Region:Global

Author(s):Rebecca

Product Code:KRAA2183

Pages:93

Published On:August 2025

Market.png)

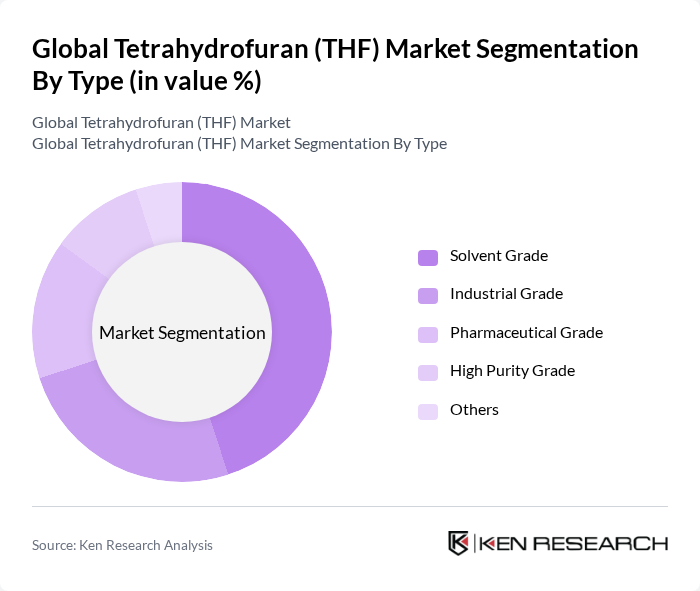

By Type:The market is segmented into Solvent Grade, Industrial Grade, Pharmaceutical Grade, High Purity Grade, and Others. Among these,Solvent Gradeis the most dominant segment, accounting for extensive use in polymer production (especially PTMEG for spandex and elastomers) and as a solvent in chemical processes. The rising demand for high-quality solvents in automotive, textile, and coatings industries continues to drive growth in this segment, with innovation in green chemistry and bio-based THF gaining traction .

By End-User:End-user segmentation includes Automotive, Pharmaceuticals, Textiles, Coatings and Adhesives, Chemical Industry, and Others. TheAutomotive sectoris the leading end-user, driven by increasing production of lightweight and high-performance materials. THF is essential in producing elastomers and polymeric materials that enhance vehicle performance and fuel efficiency. The pharmaceutical sector also shows robust growth, with THF widely used as a reaction medium and solvent in drug manufacturing. The textile industry’s demand for spandex fibers and the coatings and adhesives segment further support market expansion .

The Global Tetrahydrofuran (THF) Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Eastman Chemical Company, Mitsubishi Chemical Corporation, Dairen Chemical Corporation, INVISTA S.à r.l., Asahi Kasei Corporation, Solvay S.A., LyondellBasell Industries N.V., Huntsman Corporation, Repsol S.A., OXEA GmbH, Kraton Corporation, TPC Group Inc., INEOS Group Limited, Formosa Plastics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the THF market appears promising, driven by increasing demand across various sectors, particularly automotive and pharmaceuticals. As industries shift towards sustainable practices, the development of bio-based THF is expected to gain traction, aligning with global sustainability goals. Additionally, technological advancements in production processes will likely enhance efficiency and reduce costs, fostering market growth. Strategic partnerships among key players will further facilitate innovation and expansion into emerging markets, creating a dynamic landscape for THF applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Solvent Grade Industrial Grade Pharmaceutical Grade High Purity Grade Others |

| By End-User | Automotive Pharmaceuticals Textiles Coatings and Adhesives Chemical Industry Others |

| By Application | Polymer Production (e.g., PTMEG for Spandex) Solvent Applications Chemical Intermediates Electrolyte Solutions (e.g., Lithium-ion Batteries) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, UK, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Medium Price High Price |

| By Packaging Type | Bulk Packaging Drum Packaging Bottle Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Control Analysts |

| Automotive Coatings | 60 | Product Development Engineers, Procurement Managers |

| Textile Industry Usage | 50 | Production Supervisors, Chemical Buyers |

| Adhesives and Sealants | 70 | Application Engineers, Sales Managers |

| Research Institutions | 40 | Academic Researchers, Laboratory Managers |

The Global Tetrahydrofuran (THF) Market is valued at approximately USD 4.7 billion, driven by increasing demand in sectors such as polymer production, pharmaceuticals, and coatings, particularly in the automotive and textile industries.