Region:Global

Author(s):Rebecca

Product Code:KRAA2104

Pages:81

Published On:August 2025

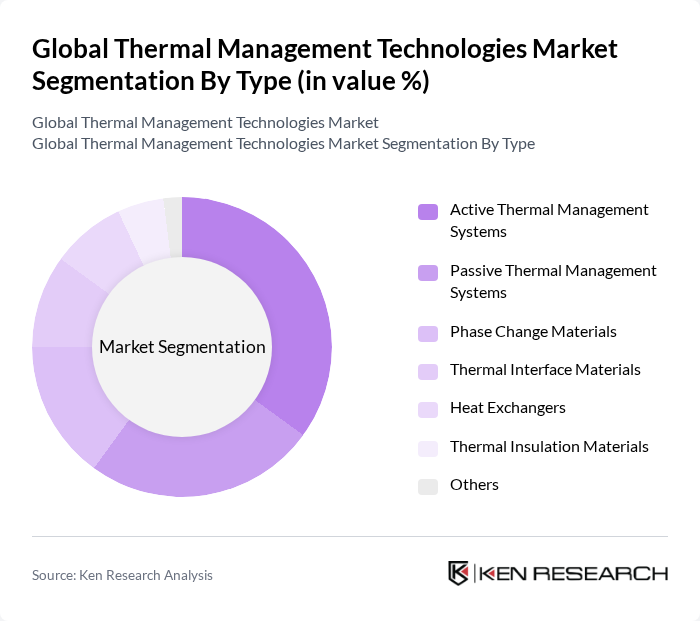

By Type:The thermal management technologies market is segmented into Active Thermal Management Systems, Passive Thermal Management Systems, Phase Change Materials, Thermal Interface Materials, Heat Exchangers, Thermal Insulation Materials, and Others. Active Thermal Management Systems are gaining traction due to their ability to deliver real-time temperature control, improved energy efficiency, and adaptability for high-performance applications such as electric vehicles, advanced data centers, and next-generation consumer electronics. Passive systems, phase change materials, and thermal interface materials remain essential for cost-effective and reliable heat dissipation in a wide range of devices.

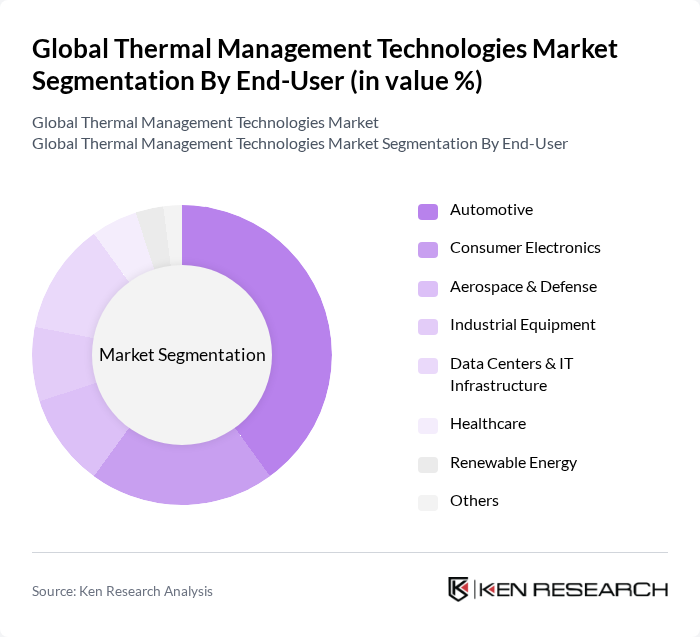

By End-User:The market is also segmented by end-user applications, including Automotive, Consumer Electronics, Aerospace & Defense, Industrial Equipment, Data Centers & IT Infrastructure, Healthcare, Renewable Energy, and Others. The Automotive sector is the leading end-user, propelled by the rapid adoption of electric vehicles, stricter emissions standards, and the need for advanced battery thermal management. Consumer electronics and data centers follow closely, driven by ongoing device miniaturization and the expansion of cloud computing infrastructure.

The Global Thermal Management Technologies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., 3M Company, Advanced Cooling Technologies Inc., Parker Hannifin Corporation, DuPont de Nemours, Inc., Gentherm Incorporated, Autoneum Holding AG, Laird Thermal Systems Inc., Henkel AG & Co. KGaA, Saint-Gobain S.A., Dow Inc., Celanese Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Siemens AG, Momentive Performance Materials Inc., Heatex Inc. (Madison Industries), Lord Corporation, Thermal Management Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of thermal management technologies is poised for significant transformation, driven by the increasing emphasis on sustainability and energy efficiency. As industries adopt more stringent energy efficiency standards, the demand for innovative thermal solutions will rise. Furthermore, advancements in smart technologies and IoT integration are expected to enhance system performance and user experience. In future, the market is likely to witness a shift towards more sustainable practices, with a focus on reducing carbon footprints and improving energy utilization across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Thermal Management Systems Passive Thermal Management Systems Phase Change Materials Thermal Interface Materials Heat Exchangers Thermal Insulation Materials Others |

| By End-User | Automotive Consumer Electronics Aerospace & Defense Industrial Equipment Data Centers & IT Infrastructure Healthcare Renewable Energy Others |

| By Application | Automotive Cooling Systems Electronics Cooling (Computers, Mobile Devices, Telecom) HVAC Applications Industrial Process Cooling Renewable Energy Systems Data Center Thermal Management Others |

| By Component | Heat Sinks Fans and Blowers Pumps Thermal Conductive Materials Phase Change Materials Thermal Interface Materials Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Sales Others |

| By Distribution Mode | B2B Distribution B2C Distribution E-commerce Platforms Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Thermal Management Solutions | 100 | Product Engineers, Automotive Designers |

| Electronics Cooling Technologies | 80 | R&D Managers, Thermal Engineers |

| HVAC System Innovations | 60 | Facility Managers, HVAC Technicians |

| Industrial Thermal Management Applications | 50 | Operations Managers, Process Engineers |

| Consumer Electronics Thermal Solutions | 70 | Product Managers, Design Engineers |

The Global Thermal Management Technologies Market is valued at approximately USD 14 billion, driven by the increasing demand for efficient thermal management solutions across various industries, including automotive, consumer electronics, and data centers.