Region:Global

Author(s):Dev

Product Code:KRAA9527

Pages:82

Published On:November 2025

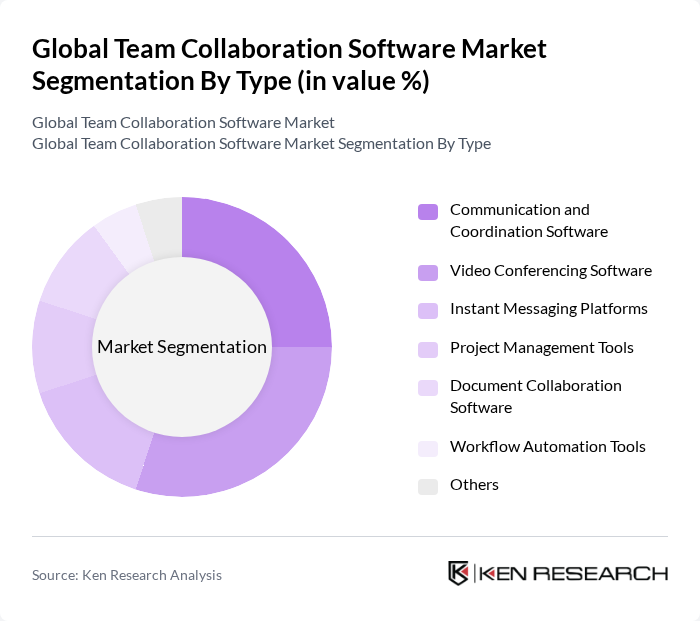

By Type:The market is segmented into various types of collaboration software, including Communication and Coordination Software, Video Conferencing Software, Instant Messaging Platforms, Project Management Tools, Document Collaboration Software, Workflow Automation Tools, and Others. Each of these sub-segments plays a vital role in enhancing team productivity and streamlining workflows. Cloud-based solutions are increasingly preferred for their scalability, integration capabilities, and cost efficiency.

TheVideo Conferencing Softwaresegment is currently dominating the market due to the surge in remote work and virtual meetings. The COVID-19 pandemic significantly accelerated the adoption of video conferencing tools, as organizations sought effective ways to maintain communication and collaboration among distributed teams. This trend has led to a growing preference for platforms that offer high-quality video and audio capabilities, user-friendly interfaces, and integration with other collaboration tools.

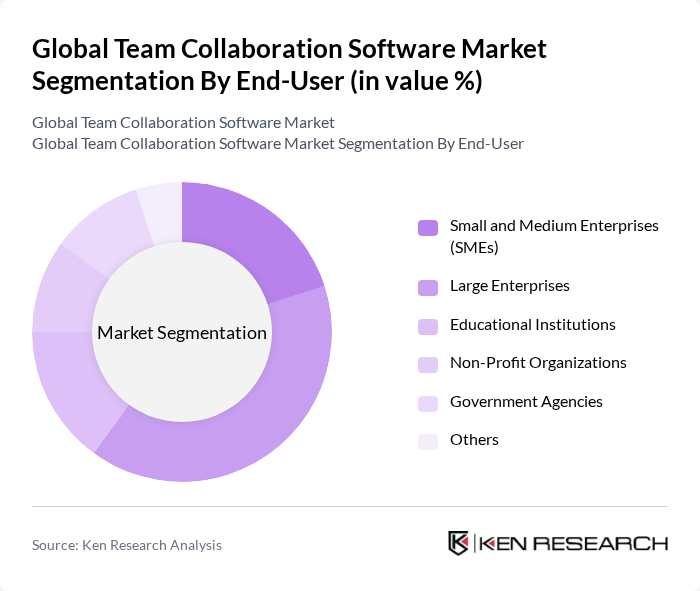

By End-User:The market is segmented by end-users, including Small and Medium Enterprises (SMEs), Large Enterprises, Educational Institutions, Non-Profit Organizations, Government Agencies, and Others. Each segment has unique requirements and preferences for collaboration tools, influencing their adoption rates. SMEs are increasingly adopting cloud-based and integrated collaboration platforms to support hybrid work models and improve productivity, while large enterprises require advanced security, scalability, and integration features.

Large Enterprisesare leading the market due to their extensive resources and the need for comprehensive collaboration solutions that can support large teams and complex projects. These organizations often require advanced features such as integration with existing systems, enhanced security protocols, and scalability, which are critical for managing their operations effectively.

The Global Team Collaboration Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Teams, Slack Technologies, Zoom Video Communications, Google Workspace, Cisco Webex, Asana, Monday.com, Atlassian (Jira and Confluence), Trello, ClickUp, Wrike, Notion Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of team collaboration software is poised for transformative growth, driven by technological advancements and evolving workplace dynamics. As organizations increasingly embrace hybrid work models, the demand for integrated solutions that enhance collaboration and productivity will intensify. Companies will likely prioritize user-friendly interfaces and seamless integrations with existing systems, fostering a more collaborative environment. Additionally, the focus on data security and compliance will shape software development, ensuring that solutions meet the rigorous standards required in today's digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Communication and Coordination Software Video Conferencing Software Instant Messaging Platforms Project Management Tools Document Collaboration Software Workflow Automation Tools Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Educational Institutions Non-Profit Organizations Government Agencies Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Industry Vertical | IT and Telecommunications Banking, Financial Services and Insurance (BFSI) Healthcare Retail and E-Commerce Manufacturing Government and Defense Media and Entertainment Education Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By User Type | Individual Users Team Users Enterprise Users Others |

| By Pricing Model | Subscription-Based (SaaS) One-Time License Fee Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Collaboration Tools | 120 | IT Managers, Team Leaders |

| Remote Work Software Adoption | 100 | Remote Employees, HR Professionals |

| Education Sector Collaboration Platforms | 80 | Educators, IT Administrators |

| Healthcare Communication Tools | 70 | Healthcare Administrators, IT Specialists |

| Small Business Collaboration Solutions | 90 | Small Business Owners, Operations Managers |

The Global Team Collaboration Software Market is valued at approximately USD 24 billion, driven by the increasing demand for remote work solutions, enhanced communication tools, and efficient project management systems.