Region:Global

Author(s):Rebecca

Product Code:KRAD0265

Pages:90

Published On:August 2025

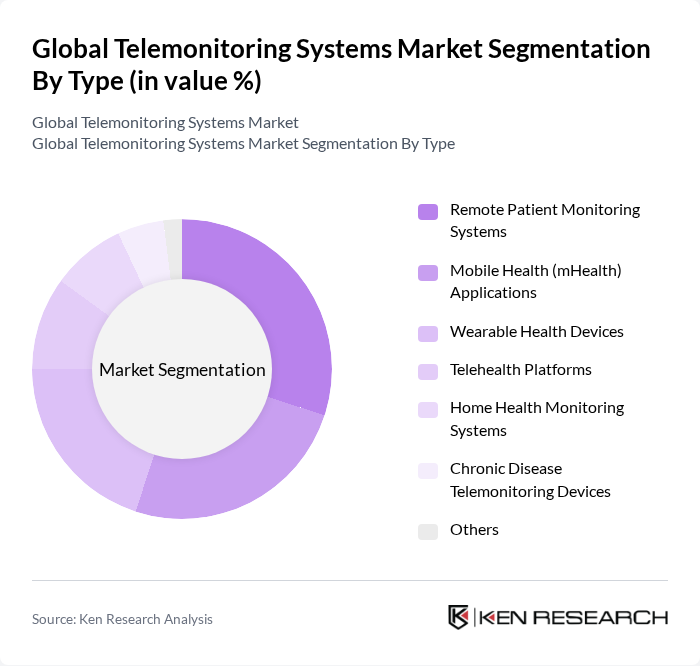

By Type:The market is segmented into various types, including Remote Patient Monitoring Systems, Mobile Health (mHealth) Applications, Wearable Health Devices, Telehealth Platforms, Home Health Monitoring Systems, Chronic Disease Telemonitoring Devices, and Others. Each of these subsegments plays a crucial role in the overall market dynamics, with remote patient monitoring systems and wearable health devices seeing particularly strong adoption due to their ability to provide continuous, real-time health data and support proactive care management .

The Remote Patient Monitoring Systems subsegment is currently dominating the market due to the increasing need for continuous health monitoring, especially among patients with chronic conditions. These systems allow healthcare providers to track patients' vital signs and health metrics in real-time, leading to timely interventions and improved patient outcomes. The growing acceptance of telehealth solutions, coupled with advancements in connectivity and device miniaturization, has made remote patient monitoring a preferred choice for both patients and healthcare providers .

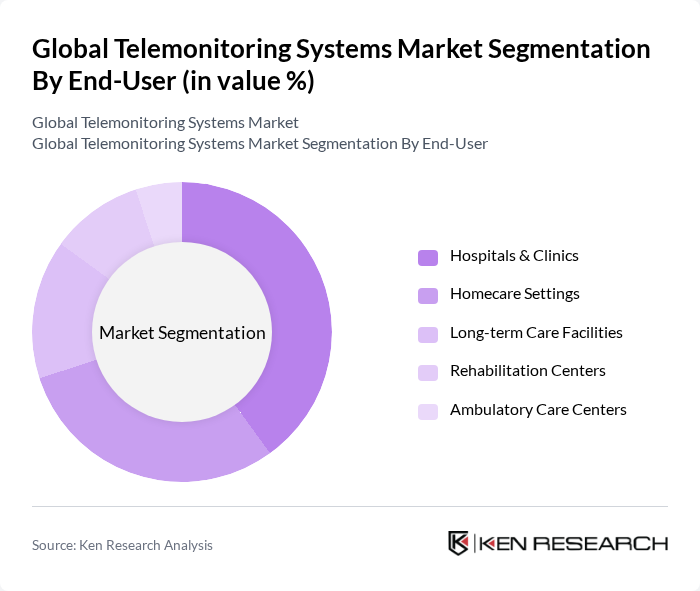

By End-User:The market is segmented by end-users, including Hospitals & Clinics, Homecare Settings, Long-term Care Facilities, Rehabilitation Centers, and Ambulatory Care Centers. Each of these segments has unique requirements and contributes differently to the overall market. Hospitals & Clinics and Homecare Settings are the primary adopters, driven by the need for efficient patient management, reduced readmissions, and the shift toward decentralized healthcare delivery .

Hospitals & Clinics are the leading end-user segment, primarily due to their need for efficient patient management and monitoring solutions. The increasing patient load and the demand for improved healthcare services have driven hospitals to adopt telemonitoring systems. These systems facilitate better patient management, reduce hospital readmission rates, and enhance overall healthcare delivery, making them indispensable in modern healthcare settings .

The Global Telemonitoring Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Medtronic plc, GE Healthcare, Siemens Healthineers, Honeywell International Inc., Cerner Corporation (Oracle Health), IBM Watson Health (Merative), Qualcomm Life (now Capsule Technologies, a part of Philips), Biotronik SE & Co. KG, OMRON Healthcare Co., Ltd., Abbott Laboratories, Boston Scientific Corporation, Tunstall Healthcare Group, LifeWatch AG (now part of BioTelemetry, a Philips company), eHealth Technologies, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nihon Kohden Corporation, Comarch SA, TytoCare Ltd., Meytec GmbH contribute to innovation, geographic expansion, and service delivery in this space .

The future of telemonitoring systems in None appears promising, driven by technological advancements and increasing healthcare demands. As the healthcare landscape shifts towards value-based care, providers are likely to invest more in telemonitoring solutions that enhance patient engagement and outcomes. Additionally, the integration of artificial intelligence and machine learning into telemonitoring systems is expected to improve data analysis and predictive capabilities, further enhancing patient care and operational efficiency in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Patient Monitoring Systems Mobile Health (mHealth) Applications Wearable Health Devices Telehealth Platforms Home Health Monitoring Systems Chronic Disease Telemonitoring Devices (e.g., cardiac, glucose, blood pressure) Others |

| By End-User | Hospitals & Clinics Homecare Settings Long-term Care Facilities Rehabilitation Centers Ambulatory Care Centers |

| By Application | Chronic Disease Management (e.g., diabetes, cardiovascular, COPD) Post-operative Monitoring Maternal and Child Health Monitoring Mental Health Monitoring Elderly Care/Remote Geriatric Monitoring |

| By Distribution Channel | Direct Sales Online Sales Distributors/Resellers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-based One-time Purchase Pay-per-use |

| By Technology | Cloud-based Solutions On-premise Solutions Hybrid Solutions AI-enabled Telemonitoring Platforms Wireless & Wearable Connectivity Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Disease Management | 100 | Healthcare Providers, Telehealth Coordinators |

| Remote Patient Monitoring | 80 | Patients, Caregivers, Health IT Specialists |

| Telehealth Technology Vendors | 60 | Product Managers, Sales Directors |

| Healthcare Policy Makers | 40 | Health Administrators, Regulatory Affairs Experts |

| Patient Experience and Satisfaction | 70 | Patients, User Experience Researchers |

The Global Telemonitoring Systems Market is valued at approximately USD 5.1 billion, driven by the increasing prevalence of chronic diseases and the rising demand for remote patient monitoring solutions.