Region:Global

Author(s):Rebecca

Product Code:KRAD0220

Pages:99

Published On:August 2025

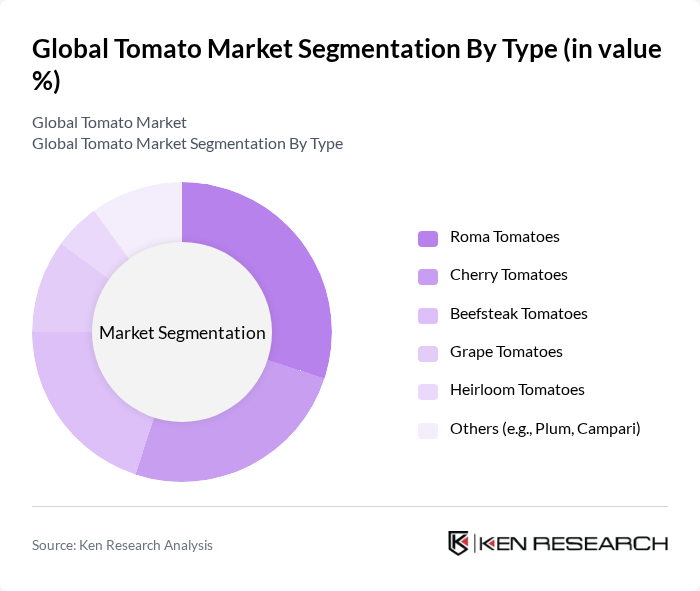

By Type:The tomato market is segmented by type, including Roma Tomatoes, Cherry Tomatoes, Beefsteak Tomatoes, Grape Tomatoes, Heirloom Tomatoes, and Others (such as Plum and Campari). Each type is distinguished by unique characteristics and consumer preferences, influencing their market performance. Roma Tomatoes are preferred for processing due to their dense flesh and low moisture, making them ideal for sauces and pastes. Cherry and Grape Tomatoes are favored for fresh consumption and snacking, while Beefsteak and Heirloom varieties are valued for their size, flavor, and use in salads and specialty dishes .

The Roma Tomatoes segment leads the market due to its versatility in cooking and processing, making it a staple in sauces and pastes. Their thick flesh and low moisture content make them ideal for canning and cooking, which aligns with consumer preferences for convenience and quality. Cherry Tomatoes are also gaining popularity for snacking and salads, contributing to their significant market share .

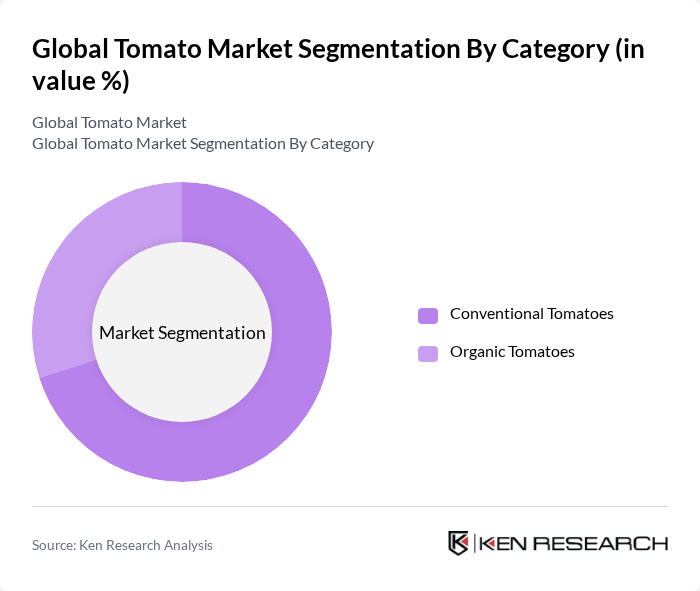

By Category:The market is divided into Conventional Tomatoes and Organic Tomatoes. The growing trend toward organic produce is influencing consumer choices and market dynamics. Conventional Tomatoes dominate due to their lower price point and widespread availability, but Organic Tomatoes are rapidly gaining traction as consumers become more health-conscious and seek chemical-free produce. This shift is driven by increasing awareness of the benefits of organic farming practices and a desire for sustainably grown food .

Conventional Tomatoes dominate the market due to their lower price point and widespread availability. However, the Organic Tomatoes segment is rapidly growing as consumers become more health-conscious and seek out organic options. This shift is driven by increasing awareness of the benefits of organic farming practices and the desire for chemical-free produce .

The Global Tomato Market is characterized by a dynamic mix of regional and international players. Leading participants such as Campbell Soup Company, Conagra Brands, Inc., Del Monte Foods, Inc., The Kraft Heinz Company, Nestlé S.A., Unilever PLC, Kagome Co., Ltd., Mutti S.p.A., Conesa Group, Olam Food Ingredients (OFI), Morning Star Packing Company, Sino Tomato Products Co., Ltd., Princes Group, Ing. A. Rossi S.p.A., La Doria S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tomato market appears promising, driven by evolving consumer preferences and technological advancements. The shift towards sustainable agriculture practices is expected to gain momentum, with more farmers adopting eco-friendly methods. Additionally, innovations in cultivation techniques, such as precision agriculture, will enhance productivity. As e-commerce continues to grow, fresh tomato sales through online platforms are likely to increase, providing new avenues for market expansion and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Roma Tomatoes Cherry Tomatoes Beefsteak Tomatoes Grape Tomatoes Heirloom Tomatoes Others (e.g., Plum, Campari) |

| By Category | Conventional Tomatoes Organic Tomatoes |

| By End User | Households Food Processing Industry Food Service (Hotels, Restaurants, Cafés) Others (Institutional, Industrial) |

| By Distribution Channel | Supermarkets/Hypermarkets Grocery Stores Online Retail Wholesale Direct Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of MEA) |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Canned Bottled Pouch Bulk |

| By Processing Method | Sun-Dried Freeze-Dried Canned Pureed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fresh Tomato Producers | 100 | Farm Owners, Agricultural Managers |

| Processed Tomato Manufacturers | 60 | Production Managers, Quality Control Supervisors |

| Retail Sector Buyers | 50 | Category Managers, Procurement Officers |

| Exporters and Importers | 40 | Logistics Coordinators, Trade Compliance Officers |

| Market Analysts and Economists | 40 | Market Research Analysts, Economic Advisors |

The global tomato market is valued at approximately USD 204 billion, driven by increasing consumer demand for fresh produce and the expanding food processing industry that utilizes tomatoes in various products like sauces and snacks.