Region:Global

Author(s):Geetanshi

Product Code:KRAA1259

Pages:96

Published On:August 2025

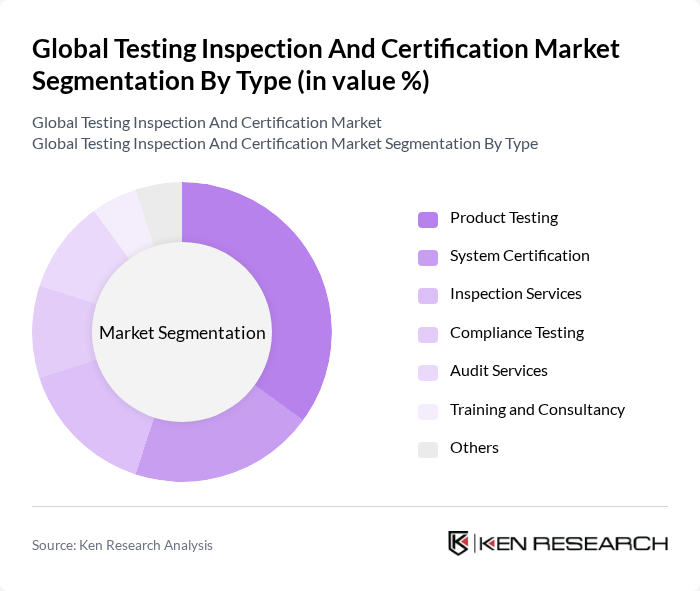

By Type:The market is segmented into various types, including Product Testing, System Certification, Inspection Services, Compliance Testing, Audit Services, Training and Consultancy, and Others. Among these, Product Testing is the leading sub-segment, driven by the increasing demand for quality assurance in consumer goods and industrial products. The rise in e-commerce and global trade has further amplified the need for rigorous product testing to ensure compliance with safety standards. System Certification and Inspection Services are also significant, supported by the growing complexity of regulatory requirements and the need for third-party verification in global supply chains .

By End-User:The end-user segmentation includes Manufacturing, Construction, Food and Beverage, Healthcare, Automotive, Aerospace, Energy & Utilities, Consumer Goods & Retail, Information & Communication Technology (ICT), and Others. The Manufacturing sector is the dominant end-user, as it requires extensive testing and certification to ensure product quality and compliance with international standards. The increasing complexity of manufacturing processes, the adoption of advanced technologies, and the need for innovation further drive the demand for testing and certification services in this sector. Other significant end-users include Automotive, Healthcare, and Food & Beverage, reflecting the critical importance of regulatory compliance and safety in these industries .

The Global Testing Inspection And Certification Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS S.A., Bureau Veritas S.A., Intertek Group plc, TÜV Rheinland AG, DNV AS, UL LLC, Eurofins Scientific SE, Applus+ Laboratories, ALS Limited, TÜV SÜD AG, DEKRA SE, SAI Global Limited, Lloyd's Register Group Limited, BSI Group, MISTRAS Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the testing, inspection, and certification market is poised for significant transformation, driven by digitalization and evolving consumer expectations. As industries increasingly adopt remote inspection technologies, the demand for innovative solutions will rise. Furthermore, the focus on sustainability will compel companies to enhance their testing protocols, ensuring compliance with environmental standards. These trends will likely reshape service offerings, fostering collaboration among industry players to meet the growing need for comprehensive quality assurance solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Product Testing System Certification Inspection Services Compliance Testing Audit Services Training and Consultancy Others |

| By End-User | Manufacturing Construction Food and Beverage Healthcare Automotive Aerospace Energy & Utilities Consumer Goods & Retail Information & Communication Technology (ICT) Others |

| By Service Type | Testing Services Inspection Services Certification Services Consulting Services Training Services Others |

| By Industry Standard | ISO Standards ASTM Standards IEC Standards EN Standards Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Client Type | Large Enterprises Small and Medium Enterprises Government Agencies Non-Governmental Organizations Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Project-Based Pricing Others |

| By Sourcing Type | In-House Services Outsourced Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Goods Testing | 100 | Quality Assurance Managers, Product Safety Officers |

| Industrial Equipment Certification | 80 | Compliance Managers, Engineering Directors |

| Food Safety Inspection | 60 | Food Safety Auditors, Operations Managers |

| Environmental Testing Services | 50 | Environmental Compliance Officers, Laboratory Managers |

| Telecommunications Certification | 40 | Regulatory Affairs Specialists, Technical Managers |

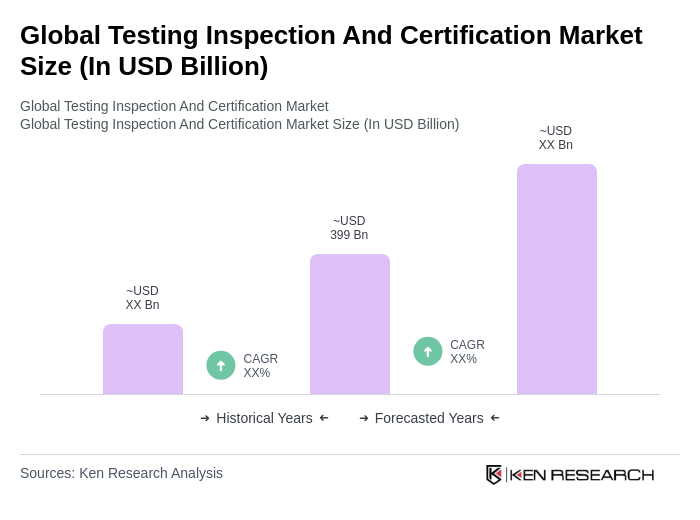

The Global Testing Inspection and Certification Market is valued at approximately USD 399 billion, reflecting significant growth driven by regulatory compliance, consumer safety awareness, and the expansion of global trade.