Region:Global

Author(s):Shubham

Product Code:KRAB0733

Pages:84

Published On:August 2025

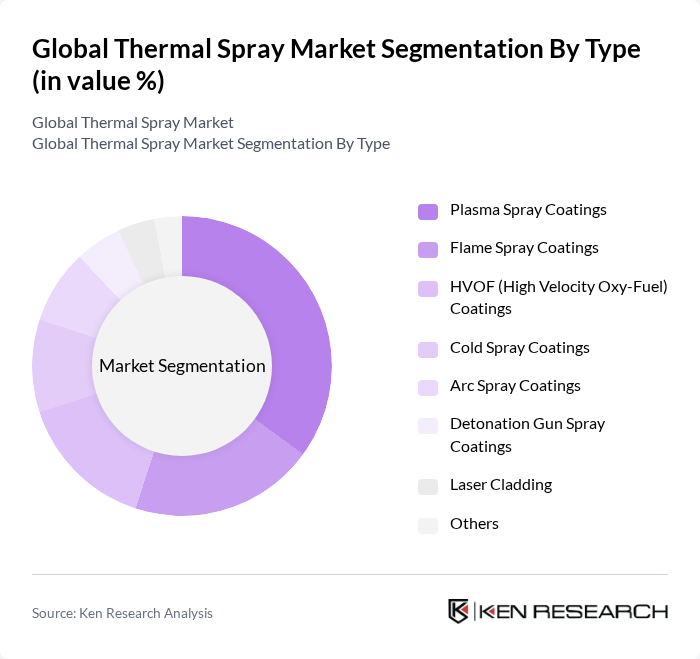

By Type:The thermal spray market is segmented into several coating types, each tailored for specific industrial applications. The primary types include Plasma Spray Coatings, Flame Spray Coatings, HVOF (High Velocity Oxy-Fuel) Coatings, Cold Spray Coatings, Arc Spray Coatings, Detonation Gun Spray Coatings, Laser Cladding, and Others. Plasma Spray Coatings lead the market due to their versatility, ability to deposit a wide range of materials, and effectiveness in providing high-performance coatings for aerospace, energy, and medical applications .

By End-User:The thermal spray market is also segmented by end-user industries, including Aerospace & Defense, Automotive, Energy & Power, Medical & Healthcare, Electronics & Semiconductors, Industrial Equipment & Machinery, Oil & Gas, Printing & Packaging, and Others. Aerospace & Defense remains the leading end-user, driven by stringent performance requirements for engine and structural components. Automotive, energy, and medical sectors are rapidly increasing adoption, leveraging thermal spray for lightweighting, corrosion resistance, and biocompatibility in implants and devices .

The Global Thermal Spray Market is characterized by a dynamic mix of regional and international players. Leading participants such as Praxair Surface Technologies (now part of Linde plc), Oerlikon Metco, Thermal Spray Technologies, Inc., H.C. Starck GmbH, Saint-Gobain Coating Solutions, Bodycote plc, Aremco Products, Inc., Metallisation Ltd., Sulzer Ltd. (Sulzer Metco), 3M Company, Kennametal Inc., Höganäs AB, Castolin Eutectic, A&A Coatings, and TWI Ltd. drive innovation, geographic expansion, and service delivery in this sector .

The future of the thermal spray market appears promising, driven by technological advancements and increasing applications across various sectors. As industries prioritize sustainability, the demand for eco-friendly thermal spray materials is expected to rise significantly. Additionally, the integration of automation in thermal spray processes will enhance efficiency and reduce operational costs, making thermal spray solutions more accessible to a broader range of industries, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Plasma Spray Coatings Flame Spray Coatings HVOF (High Velocity Oxy-Fuel) Coatings Cold Spray Coatings Arc Spray Coatings Detonation Gun Spray Coatings Laser Cladding Others |

| By End-User | Aerospace & Defense Automotive Energy & Power Medical & Healthcare Electronics & Semiconductors Industrial Equipment & Machinery Oil & Gas Printing & Packaging Others |

| By Application | Wear Resistance Corrosion Resistance Thermal Barrier Coatings Electrical Conductivity Biocompatible Coatings Aesthetic Coatings Others |

| By Material | Metals Ceramics Carbides Polymers Composites Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Thermal Spray Applications | 100 | Manufacturing Engineers, Quality Control Managers |

| Automotive Coating Solutions | 80 | Production Managers, R&D Specialists |

| Industrial Machinery Coatings | 70 | Maintenance Supervisors, Operations Directors |

| Energy Sector Thermal Spray Technologies | 60 | Project Managers, Technical Directors |

| Research and Development in Thermal Spray | 40 | Research Scientists, Innovation Managers |

The Global Thermal Spray Market is valued at approximately USD 12.5 billion, driven by increasing demand for advanced coating technologies across various sectors, including aerospace, automotive, energy, and medical industries.