Region:Global

Author(s):Dev

Product Code:KRAA2202

Pages:92

Published On:August 2025

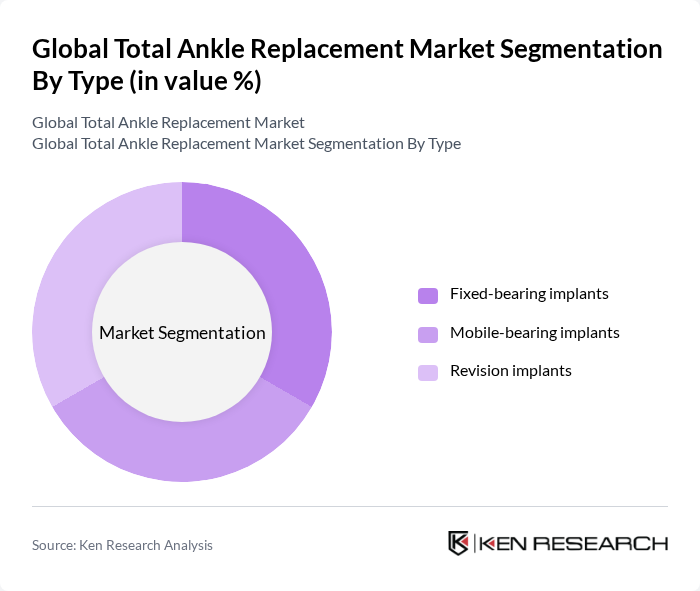

By Type:The market is segmented into three main types: Fixed-bearing implants, Mobile-bearing implants, and Revision implants. Among these, Fixed-bearing implants currently lead the market due to their established reliability and performance in providing stability and durability for patients. Mobile-bearing implants are gaining traction as they offer improved range of motion and reduced wear, appealing to a younger demographic seeking active lifestyles. Revision implants, while crucial for patients requiring follow-up surgeries, represent a smaller segment of the market .

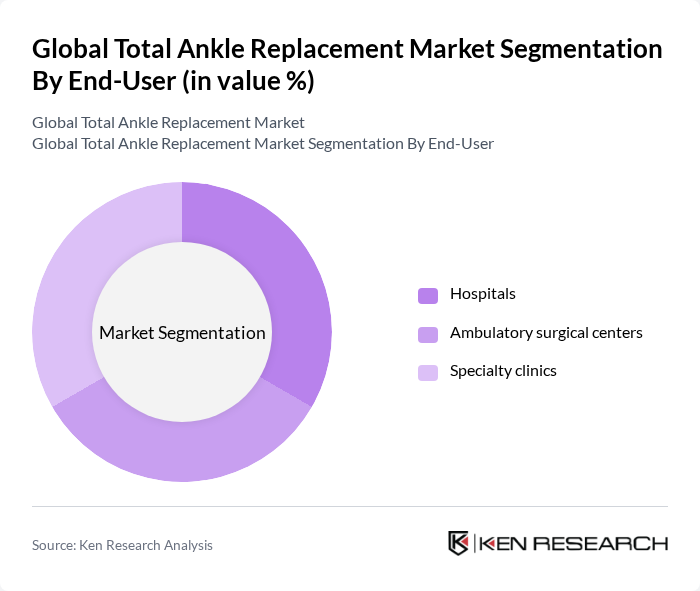

By End-User:The market is categorized into Hospitals, Ambulatory surgical centers, and Specialty clinics. Hospitals dominate the market due to their comprehensive facilities and access to advanced surgical technologies, making them the preferred choice for total ankle replacement surgeries. Ambulatory surgical centers are witnessing growth as they offer cost-effective and efficient outpatient services, appealing to patients seeking quicker recovery times. Specialty clinics, while smaller in scale, provide focused care and expertise, catering to specific patient needs .

The Global Total Ankle Replacement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson), Wright Medical Group N.V., Exactech, Inc., Aesculap Implant Systems, LLC, Integra LifeSciences Corporation, Smith & Nephew plc, Medtronic plc, Arthrex, Inc., B. Braun Melsungen AG, Orthofix Medical Inc., CONMED Corporation, Corin Group, Allegra Orthopaedics Limited, restor3d contribute to innovation, geographic expansion, and service delivery in this space.

The future of the total ankle replacement market appears promising, driven by ongoing advancements in surgical technologies and a growing emphasis on patient-centered care. As healthcare providers increasingly adopt outpatient surgical procedures, patient recovery times are expected to decrease, enhancing overall satisfaction. Furthermore, the integration of digital technologies in surgical practices will likely improve precision and outcomes, fostering greater acceptance of total ankle replacements among patients and healthcare professionals alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-bearing implants Mobile-bearing implants Revision implants |

| By End-User | Hospitals Ambulatory surgical centers Specialty clinics |

| By Material | Metal alloys Polyethylene Ceramic |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Surgical Approach | Anterior approach Lateral approach Posterior approach |

| By Distribution Channel | Direct sales Distributors Online sales |

| By Price Range | Premium Mid-range Budget |

| By Fixation Type | Cemented Cementless Hybrid Reverse Hybrid |

| By Procedure | Total Replacement Partial Replacement Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 100 | Surgeons specializing in ankle and foot procedures |

| Hospital Administrators | 60 | Decision-makers in orthopedic departments |

| Patients with Ankle Replacements | 50 | Individuals who have undergone total ankle replacement |

| Medical Device Manufacturers | 40 | Product managers and sales representatives in orthopedic devices |

| Health Economists | 40 | Experts analyzing cost-effectiveness of orthopedic interventions |

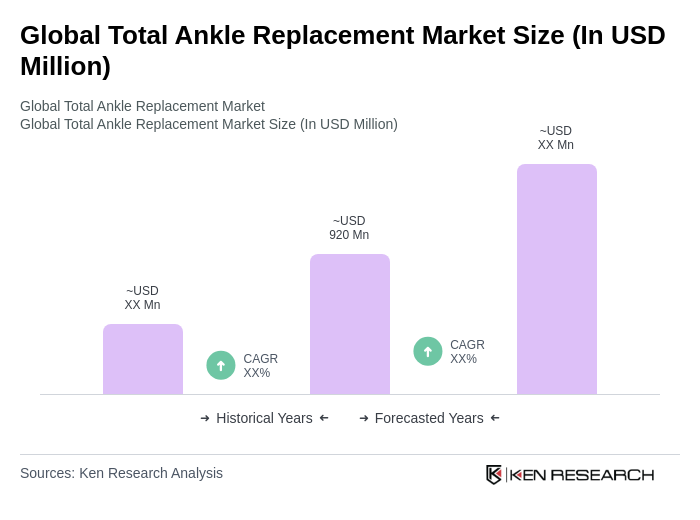

The Global Total Ankle Replacement Market is valued at approximately USD 920 million, driven by factors such as the increasing prevalence of ankle arthritis, rising obesity rates, and advancements in surgical techniques and implant designs.