Region:Global

Author(s):Shubham

Product Code:KRAB0811

Pages:81

Published On:August 2025

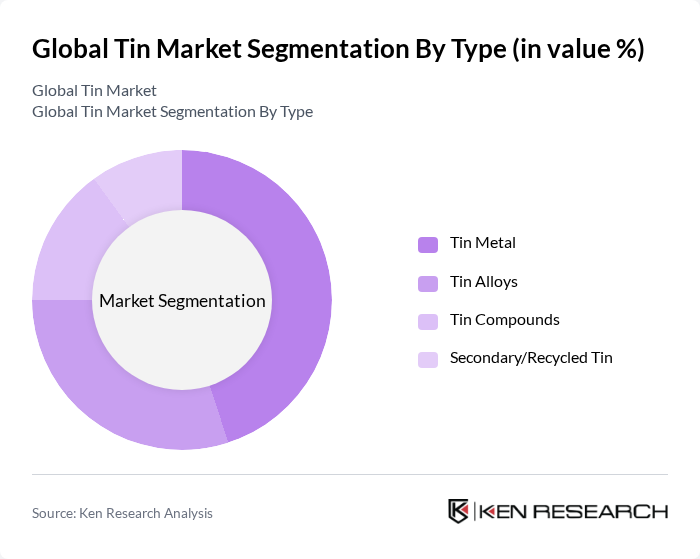

By Type:The tin market is segmented into four main types: Tin Metal, Tin Alloys, Tin Compounds, and Secondary/Recycled Tin. Tin Metal remains the leading subsegment due to its extensive use in soldering and electronics manufacturing. Demand for Tin Alloys is also significant, driven by applications in automotive, construction, and specialty alloys. Secondary/Recycled Tin is gaining momentum as manufacturers prioritize sustainability and circular economy initiatives .

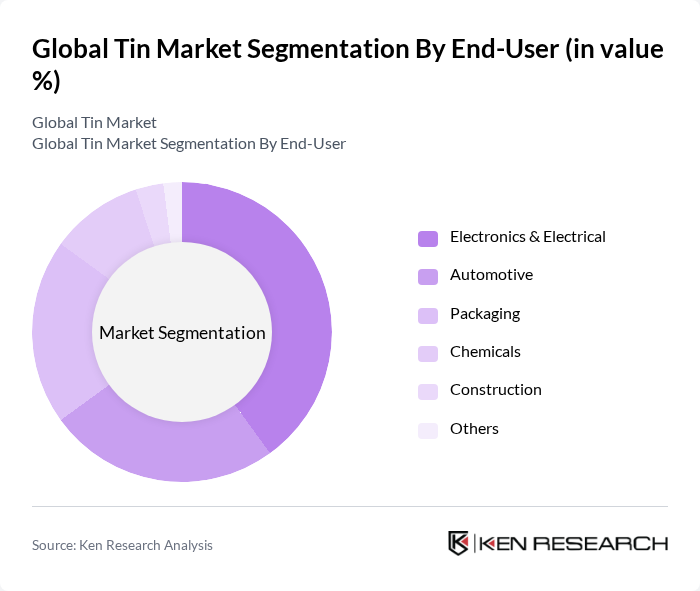

By End-User:The end-user segmentation includes Electronics & Electrical, Automotive, Packaging, Chemicals, Construction, and Others. The Electronics & Electrical sector is the dominant segment, attributed to the high demand for tin-based solder in electronic devices and circuit boards. The Automotive sector follows, with tin used in various alloys and electronic components. The Packaging industry remains significant, utilizing tin for its corrosion resistance and recyclability, while Chemicals and Construction segments contribute through specialized applications .

The Global Tin Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Timah Tbk, Yunnan Tin Company Limited, Minsur S.A., Thaisarco (Thailand Smelting and Refining Co. Ltd.), Malaysia Smelting Corporation Berhad, China Tin Group Co., Ltd., Metallo-Chimique N.V., O.M. Group, Inc., Nyrstar NV, Glencore International AG, Amalgamated Metal Corporation plc, CWT International Limited, TINCO Investments Ltd., African Pan African Tin (APT) Ltd., and TIN International AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tin market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly materials, the demand for tin in green technologies is expected to rise. Additionally, innovations in mining techniques are likely to enhance production efficiency. The growing emphasis on recycling and sustainable sourcing will also play a crucial role in shaping the market landscape, ensuring a steady supply of tin while minimizing environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Tin Metal Tin Alloys Tin Compounds Secondary/Recycled Tin |

| By End-User | Electronics & Electrical Automotive Packaging Chemicals Construction Others |

| By Application | Soldering Tin Plating Chemicals (e.g., PVC stabilizers, catalysts) Lead-Acid Batteries Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (South Africa, GCC, Rest of MEA) |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tin Mining Operations | 60 | Mine Managers, Operations Directors |

| Tin Smelting and Refining | 50 | Plant Managers, Metallurgical Engineers |

| End-User Industries (Electronics) | 40 | Product Managers, Supply Chain Analysts |

| Automotive Sector Applications | 40 | Procurement Managers, Quality Assurance Leads |

| Construction and Building Materials | 40 | Project Managers, Material Engineers |

The Global Tin Market is valued at approximately USD 6.8 billion, driven by increasing demand in sectors such as electronics, automotive, and packaging, alongside the adoption of sustainable practices like recycled tin.