Region:Global

Author(s):Dev

Product Code:KRAA2611

Pages:88

Published On:August 2025

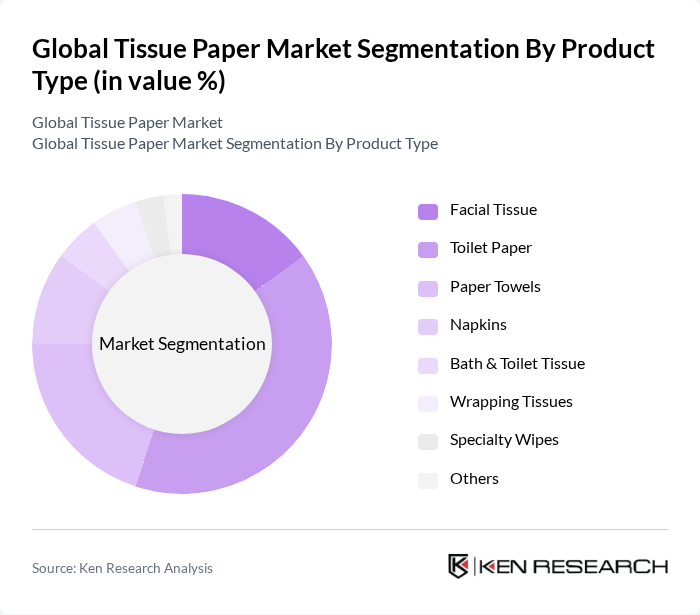

By Product Type:The product type segmentation includes categories such as Facial Tissue, Toilet Paper, Paper Towels, Napkins, Bath & Toilet Tissue, Wrapping Tissues, Specialty Wipes, and Others.Toilet Paperremains the leading sub-segment, driven by its essential role in daily hygiene practices. The increasing consumer preference for convenience and comfort has led to a surge in demand for high-quality toilet paper products, which are often marketed as soft, strong, and absorbent. The rise in e-commerce and private label offerings has also facilitated easier access to a variety of tissue products, further boosting sales .

By Ply Type:This segmentation includes 1 Ply, 2 Ply, 3 Ply, and Others. The2 Plysub-segment dominates the market due to its optimal balance of softness and strength, making it a preferred choice for consumers seeking comfort and durability. Demand for 2 Ply products is further bolstered by marketing strategies that emphasize superior absorbency and quality. The trend toward premium and luxury products has also led to increased production and consumption of higher ply options, reflecting evolving consumer preferences .

The Global Tissue Paper Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Kimberly-Clark Corporation, Georgia-Pacific LLC, Essity AB, Svenska Cellulosa Aktiebolaget (SCA), Cascades Inc., Metsä Tissue Corporation, Sofidel Group, Oji Holdings Corporation, Asia Pulp & Paper Co., Ltd., Clearwater Paper Corporation, Domtar Corporation, Hengan International Group Company Limited, Vinda International Holdings Limited, and Unicharm Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tissue paper market appears promising, driven by ongoing trends toward sustainability and innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in sustainable practices and materials. Additionally, the rise of e-commerce is expected to facilitate greater market access, allowing companies to reach a broader audience. These trends indicate a dynamic market landscape, where adaptability and responsiveness to consumer needs will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Facial Tissue Toilet Paper Paper Towels Napkins Bath & Toilet Tissue Wrapping Tissues Specialty Wipes Others |

| By Material | Virgin Pulp Recycled Pulp Bamboo Fiber Others |

| By Application | Household Commercial Industrial |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Wholesale Distributors Direct Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Tissue Products | 120 | Household Consumers, Product Users |

| Retail Sector Demand Analysis | 90 | Store Managers, Category Buyers |

| Hospitality Industry Usage Patterns | 70 | Hotel Managers, Facility Managers |

| Healthcare Sector Supply Chain | 60 | Procurement Officers, Hospital Administrators |

| Environmental Impact Assessments | 50 | Sustainability Managers, Environmental Compliance Officers |

The Global Tissue Paper Market is valued at approximately USD 77 billion. This growth is driven by increasing consumer demand for hygiene products, rising awareness of personal health, and a trend towards sustainable and eco-friendly products.