Region:Global

Author(s):Dev

Product Code:KRAC0354

Pages:81

Published On:August 2025

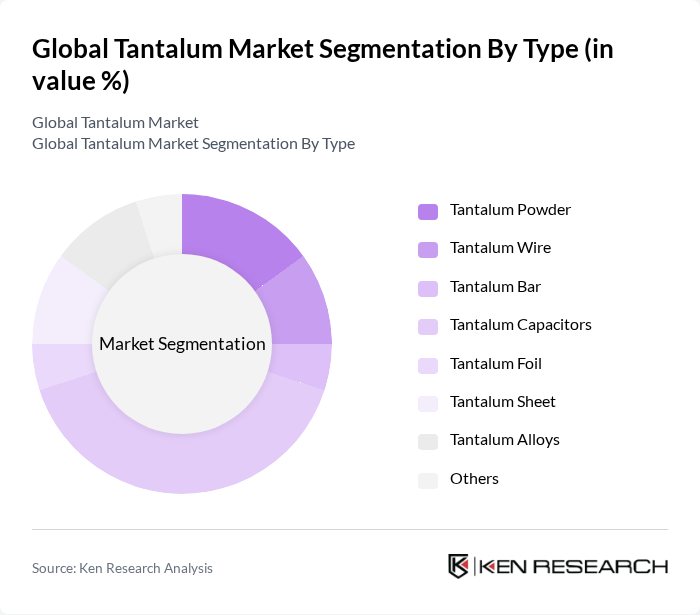

By Type:The tantalum market can be segmented into various types, including Tantalum Powder, Tantalum Wire, Tantalum Bar, Tantalum Capacitors, Tantalum Foil, Tantalum Sheet, Tantalum Alloys, and Others. Among these, Tantalum Capacitors are the most dominant due to their extensive use in electronic devices, where they provide high capacitance in a small volume, catering to the growing demand for compact electronic components. The market also sees notable growth in tantalum alloys and powder forms, driven by expanding applications in additive manufacturing and high-performance aerospace components.

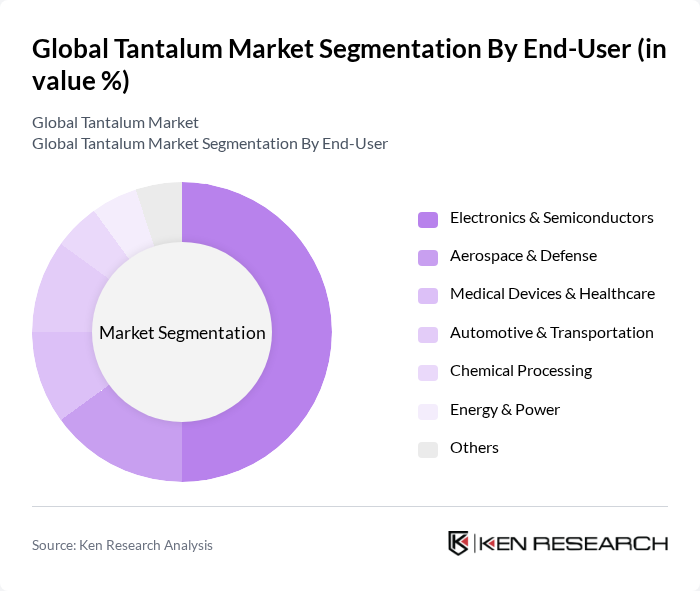

By End-User:The end-user segments for tantalum include Electronics & Semiconductors, Aerospace & Defense, Medical Devices & Healthcare, Automotive & Transportation, Chemical Processing, Energy & Power, and Others. The Electronics & Semiconductors segment leads the market, driven by the increasing demand for tantalum capacitors in smartphones, laptops, and other electronic devices, which require high reliability and performance. Aerospace & Defense is also a significant segment, leveraging tantalum's ability to withstand extreme temperatures and pressures in turbine blades and missile components. Medical Devices & Healthcare benefit from tantalum's biocompatibility, supporting its use in surgical implants and equipment.

The Global Tantalum Market is characterized by a dynamic mix of regional and international players. Leading participants such as KEMET Corporation, AVX Corporation (Kyocera AVX), Global Advanced Metals Pty Ltd, Pilbara Minerals Limited, AMG Advanced Metallurgical Group N.V., Ningxia Orient Tantalum Industry Co., Ltd., H.C. Starck GmbH, Minsur S.A. (Mineração Taboca S.A.), Alliance Mineral Assets Limited, Vishay Intertechnology, Inc., Panasonic Corporation, Hongda Electronics Corp, Tantalum Mining Corporation of Canada Limited, Jiangxi Dinghai Tantalum & Niobium Co., Ltd., Tanshan Jincheng Tantalum & Niobium Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tantalum market appears promising, driven by technological advancements and increasing applications across various sectors. As industries prioritize sustainability, the shift towards recycling tantalum will gain momentum, potentially reducing reliance on mined materials. Additionally, the expansion of electric vehicle production will create new demand for tantalum components, particularly in batteries and electronic systems. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Tantalum Powder Tantalum Wire Tantalum Bar Tantalum Capacitors Tantalum Foil Tantalum Sheet Tantalum Alloys Others |

| By End-User | Electronics & Semiconductors Aerospace & Defense Medical Devices & Healthcare Automotive & Transportation Chemical Processing Energy & Power Others |

| By Application | Capacitors Superalloys Sputtering Targets Chemical Processing Equipment Orthopedic & Dental Implants Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Manufacturing | 100 | Product Managers, Supply Chain Analysts |

| Aerospace Applications | 75 | Engineering Managers, Procurement Specialists |

| Medical Device Production | 60 | Quality Assurance Managers, Regulatory Affairs Officers |

| Tantalum Recycling Initiatives | 50 | Sustainability Managers, Operations Directors |

| Research and Development in Tantalum Applications | 40 | R&D Managers, Technical Directors |

The Global Tantalum Market is valued at approximately USD 420 million, driven by increasing demand in electronics, aerospace, and medical applications, as well as advancements in battery technologies and electric vehicle adoption.