAV Technology:Technological innovations are propelling the tactical UAV market forward, with advancements in sensor technology, battery life, and data processing capabilities. In future, the global UAV technology market is expected to exceed $32 billion, with a substantial focus on miniaturization and improved payload capacities. These advancements enable UAVs to perform complex missions, such as real-time data collection and analysis, which are essential for modern military and commercial applications, thereby driving market growth.

- Rising Defense Budgets Globally:The increase in defense budgets worldwide is a significant growth driver for the tactical UAV market. In future, defense spending in Europe is projected to rise by 5% to approximately $525 billion, reflecting a renewed focus on military capabilities. This trend is mirrored in Asia-Pacific, where countries like India and Japan are increasing their defense expenditures, further fueling investments in UAV systems. Such financial commitments are vital for the development and procurement of advanced UAV technologies.

Market Challenges

- Regulatory Hurdles and Airspace Restrictions:Regulatory challenges pose significant barriers to the tactical UAV market, particularly concerning airspace management and operational regulations. In future, the FAA is expected to enforce stricter regulations on UAV operations, impacting commercial and military applications. These regulations can delay deployment timelines and increase compliance costs, hindering market growth. Additionally, airspace restrictions in urban areas limit the operational scope of UAVs, complicating their integration into existing air traffic systems.

- High Initial Investment Costs:The high initial investment required for tactical UAV systems remains a critical challenge. In future, the average cost of advanced tactical UAVs is estimated to be around $2.1 million, which can deter smaller defense contractors and commercial entities from entering the market. This financial barrier limits the adoption of UAV technologies, particularly in emerging markets where budget constraints are prevalent. Consequently, the high cost of entry can stifle innovation and competition within the industry.

Global Tactical UAV Market Future Outlook

The future of the tactical UAV market appears promising, driven by technological advancements and increasing defense budgets. As nations prioritize surveillance capabilities, the integration of AI and machine learning into UAV systems is expected to enhance operational efficiency and decision-making. Furthermore, the collaboration between military and commercial sectors will likely foster innovation, leading to the development of versatile UAV applications. This synergy will create a dynamic environment for growth, positioning the tactical UAV market for significant advancements in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present substantial opportunities for tactical UAV growth. Countries in Southeast Asia and Africa are increasingly investing in UAV technologies for surveillance and agricultural applications. With a projected increase in defense budgets in these regions, estimated at 11% annually, the demand for tactical UAVs is expected to rise significantly, creating new market avenues for manufacturers and service providers.

- Integration with AI and Machine Learning:The integration of AI and machine learning into UAV systems offers transformative potential for the tactical UAV market. In future, the AI in UAV market is expected to reach $6 billion, enhancing capabilities such as autonomous navigation and real-time data analysis. This technological synergy will not only improve operational efficiency but also expand the range of applications, from military operations to disaster response, driving further market growth.