Region:Global

Author(s):Dev

Product Code:KRAD0574

Pages:87

Published On:August 2025

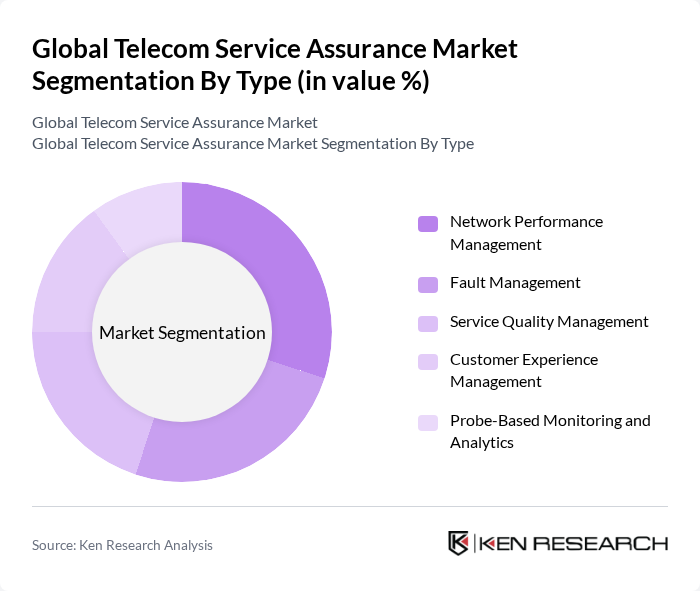

By Type:The segmentation by type includes various subsegments that cater to different aspects of telecom service assurance. The subsegments are Network Performance Management, Fault Management, Service Quality Management, Customer Experience Management, and Probe-Based Monitoring and Analytics. Each of these subsegments plays a crucial role in ensuring the reliability and efficiency of telecom services.

The Network Performance Management subsegment is currently dominating the market due to the increasing need for real-time monitoring and optimization of network performance. As telecom operators strive to enhance service delivery and minimize downtime, the demand for solutions that provide insights into network health and performance metrics has surged. This trend is further fueled by the rollout of 5G technology, which necessitates advanced performance management tools to ensure optimal user experiences.

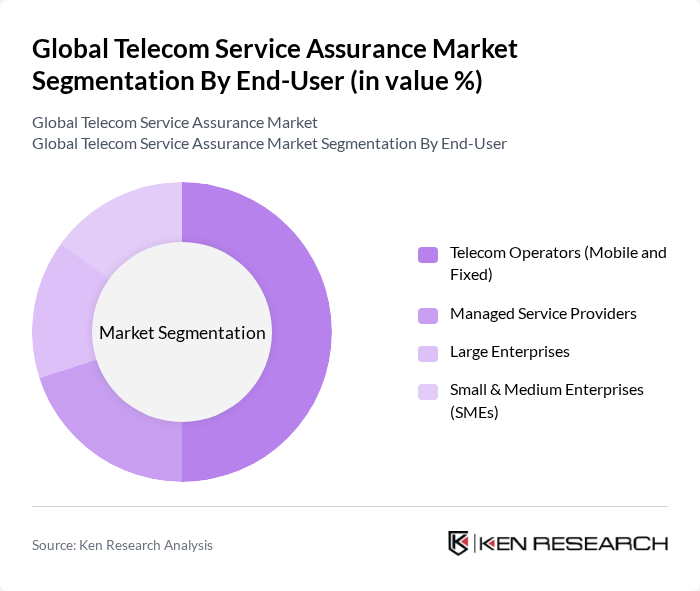

By End-User:The segmentation by end-user includes Telecom Operators (Mobile and Fixed), Managed Service Providers, Large Enterprises, and Small & Medium Enterprises (SMEs). Each of these end-users has unique requirements and challenges that drive the demand for telecom service assurance solutions.

Telecom Operators (Mobile and Fixed) are the leading end-users in the market, primarily due to their extensive reliance on service assurance solutions to maintain service quality and customer satisfaction. As competition intensifies among telecom providers, the need for robust service assurance mechanisms becomes critical to differentiate offerings and retain customers. This segment's growth is also driven by the increasing complexity of network environments and the demand for seamless connectivity.

The Global Telecom Service Assurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amdocs, Nokia Corporation, Cisco Systems, Inc., IBM Corporation, Ericsson, Accenture, NETSCOUT Systems, Inc., Spirent Communications plc, Viavi Solutions Inc., Huawei Technologies Co., Ltd., ZTE Corporation, Infosys Limited, TEOCO Corporation, FNT Software, Broadcom Inc. (CA Technologies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telecom service assurance market is poised for transformative growth, driven by technological advancements and evolving consumer demands. As 5G networks expand, operators will increasingly leverage AI and machine learning to enhance service reliability and customer experience. Additionally, the integration of advanced analytics will enable proactive network management, ensuring optimal performance. Sustainability initiatives will also gain traction, as telecom companies seek to reduce their environmental impact while meeting regulatory requirements and consumer expectations for greener technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Performance Management Fault Management Service Quality Management Customer Experience Management Probe-Based Monitoring and Analytics |

| By End-User | Telecom Operators (Mobile and Fixed) Managed Service Providers Large Enterprises Small & Medium Enterprises (SMEs) |

| By Component | Solutions (Fault, Performance, Quality Monitoring, Workforce/Network Management) Services (Professional and Managed Services) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Application | Network Monitoring and Real-Time Analytics Incident and Fault Management Performance Optimization and Capacity Planning G/Network Slicing Assurance |

| By Sales Channel | Direct Sales Indirect Sales (Partners/Resellers) |

| By Pricing Model | Subscription (SaaS) Perpetual/One-Time License Pay-As-You-Go/Consumption-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Network Performance Management | 120 | Network Operations Managers, Performance Analysts |

| Fault Management Solutions | 90 | Service Assurance Engineers, Technical Support Leads |

| Customer Experience Assurance | 70 | Customer Experience Managers, Quality Assurance Specialists |

| Service Level Agreement Monitoring | 60 | Compliance Officers, Service Delivery Managers |

| Telecom Analytics Tools | 80 | Data Analysts, Business Intelligence Managers |

The Global Telecom Service Assurance Market is valued at approximately USD 9 billion, reflecting a significant growth driven by the increasing demand for reliable telecom services and the expansion of 5G networks.