Region:Global

Author(s):Geetanshi

Product Code:KRAA1184

Pages:98

Published On:August 2025

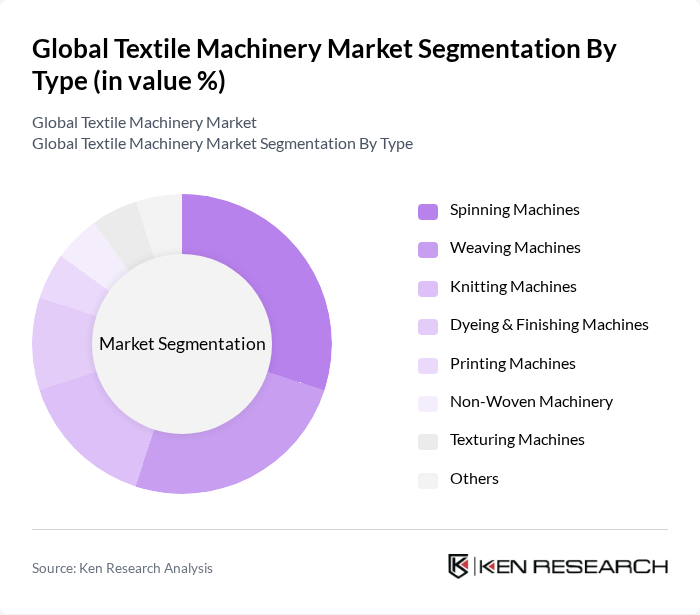

By Type:The textile machinery market is segmented into spinning machines, weaving machines, knitting machines, dyeing & finishing machines, printing machines, non-woven machinery, texturing machines, and others. Among these,spinning machinesare currently leading the market due to their essential role in converting fibers into yarn, which is foundational for all textile production. The demand for high-quality yarns in the apparel and home textile sectors continues to drive the growth of this sub-segment. Spinning machinery holds the largest revenue share among machine types .

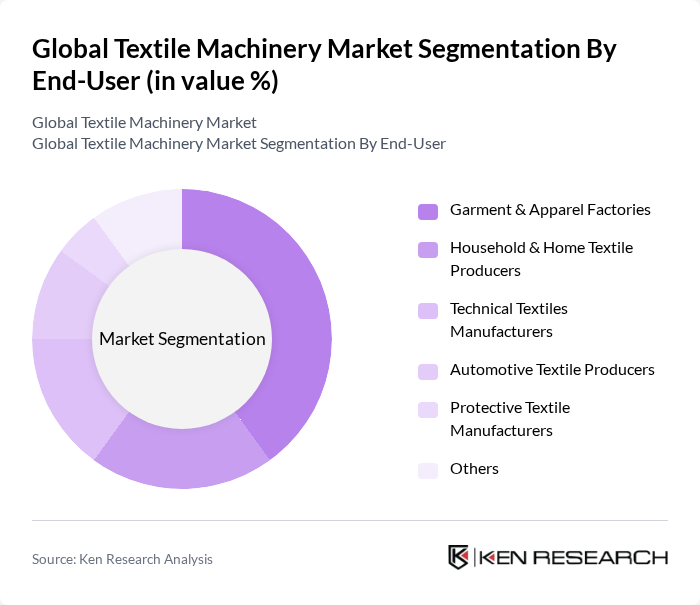

By End-User:The end-user segment of the textile machinery market includes garment & apparel factories, household & home textile producers, technical textiles manufacturers, automotive textile producers, protective textile manufacturers, and others.Garment & apparel factoriesdominate this segment as they require a wide range of machinery for various production processes. The increasing demand for fast fashion, customization, and efficient production has led to a surge in machinery investments in this sector. Textile manufacturers and apparel producers hold the largest market share among end-users .

The Global Textile Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rieter Holding AG, Trützschler GmbH & Co. KG, Saurer AG, Itema S.p.A., Lindauer DORNIER GmbH, Picanol N.V., Mitsubishi Heavy Industries, Ltd., Juki Corporation, Brother Industries, Ltd., Karl Mayer Textilmaschinenfabrik GmbH, Oerlikon Textile GmbH & Co. KG, A. Monforts Textilmaschinen GmbH & Co. KG, Lohia Corp Limited, TMT Machinery, Inc., Toyota Industries Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the textile machinery market appears promising, driven by ongoing technological innovations and a growing emphasis on sustainability. As manufacturers increasingly adopt automation and AI, production efficiency is expected to improve significantly. Additionally, the rising demand for sustainable textiles will likely encourage investments in eco-friendly machinery. The expansion of e-commerce platforms will further facilitate market growth, enabling manufacturers to reach a broader customer base and adapt to changing consumer preferences in real-time.

| Segment | Sub-Segments |

|---|---|

| By Type | Spinning Machines Weaving Machines Knitting Machines Dyeing & Finishing Machines Printing Machines Non-Woven Machinery Texturing Machines Others |

| By End-User | Garment & Apparel Factories Household & Home Textile Producers Technical Textiles Manufacturers Automotive Textile Producers Protective Textile Manufacturers Others |

| By Application | Fashion Apparel Industrial Textiles Medical Textiles Home Furnishings Automotive Textiles Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Machinery Mid-Range Machinery High-End Machinery |

| By Technology | Conventional Technology Automated Technology Smart Technology Industry 4.0/AI-Enabled Machinery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Machinery Manufacturers | 100 | Product Managers, R&D Directors |

| Textile Production Facilities | 90 | Operations Managers, Plant Supervisors |

| Textile Machinery Distributors | 60 | Sales Managers, Distribution Coordinators |

| Industry Experts and Analysts | 50 | Market Analysts, Industry Consultants |

| Textile Trade Associations | 40 | Policy Makers, Industry Representatives |

The Global Textile Machinery Market is valued at approximately USD 31 billion, driven by increasing demand for high-quality textiles, technological advancements, and the trend towards automation and digitalization in manufacturing processes.