Region:Global

Author(s):Geetanshi

Product Code:KRAA1267

Pages:82

Published On:August 2025

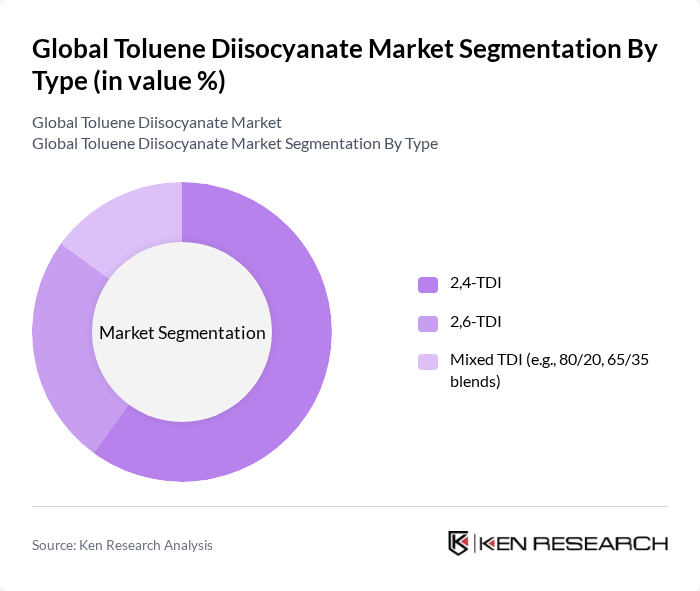

By Type:

The Toluene Diisocyanate market is segmented into three main types: 2,4-TDI, 2,6-TDI, and Mixed TDI (e.g., 80/20, 65/35 blends). Among these, 2,4-TDI is the leading subsegment, primarily due to its extensive application in the production of flexible polyurethane foams, which are widely used in furniture and automotive industries. The demand for 2,4-TDI is driven by its superior performance characteristics, including durability and comfort, making it a preferred choice for manufacturers. The 2,6-TDI subsegment is also significant, but its applications are more specialized, limiting its overall market share compared to 2,4-TDI .

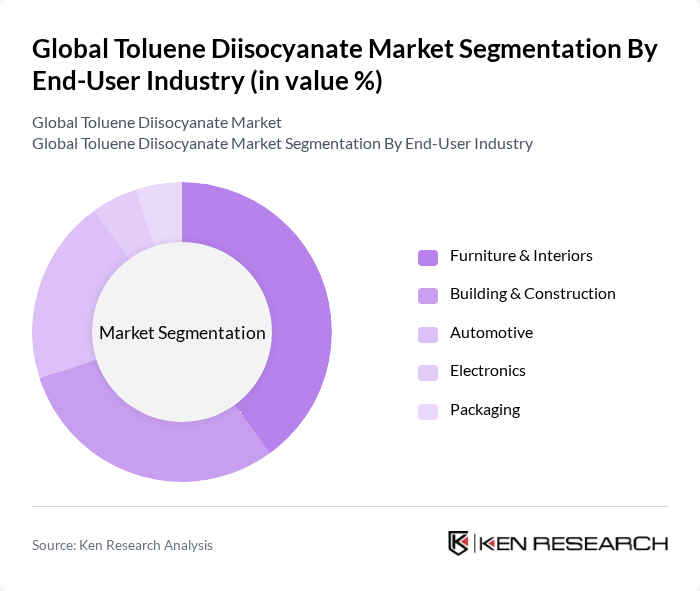

By End-User Industry:

The Toluene Diisocyanate market is segmented by end-user industries, including Furniture & Interiors, Building & Construction, Automotive, Electronics, and Packaging. The Furniture & Interiors segment holds the largest market share, driven by the increasing demand for comfortable and durable furniture products. The automotive industry follows closely, as TDI is essential for manufacturing lightweight and energy-efficient vehicles. The growth in construction activities, particularly in emerging economies, also contributes significantly to the demand for TDI in insulation and coatings. Electronics and packaging use TDI in specialty foams and adhesives, though these segments remain smaller in comparison .

The Global Toluene Diisocyanate Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, Covestro AG, Huntsman Corporation, Wanhua Chemical Group Co., Ltd., Tosoh Corporation, Mitsui Chemicals, Inc., KUKDO Chemical Co., Ltd., Vencorex S.A., ChemChina (China National Chemical Corporation), OCI Company Ltd., DIC Corporation, Sika AG, Perstorp Holding AB, Hanwha Solutions Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the toluene diisocyanate market appears promising, driven by innovations in production technologies and a shift towards sustainable practices. As manufacturers increasingly adopt eco-friendly alternatives, the demand for bio-based TDI is expected to rise significantly. Furthermore, strategic partnerships among industry players are likely to enhance market penetration in emerging economies, fostering growth opportunities. The focus on product customization will also cater to diverse consumer needs, ensuring a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | ,4-TDI ,6-TDI Mixed TDI (e.g., 80/20, 65/35 blends) |

| By End-User Industry | Furniture & Interiors Building & Construction Automotive Electronics Packaging |

| By Application | Flexible Polyurethane Foam Rigid Polyurethane Foam Coatings Adhesives & Sealants Elastomers |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 60 | Product Development Engineers, Procurement Managers |

| Construction Sector Usage | 50 | Project Managers, Material Suppliers |

| Furniture Manufacturing | 40 | Design Engineers, Operations Managers |

| Coatings and Adhesives | 45 | R&D Managers, Quality Assurance Specialists |

| Consumer Goods Applications | 55 | Marketing Managers, Product Managers |

The Global Toluene Diisocyanate Market is valued at approximately USD 4.5 billion, driven by increasing demand for polyurethane products across various industries such as automotive, construction, and furniture.