Region:Global

Author(s):Dev

Product Code:KRAB0348

Pages:81

Published On:August 2025

By Type:The market is segmented into various types of lab automation technologies, including Robotic Systems, Liquid Handling Systems, Sample Management Systems, Automated Storage Systems, Laboratory Information Management Systems (LIMS), Automated Plate Handlers, Automated Analyzers, and Others. Among these, Liquid Handling Systems and Robotic Systems are particularly prominent due to their critical roles in enhancing laboratory efficiency, accuracy, and throughput. Automated liquid handlers currently hold the largest market share among equipment categories .

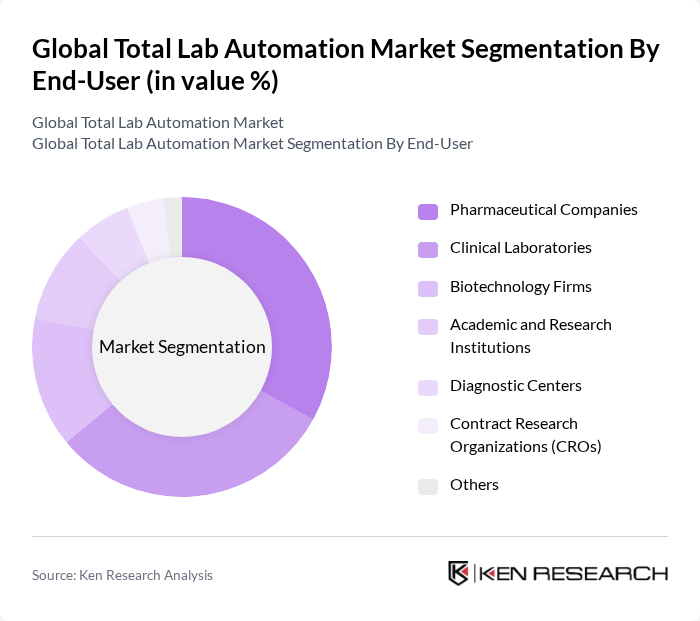

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, Clinical Laboratories, Diagnostic Centers, Contract Research Organizations (CROs), and Others. Pharmaceutical Companies and Clinical Laboratories are the leading segments, driven by the need for efficient drug development processes, accurate diagnostic testing, and the increasing adoption of automation to address labor shortages and regulatory compliance requirements .

The Global Total Lab Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Siemens Healthineers AG, Beckman Coulter, Inc., Agilent Technologies, Inc., Roche Diagnostics International AG, Abbott Laboratories, PerkinElmer, Inc., Tecan Group Ltd., Eppendorf AG, QIAGEN N.V., Bio-Rad Laboratories, Inc., Hamilton Company, Danaher Corporation, Inpeco SA, Labcorp contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lab automation market appears promising, driven by ongoing technological advancements and increasing demand for efficiency. As laboratories continue to embrace automation, the integration of AI and machine learning will play a crucial role in enhancing data analysis and operational workflows. Furthermore, the shift towards cloud-based solutions is expected to facilitate remote access and collaboration, making lab operations more flexible and responsive to changing research needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotic Systems Liquid Handling Systems Sample Management Systems Automated Storage Systems Laboratory Information Management Systems (LIMS) Automated Plate Handlers Automated Analyzers Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Clinical Laboratories Diagnostic Centers Contract Research Organizations (CROs) Others |

| By Application | Drug Discovery Clinical Diagnostics Genomics and Proteomics Environmental Testing Food & Beverage Testing Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Policy Support | Government Grants Tax Incentives Research Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Lab Automation | 100 | Laboratory Managers, Automation Engineers |

| Biotechnology Research Facilities | 80 | R&D Directors, Lab Technicians |

| Academic Research Institutions | 60 | Principal Investigators, Lab Coordinators |

| Clinical Laboratories | 50 | Quality Control Managers, Operations Supervisors |

| Environmental Testing Labs | 40 | Environmental Scientists, Lab Directors |

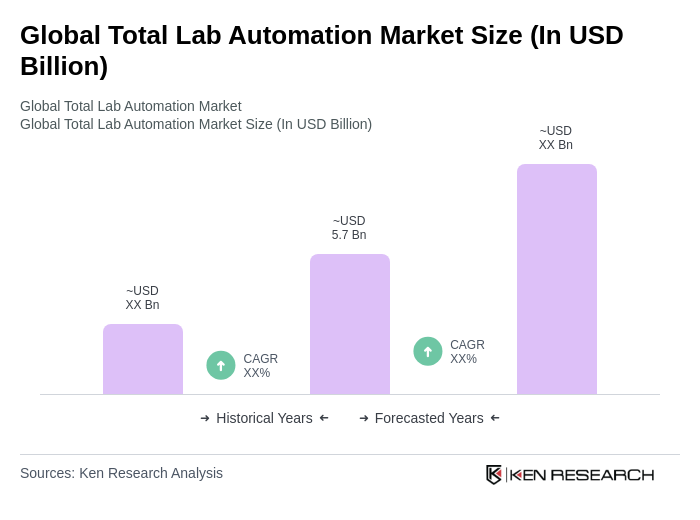

The Global Total Lab Automation Market is valued at approximately USD 5.7 billion, reflecting a significant growth trend driven by advancements in automation technologies and increasing demand for laboratory efficiency and high-throughput screening.