Region:Global

Author(s):Shubham

Product Code:KRAC0599

Pages:87

Published On:August 2025

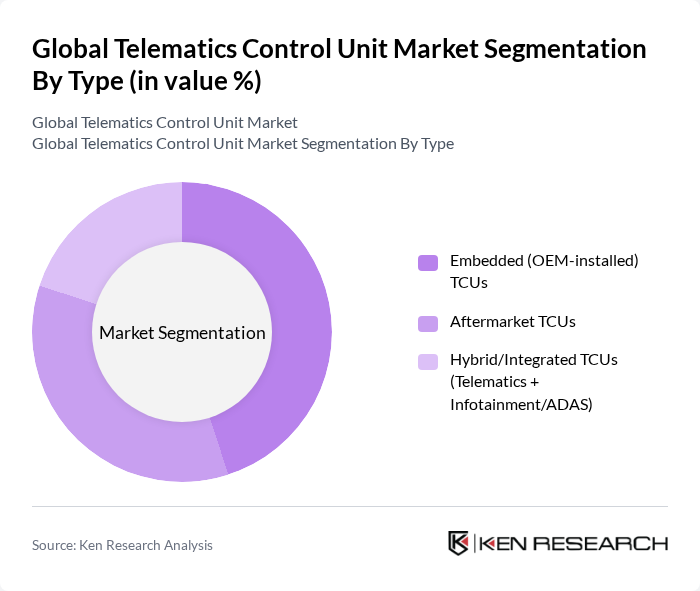

By Type:The telematics control unit market is segmented into three main types: Embedded (OEM-installed) TCUs, Aftermarket TCUs, and Hybrid/Integrated TCUs (Telematics + Infotainment/ADAS). Embedded TCUs are increasingly favored by OEMs due to mandated safety/connectivity features and seamless in-vehicle integration, while aftermarket TCUs serve retrofit needs across fleets and consumer vehicles. Hybrid/Integrated TCUs are gaining traction as OEMs converge telematics with infotainment head units and ADAS domain controllers, leveraging 4G/5G and C-V2X to support diagnostics, OTA updates, and safety services .

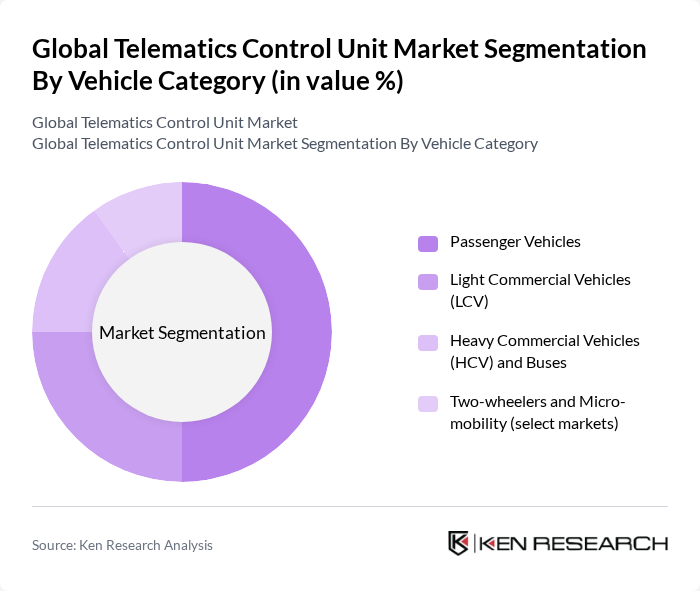

By Vehicle Category:The market is further segmented by vehicle category, including Passenger Vehicles, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV) and Buses, and Two-wheelers and Micro-mobility (select markets). Passenger vehicles dominate on the back of OEM-installed connectivity, safety mandates (e.g., eCall), and consumer demand for connected services; LCVs and HCVs benefit from fleet management, remote diagnostics, and compliance use cases; two-wheelers and micro-mobility remain emerging niches in select markets as connectivity modules become more cost-efficient .

The Global Telematics Control Unit Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Electronics, Samsung Electronics (HARMAN International), Continental AG, Robert Bosch GmbH (Bosch Mobility), Denso Corporation, Marelli, Aptiv PLC, Panasonic Holdings Corporation, Valeo, Visteon Corporation, Qualcomm Technologies, Inc., Autotalks Ltd., Sierra Wireless (Semtech), Telit Cinterion, CalAmp Corp., Marelli Automotive Lighting and Electronics, Aisin Corporation, Fibocom Wireless Inc., Quectel Wireless Solutions, PATEO CONNECT+ contribute to innovation, geographic expansion, and service delivery in this space .

The telematics control unit market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of AI and machine learning is expected to enhance predictive analytics capabilities, allowing for more efficient fleet management and improved vehicle safety. Additionally, the expansion of 5G networks will facilitate faster data transmission, enabling real-time monitoring and analytics, which are crucial for the development of smart transportation systems and connected vehicles.

| Segment | Sub-Segments |

|---|---|

| By Type | Embedded (OEM-installed) TCUs Aftermarket TCUs Hybrid/Integrated TCUs (Telematics + Infotainment/ADAS) |

| By Vehicle Category | Passenger Vehicles Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) and Buses Two-wheelers and Micro-mobility (select markets) |

| By Connectivity Technology | G LTE/LTE Advanced G NR DSRC/C-V2X Satellite (backup/remote coverage) |

| By Function | Vehicle Diagnostics & Prognostics eCall/Crash Notification & Emergency Assistance Fleet Management & UBI Infotainment, Navigation & OTA Updates Driver Assistance & Safety (ADAS enablement) |

| By Deployment | OEM-Installed Aftermarket Installed |

| By Sales Channel | Direct to OEM Tier-1/Tier-2 Supplier Networks Aftermarket Distributors/Online |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Solutions | 140 | Fleet Managers, Operations Directors |

| Insurance Telematics | 100 | Insurance Underwriters, Risk Assessment Analysts |

| Automotive OEM Integration | 80 | Product Managers, R&D Engineers |

| Telematics Device Manufacturing | 70 | Manufacturing Engineers, Supply Chain Managers |

| Consumer Telematics Applications | 90 | Product Development Managers, Marketing Executives |

The Global Telematics Control Unit Market is valued at approximately USD 15.04 billion, reflecting a five-year historical analysis and aligning with trends in connected vehicle adoption and OEM integration.