Region:Global

Author(s):Dev

Product Code:KRAA2222

Pages:95

Published On:August 2025

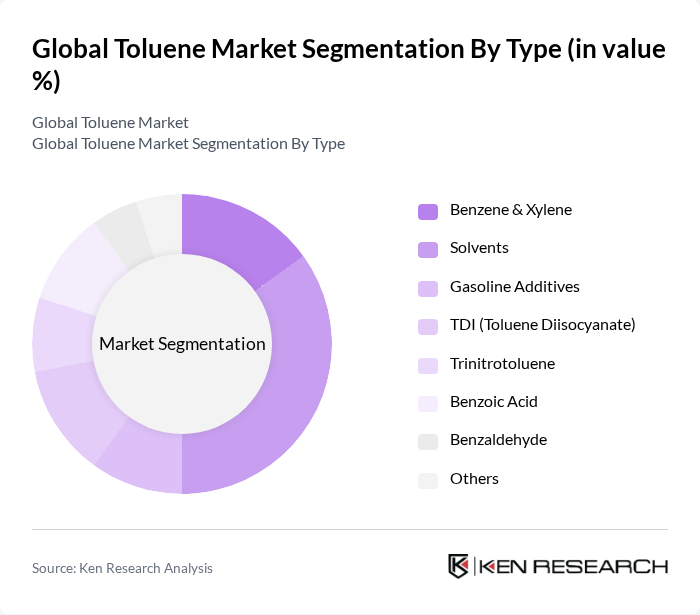

By Type:The market is segmented into various types, including Benzene & Xylene, Solvents, Gasoline Additives, TDI (Toluene Diisocyanate), Trinitrotoluene, Benzoic Acid, Benzaldehyde, and Others. Among these,Solventsare the leading sub-segment due to their extensive use in paints, coatings, and adhesives, driven by the growth in the construction and automotive sectors. The production of benzene and xylene from toluene is also a major application, supporting the manufacturing of plastics, synthetic fibers, and resins .

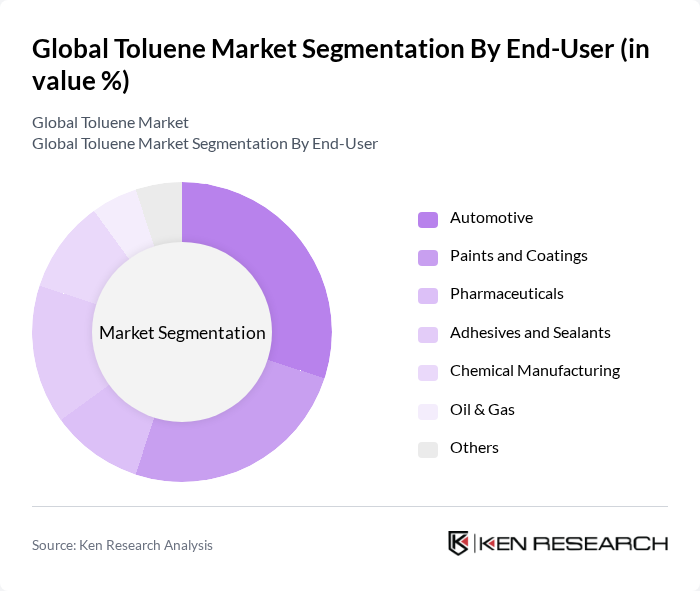

By End-User:The end-user segmentation includes Automotive, Paints and Coatings, Pharmaceuticals, Adhesives and Sealants, Chemical Manufacturing, Oil & Gas, and Others. TheAutomotivesector is the dominant end-user, driven by increasing vehicle production and rising demand for high-performance fuels and additives. Paints and coatings also represent a significant share, reflecting the importance of toluene as a solvent in these industries .

The Global Toluene Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, ExxonMobil Chemical Company, Shell plc, Mitsubishi Gas Chemical Company, Inc., Repsol S.A., LyondellBasell Industries N.V., TotalEnergies SE, Eastman Chemical Company, Chevron Phillips Chemical Company LLC, INEOS Group Holdings S.A., Covestro AG, Formosa Chemicals & Fibre Corporation, PTT Global Chemical Public Company Limited, SABIC (Saudi Basic Industries Corporation), and China Petroleum & Chemical Corporation (Sinopec) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the toluene market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production methods, such as the development of bio-based toluene, are expected to gain traction, aligning with global sustainability goals. Additionally, emerging markets in Asia and Africa are likely to present new growth avenues, fueled by industrialization and urbanization. Companies that adapt to these trends will be well-positioned to capitalize on the evolving landscape of the toluene market.

| Segment | Sub-Segments |

|---|---|

| By Type | Benzene & Xylene Solvents Gasoline Additives TDI (Toluene Diisocyanate) Trinitrotoluene Benzoic Acid Benzaldehyde Others |

| By End-User | Automotive Paints and Coatings Pharmaceuticals Adhesives and Sealants Chemical Manufacturing Oil & Gas Others |

| By Application | Chemical Intermediates Fuel Additives Extraction Solvent Paint Thinners Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Medium Price Range High Price Range |

| By Packaging Type | Bulk Packaging Drum Packaging Can Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Toluene Usage | 100 | Product Managers, R&D Engineers |

| Paint and Coatings Sector | 80 | Manufacturing Supervisors, Quality Control Managers |

| Pharmaceutical Applications | 60 | Formulation Scientists, Regulatory Affairs Specialists |

| Chemical Intermediates Production | 70 | Process Engineers, Supply Chain Managers |

| Environmental Impact Assessments | 40 | Environmental Compliance Officers, Sustainability Managers |

The Global Toluene Market is valued at approximately USD 25 billion, driven by increasing demand in various applications such as solvents, fuel additives, and chemical intermediates, particularly in the automotive, construction, and electronics sectors.