Region:Global

Author(s):Rebecca

Product Code:KRAA2161

Pages:99

Published On:August 2025

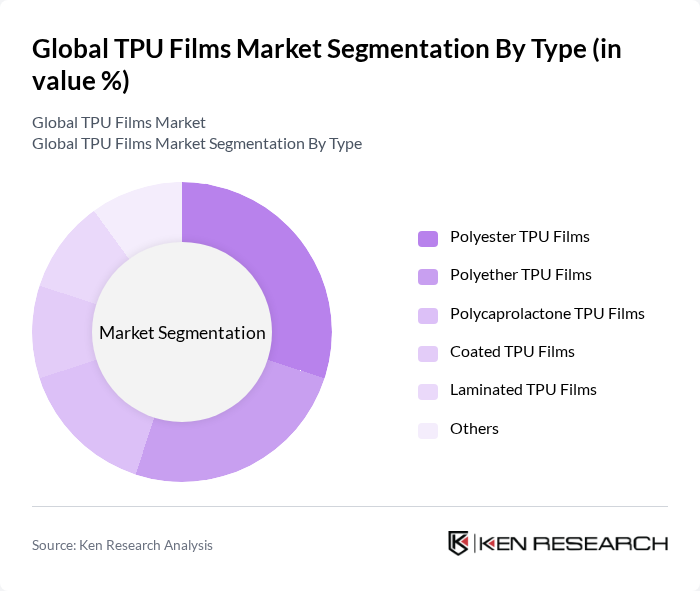

By Type:The TPU films market can be segmented into various types, including Polyester TPU Films, Polyether TPU Films, Polycaprolactone TPU Films, Coated TPU Films, Laminated TPU Films, and Others. Each type has unique properties that cater to specific applications, influencing their market dynamics. Polyether-based TPU films are widely used in applications requiring superior hydrolysis resistance, such as medical and technical textiles, while polyester TPU films are preferred for their mechanical strength and chemical resistance in automotive and industrial uses .

The Polyester TPU Films segment is currently dominating the market due to their excellent mechanical properties and resistance to chemicals, making them ideal for automotive and industrial applications. The expanding automotive sector, which increasingly demands lightweight and durable materials, has significantly contributed to the rise of this segment. Additionally, the versatility of polyester TPU films in applications such as coatings, adhesives, and protective films further enhances their market presence .

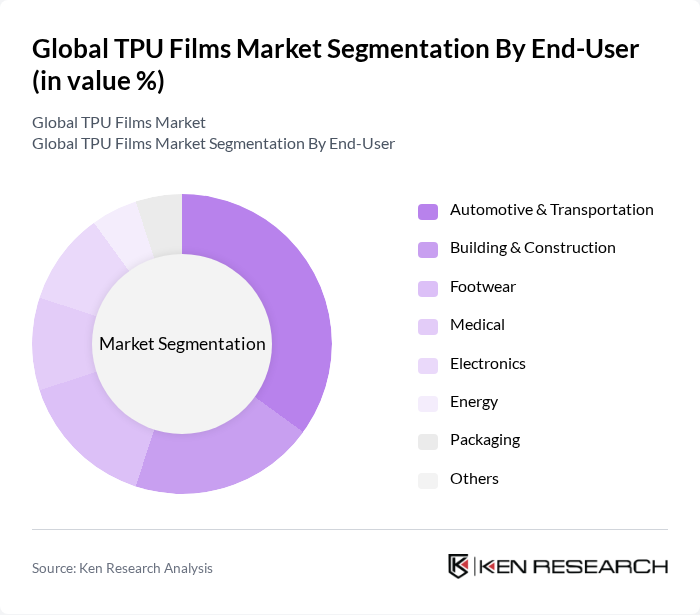

By End-User:The TPU films market is segmented by end-user industries, including Automotive & Transportation, Building & Construction, Footwear, Medical, Electronics, Energy, Packaging, and Others. Each end-user segment has distinct requirements that influence the demand for TPU films. Automotive and transportation applications lead due to the need for lightweight, high-performance materials, while medical and electronics sectors are rapidly increasing their adoption for protective and functional uses .

The Automotive & Transportation segment leads the market due to the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions. The automotive industry is rapidly adopting TPU films for applications such as interior components, protective films, and exterior coatings. This trend is driven by consumer preferences for sustainable and high-performance materials, making this segment a key driver of market growth .

The Global TPU Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, Huntsman Corporation, Wanhua Chemical Group Co., Ltd., Lubrizol Corporation, 3M Company, DuPont de Nemours, Inc., Eastman Chemical Company, Teijin Limited, KRAIBURG TPE GmbH & Co. KG, Sika AG, Erez Europe, Novotex Italiana S.p.A., Bond-A-Band Transmission Limited, Permali Gloucester Limited, DUNMORE, Evermax Eco, Redwood TTM Ltd, Wiman Corporation, PROCHIMIR SAS contribute to innovation, geographic expansion, and service delivery in this space.

The TPU films market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As industries increasingly prioritize sustainability, the shift towards eco-friendly materials is expected to accelerate. Innovations in manufacturing processes will enhance product quality and reduce costs, while the growing demand for customized solutions will further shape market dynamics. Additionally, the expansion of e-commerce is likely to create new distribution channels, facilitating broader access to TPU films across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyester TPU Films Polyether TPU Films Polycaprolactone TPU Films Coated TPU Films Laminated TPU Films Others |

| By End-User | Automotive & Transportation Building & Construction Footwear Medical Electronics Energy Packaging Others |

| By Application | Protective Films Adhesive Films Insulation Films Decorative Films Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Russia, Spain, etc.) Asia-Pacific (China, India, Japan, South Korea, Southeast Asia, etc.) Latin America (Brazil, Argentina, etc.) Middle East & Africa (Saudi Arabia, South Africa, etc.) |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Rolls Sheets Custom Shapes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive TPU Film Applications | 100 | Product Engineers, Procurement Managers |

| Electronics Packaging Solutions | 80 | Supply Chain Managers, R&D Directors |

| Medical Device TPU Films | 70 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 90 | Marketing Managers, Product Development Leads |

| Industrial Applications of TPU Films | 60 | Operations Managers, Technical Sales Representatives |

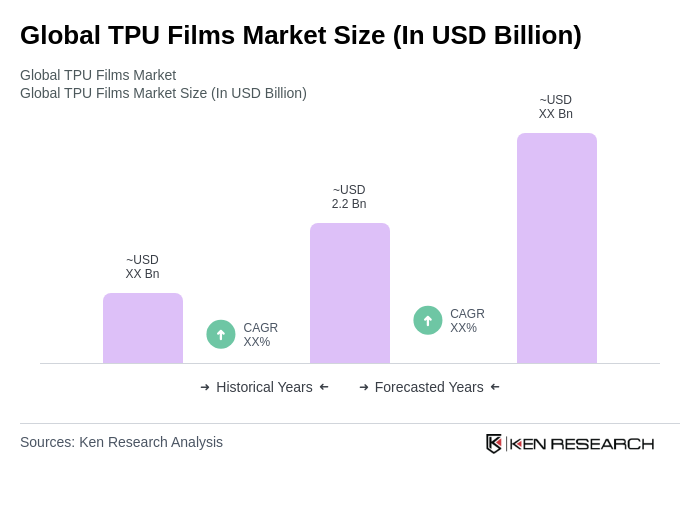

The Global TPU Films Market is valued at approximately USD 2.2 billion, reflecting a robust growth trajectory driven by the increasing demand for lightweight, durable, and flexible materials across various industries, including automotive, electronics, and packaging.