Region:Global

Author(s):Dev

Product Code:KRAD0543

Pages:81

Published On:August 2025

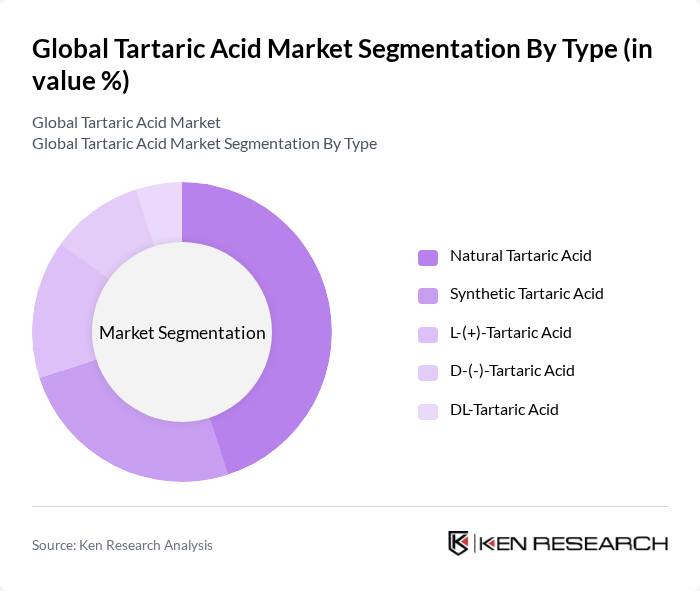

By Type:The market is segmented into various types of tartaric acid, including Natural Tartaric Acid, Synthetic Tartaric Acid, L-(+)-Tartaric Acid, D-(-)-Tartaric Acid, and DL-Tartaric Acid. Natural Tartaric Acid is gaining traction as wineries and food processors prefer grape-derived sources for clean-label positioning, while maleic anhydride–based routes supply synthetic grades for consistent purity and cost efficiency. Demand for L-(+)-Tartaric Acid is notable in pharmaceuticals as a chiral resolving agent and excipient in effervescent tablets and salts.

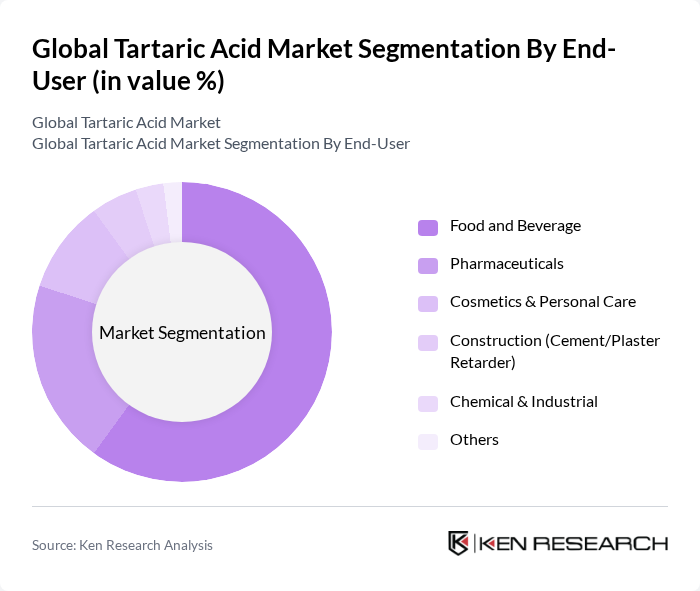

By End-User:The end-user segments include Food and Beverage, Pharmaceuticals, Cosmetics & Personal Care, Construction (Cement/Plaster Retarder), Chemical & Industrial, and Others. The Food and Beverage sector is the leading segment due to wine acidification/stabilization, baking applications (cream of tartar), and beverage acidulation; industry sources indicate food and beverage is the largest share of consumption globally. The Pharmaceuticals segment is also significant with usage in effervescent formulations and as a chiral agent.

The Global Tartaric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tarac Technologies Pty Ltd, Distillerie Mazzari S.p.A., Derivados Vínicos S.A. (Portugal), Actylis (formerly Aceto) – Tartaric Acid Portfolio, Anhui Sealong Biotechnology Co., Ltd., Caviro Extra S.p.A., Polsinelli Enologia Srl, American Tartaric Products Inc., Merck KGaA (Food/Pharma Grade Tartaric Acid), ATPGroup (Enological Supplies), Changmao Biochemical Engineering Co., Ltd., Thirumalai Chemicals Ltd., Vinicas S.A., Laffort, Tartaros Gonzalo Castelló, S.L. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tartaric acid market appears promising, driven by increasing consumer preferences for natural and organic products. As health consciousness rises, manufacturers are likely to focus on sustainable sourcing and innovative production techniques. Additionally, the expansion of the food and beverage sector in emerging economies will create new opportunities for growth. Companies that adapt to these trends and invest in quality improvements will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Tartaric Acid Synthetic Tartaric Acid L-(+)-Tartaric Acid D-(-)-Tartaric Acid DL-Tartaric Acid |

| By End-User | Food and Beverage Pharmaceuticals Cosmetics & Personal Care Construction (Cement/Plaster Retarder) Chemical & Industrial Others |

| By Application | Wine Production & Must/Acidity Adjustment Baking Powder/Leavening Agent Confectionery & Beverages (Acidulant/Flavor Enhancer) Pharmaceutical Excipients & Chiral Intermediates Cosmetics Exfoliants (AHA) Construction Set Retarder & Admixtures Others |

| By Distribution Channel | Direct/Bulk Sales (B2B) Distributors/Channel Partners Online/B2B Marketplaces Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging (25 kg, 500–1000 kg FIBCs) Retail/Small Packs Others |

| By Price Range | Economy Mid-Range Premium |

| By Grade | Food Grade Pharmaceutical Grade Industrial/Technical Grade |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Applications | 120 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Industry Usage | 90 | Regulatory Affairs Managers, R&D Scientists |

| Cosmetic and Personal Care Products | 70 | Formulation Chemists, Brand Managers |

| Industrial Applications | 60 | Procurement Managers, Operations Directors |

| Export and Trade Analysis | 50 | Trade Analysts, Export Managers |

The Global Tartaric Acid Market is valued at approximately USD 390 million, based on a five-year historical analysis. This valuation reflects the demand across various sectors, including food and beverage, pharmaceuticals, and cosmetics.