Region:Global

Author(s):Geetanshi

Product Code:KRAB0035

Pages:90

Published On:August 2025

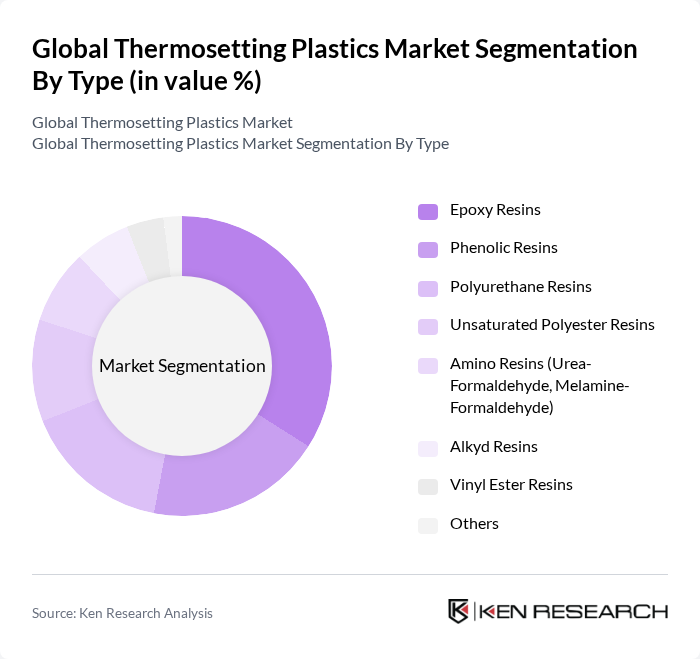

By Type:The thermosetting plastics market is segmented into epoxy resins, phenolic resins, polyurethane resins, unsaturated polyester resins, amino resins (urea-formaldehyde, melamine-formaldehyde), alkyd resins, vinyl ester resins, and others.Epoxy resinsremain the most dominant type due to their superior mechanical strength, chemical resistance, and heat resistance, making them ideal for automotive, aerospace, and electronics applications. Phenolic and polyurethane resins also hold significant shares, driven by their use in insulation, coatings, and structural components .

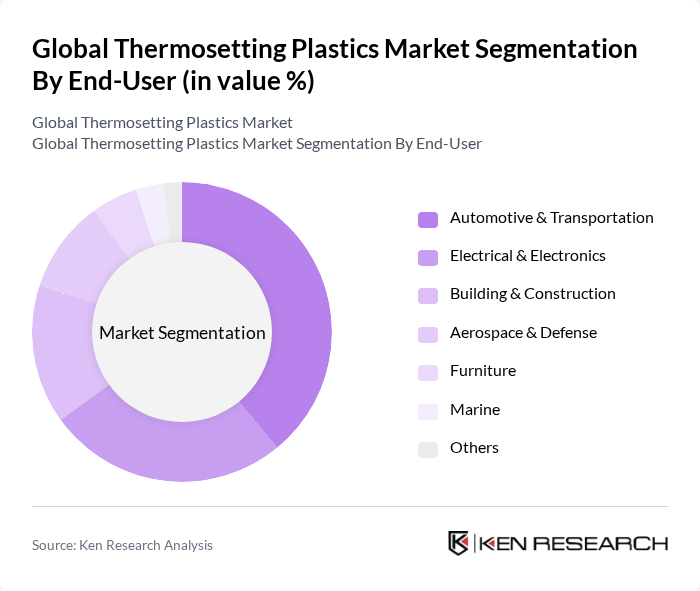

By End-User:End-user segmentation includes automotive & transportation, electrical & electronics, building & construction, aerospace & defense, furniture, marine, and others. Theautomotive & transportationsector is the leading end-user, driven by the need for lightweight, high-strength, and corrosion-resistant materials to improve fuel efficiency and vehicle performance. Electrical & electronics and building & construction sectors are also significant consumers, leveraging thermosets for insulation, circuit boards, and structural components .

The Global Thermosetting Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, DuPont de Nemours, Inc., Covestro AG, Sika AG, Momentive Performance Materials Inc., Ashland Global Holdings Inc., Mitsubishi Chemical Corporation, Solvay S.A., Wacker Chemie AG, DSM-Firmenich AG, LG Chem Ltd., Eastman Chemical Company, Polynt S.p.A., Hexion Inc., SABIC (Saudi Basic Industries Corporation), Dow Inc., Allnex Group, Asahi Kasei Corporation, Alchemie Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermosetting plastics market appears promising, driven by technological advancements and increasing applications across various industries. The integration of smart technologies into thermosetting plastics is expected to enhance product functionality, while the shift towards bio-based materials aligns with sustainability trends. Additionally, the ongoing expansion in emerging markets, particularly in Asia-Pacific, will likely create new growth avenues, fostering innovation and collaboration among industry players to meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Resins Phenolic Resins Polyurethane Resins Unsaturated Polyester Resins Amino Resins (Urea-Formaldehyde, Melamine-Formaldehyde) Alkyd Resins Vinyl Ester Resins Others |

| By End-User | Automotive & Transportation Electrical & Electronics Building & Construction Aerospace & Defense Furniture Marine Others |

| By Application | Adhesives & Sealants Coatings Composites Molding Compounds Insulation Laminates Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Product Form | Sheets Films Powders Liquids Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Design Managers |

| Electronics Manufacturing | 60 | Manufacturing Engineers, Quality Assurance Managers |

| Construction Materials | 50 | Project Managers, Procurement Specialists |

| Aerospace Components | 40 | Materials Scientists, Compliance Officers |

| Consumer Goods Packaging | 70 | Product Development Managers, Marketing Directors |

The Global Thermosetting Plastics Market is valued at approximately USD 130 billion, driven by increasing demand for durable and heat-resistant materials across various sectors, including automotive, aerospace, electronics, and construction.