Region:Global

Author(s):Geetanshi

Product Code:KRAD0087

Pages:96

Published On:August 2025

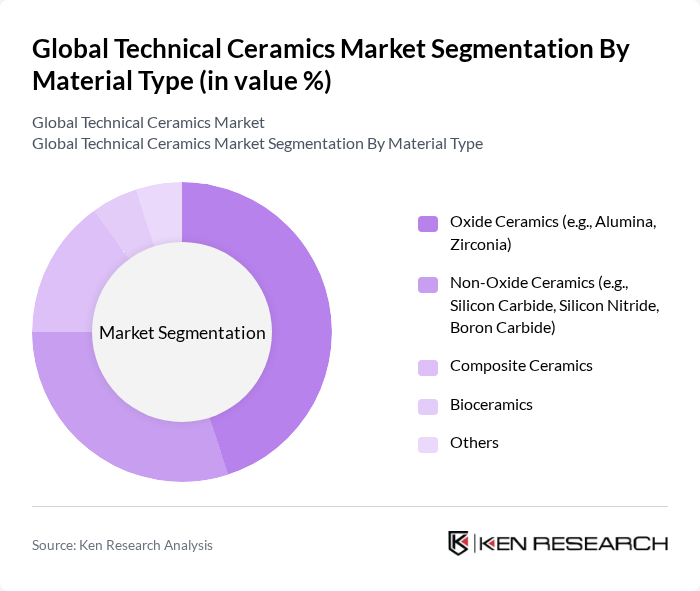

By Material Type:

The material type segmentation includes Oxide Ceramics, Non-Oxide Ceramics, Composite Ceramics, Bioceramics, and Others. Among these, Oxide Ceramics—particularly Alumina and Zirconia—dominate the market due to their superior mechanical properties, chemical resistance, and thermal stability, making them ideal for electronics, medical, and industrial applications. Non-Oxide Ceramics, such as Silicon Carbide and Silicon Nitride, are gaining traction for their high thermal conductivity, strength, and resistance to wear, especially in automotive, aerospace, and energy sectors. The demand for Bioceramics is increasing in the medical field, driven by the need for biocompatible materials for implants, dental applications, and prosthetics .

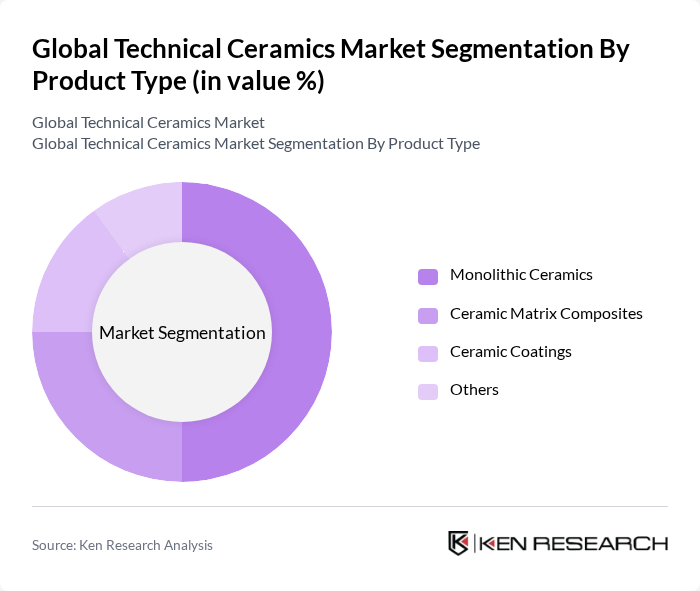

By Product Type:

The product type segmentation includes Monolithic Ceramics, Ceramic Matrix Composites, Ceramic Coatings, and Others. Monolithic Ceramics are the leading product type, widely used in electrical and electronic applications for their high dielectric strength, thermal stability, and mechanical robustness. Ceramic Matrix Composites are increasingly adopted in aerospace and automotive industries due to their lightweight, high-strength, and thermal shock resistance. Ceramic Coatings are used for protective applications, improving the durability and performance of components exposed to harsh environments, such as in energy, chemical, and industrial processing sectors .

The Global Technical Ceramics Market is characterized by a dynamic mix of regional and international players. Leading participants such as CeramTec GmbH, Kyocera Corporation, CoorsTek, Inc., Morgan Advanced Materials plc, Saint-Gobain S.A., NGK Insulators, Ltd., Rauschert Steinbach GmbH, 3M Company, Ceradyne, Inc. (a 3M company), Elan Technology, LLC, Aremco Products, Inc., Advanced Ceramic Materials, LLC, H.C. Starck GmbH, DOWA Electronics Materials Co., Ltd., SGL Carbon SE, Mantec Technical Ceramics Ltd., Bakony Technical Ceramics Ltd., General Electric Company, NGK Spark Plug Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the technical ceramics market appears promising, driven by technological advancements and increasing demand across various sectors. The integration of smart ceramics and IoT technologies is expected to revolutionize manufacturing processes, enhancing efficiency and product capabilities. Furthermore, the shift towards sustainable production methods will likely gain momentum, as companies seek to reduce their environmental footprint while meeting regulatory standards. This evolving landscape presents significant opportunities for innovation and growth in the technical ceramics market.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Oxide Ceramics (e.g., Alumina, Zirconia) Non-Oxide Ceramics (e.g., Silicon Carbide, Silicon Nitride, Boron Carbide) Composite Ceramics Bioceramics Others |

| By Product Type | Monolithic Ceramics Ceramic Matrix Composites Ceramic Coatings Others |

| By Application | Electrical Equipment & Electronics (e.g., substrates, insulators, semiconductors) Automotive (e.g., engine parts, sensors, brake components) Aerospace (e.g., turbine blades, thermal shields) Medical (e.g., implants, dental ceramics, prosthetics) Environmental & Energy (e.g., catalyst supports, filters, hydrogen electrolyser components) Others |

| By End-User Industry | Electrical & Electronics Automotive Aerospace & Defense Medical & Healthcare Industrial Machinery Environmental & Energy Others |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 100 | Materials Engineers, Aerospace Product Managers |

| Automotive Components | 80 | Procurement Managers, Quality Assurance Specialists |

| Electronics Manufacturing | 90 | Production Supervisors, R&D Engineers |

| Medical Device Applications | 70 | Regulatory Affairs Managers, Product Development Engineers |

| Industrial Applications | 60 | Operations Managers, Supply Chain Analysts |

The Global Technical Ceramics Market is valued at approximately USD 12.2 billion, reflecting a robust growth trajectory driven by increasing demand for advanced materials in sectors such as electronics, automotive, and aerospace.