Region:Global

Author(s):Rebecca

Product Code:KRAD0187

Pages:98

Published On:August 2025

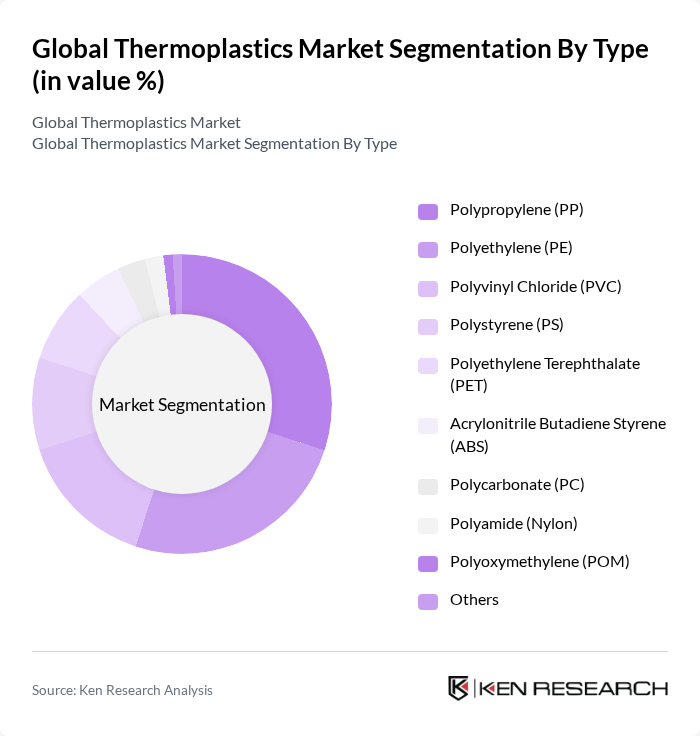

By Type:The thermoplastics market is segmented into Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), Acrylonitrile Butadiene Styrene (ABS), Polycarbonate (PC), Polyamide (Nylon), Polyoxymethylene (POM), and Others. Among these, Polypropylene (PP) and Polyethylene (PE) are the leading subsegments due to their extensive use in packaging, automotive, and consumer goods applications. The demand for these materials is driven by their lightweight nature, cost-effectiveness, durability, and recyclability, making them favorable choices for manufacturers.

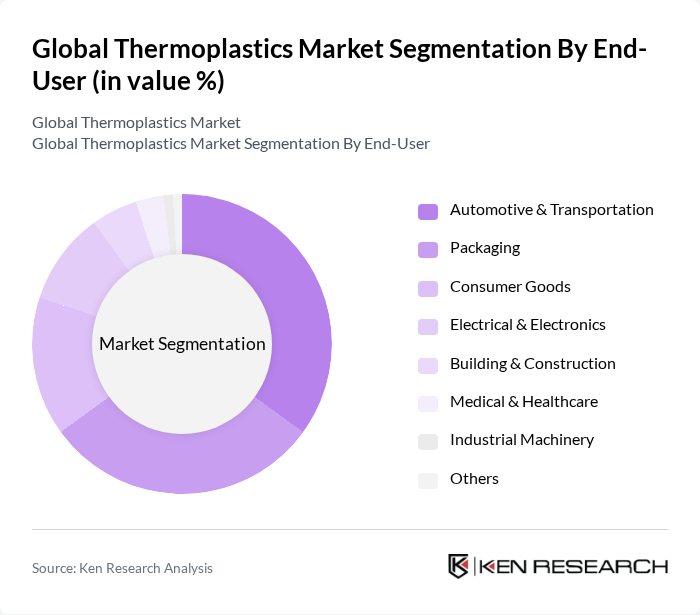

By End-User:The end-user segmentation includes Automotive & Transportation, Packaging, Consumer Goods, Electrical & Electronics, Building & Construction, Medical & Healthcare, Industrial Machinery, and Others. The automotive and packaging sectors are the most significant contributors to the thermoplastics market, driven by the need for lightweight materials that enhance fuel efficiency, reduce costs, and support sustainability initiatives. The growing trend towards sustainable and recyclable packaging solutions is also propelling the demand for thermoplastics in these industries.

The Global Thermoplastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., LyondellBasell Industries N.V., SABIC, Covestro AG, DuPont de Nemours, Inc., Eastman Chemical Company, INEOS Group Holdings S.A., Mitsubishi Chemical Group Corporation, Solvay S.A., Toray Industries, Inc., Huntsman Corporation, Celanese Corporation, Teijin Limited, Formosa Plastics Corporation, Arkema S.A., Evonik Industries AG, LG Chem Ltd., Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermoplastics market appears promising, driven by technological advancements and evolving consumer preferences. As industries increasingly adopt sustainable practices, the integration of bioplastics and smart technologies is expected to gain momentum. Furthermore, the shift towards a circular economy will encourage manufacturers to innovate in recycling and product design. These trends will likely create a dynamic environment for growth, fostering collaboration between companies and research institutions to develop eco-friendly solutions that meet market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Polypropylene (PP) Polyethylene (PE) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) Acrylonitrile Butadiene Styrene (ABS) Polycarbonate (PC) Polyamide (Nylon) Polyoxymethylene (POM) Others |

| By End-User | Automotive & Transportation Packaging Consumer Goods Electrical & Electronics Building & Construction Medical & Healthcare Industrial Machinery Others |

| By Application | Injection Molding Extrusion Blow Molding Thermoforming D Printing Film & Sheet Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesale Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Medium High |

| By Sustainability Certification | ISO 14001 Cradle to Cradle ISCC PLUS Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Thermoplastics Usage | 100 | Product Engineers, R&D Managers |

| Packaging Industry Insights | 90 | Packaging Designers, Supply Chain Managers |

| Consumer Goods Applications | 80 | Brand Managers, Product Development Leads |

| Construction Material Trends | 60 | Architects, Project Managers |

| Bioplastics Adoption Rates | 40 | Sustainability Officers, Regulatory Affairs Managers |

The Global Thermoplastics Market is valued at approximately USD 290 billion, driven by the increasing demand for lightweight, durable, and recyclable materials across various industries, including automotive, packaging, consumer goods, and electronics.