Region:Global

Author(s):Shubham

Product Code:KRAC0711

Pages:93

Published On:August 2025

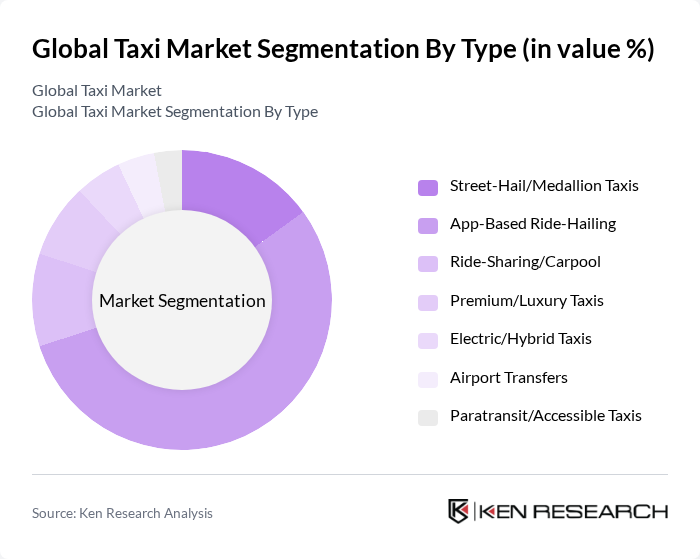

By Type:The taxi market is segmented into various types, including Street-Hail/Medallion Taxis, App-Based Ride-Hailing, Ride-Sharing/Carpool, Premium/Luxury Taxis, Electric/Hybrid Taxis, Airport Transfers, and Paratransit/Accessible Taxis. Among these, App-Based Ride-Hailing has emerged as the dominant segment due to its convenience, user-friendly interfaces, and widespread smartphone adoption, with online bookings now representing a leading channel for taxi and ride-hailing demand across major regions .

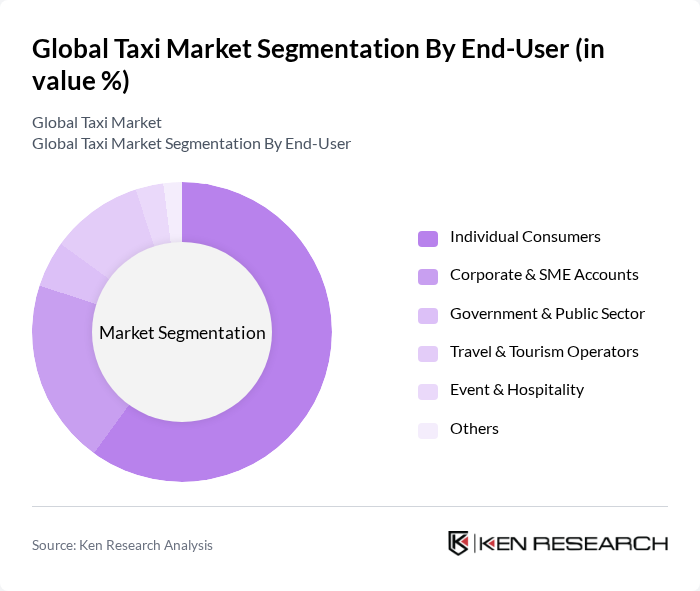

By End-User:The market is segmented by end-user into Individual Consumers, Corporate & SME Accounts, Government & Public Sector, Travel & Tourism Operators, Event & Hospitality, and Others. Individual Consumers represent the largest segment, driven by frequent commuting, urban leisure travel, and on?demand usage patterns enabled by mobile platforms. Corporate accounts remain significant due to managed travel programs and expense-integrated bookings across ride-hailing and traditional taxi providers .

The Global Taxi Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uber Technologies, Inc., Lyft, Inc., Beijing Xiaoju Technology Co., Ltd. (DiDi), ANI Technologies Pvt. Ltd. (Ola Cabs), Grab Holdings Inc., Bolt Technology OÜ, Gett, Inc., Curb Mobility, LLC, FREE NOW (Joint Venture of BMW Group and Mercedes-Benz Mobility), Yandex Go (formerly Yandex.Taxi), GoTo Gojek Tokopedia Tbk (Gojek), Maxi Mobility Spain, S.L. (Cabify), BlaBlaCar, Via Transportation, Inc., Dubai Taxi Company PJSC contribute to innovation, geographic expansion, and service delivery in this space .

The future of the taxi market is poised for transformation, driven by technological innovations and changing consumer preferences. As urbanization continues, the demand for efficient and accessible transportation will grow. The integration of electric vehicles and autonomous technologies is expected to reshape service offerings, enhancing sustainability and operational efficiency. Additionally, partnerships with technology providers will facilitate the development of advanced mobility solutions, ensuring that taxi services remain competitive in an evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Street-Hail/Medallion Taxis App-Based Ride-Hailing Ride-Sharing/Carpool Premium/Luxury Taxis Electric/Hybrid Taxis Airport Transfers Paratransit/Accessible Taxis |

| By End-User | Individual Consumers Corporate & SME Accounts Government & Public Sector Travel & Tourism Operators Event & Hospitality Others |

| By Service Model | On-Demand (Real-Time Booking) Pre-Booked/Dispatch Subscription/Corporate Contracts Others |

| By Vehicle Type | Sedans SUVs MPVs/Vans Motorcycles/Two-Wheelers Others |

| By Payment Method | Cash Cards (Credit/Debit) Mobile Wallets/UPI Others |

| By Geographic Coverage | Urban Suburban Rural Airport/Intercity Corridors |

| By Customer Segment | Business Travelers Tourists Local Residents/Commuters Students & Youth |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Taxi Fleet Operators | 100 | Fleet Managers, Business Owners |

| Taxi Drivers | 140 | Independent Drivers, Company Drivers |

| Ride-Hailing Service Users | 120 | Frequent Users, Occasional Users |

| Urban Transportation Planners | 80 | City Planners, Policy Makers |

| Taxi Industry Experts | 50 | Consultants, Academics |

The Global Taxi Market is valued at approximately USD 250 billion, driven by increasing demand for convenient transportation solutions, urbanization, and the rise of app-based ride-hailing services, which significantly contribute to global trips and revenue.