Region:Global

Author(s):Geetanshi

Product Code:KRAB0051

Pages:99

Published On:August 2025

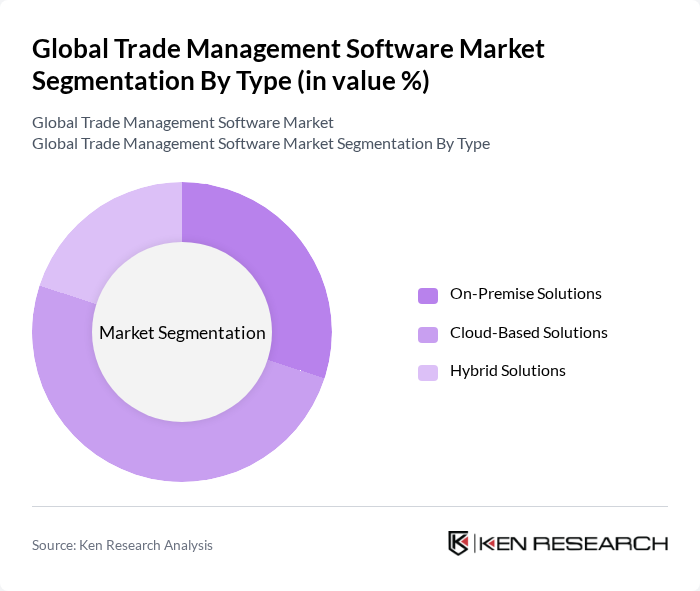

By Type:The market is segmented into On-Premise Solutions, Cloud-Based Solutions, and Hybrid Solutions. Cloud-based solutions are gaining significant traction due to their scalability, cost-effectiveness, and ability to support real-time collaboration and compliance updates. On-premise solutions remain relevant for organizations with strict data security requirements, while hybrid solutions offer a balance between control and flexibility.

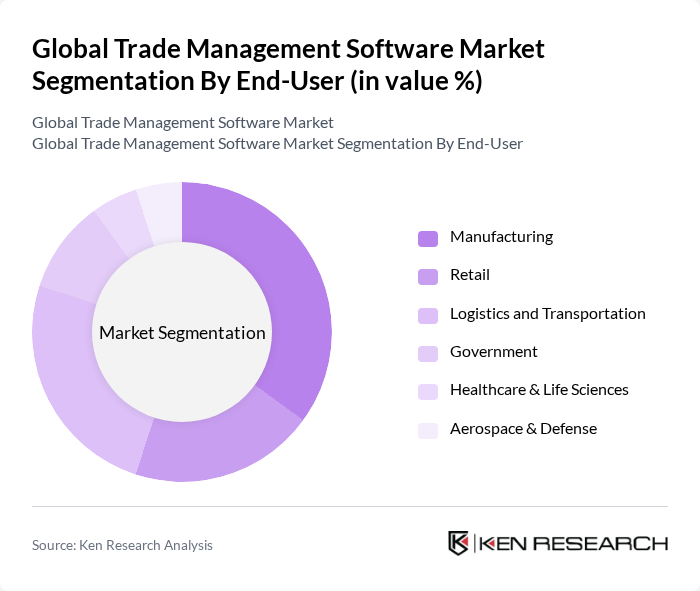

By End-User:The end-user segmentation includes Manufacturing, Retail, Logistics and Transportation, Government, Healthcare & Life Sciences, and Aerospace & Defense. Manufacturing remains the leading segment, driven by the need for efficient supply chain management, regulatory compliance, and automation. Logistics and transportation are also significant adopters, leveraging trade management software for real-time tracking, customs automation, and risk mitigation.

The Global Trade Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Infor, Inc., Descartes Systems Group Inc., Amber Road, Inc., BluJay Solutions Ltd., Kuebix, LLC, MIC Customs Solutions, WiseTech Global Limited, QAD Inc., E2open, LLC, Aptean, Inc., Manhattan Associates, Inc., Integration Point, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the trade management software market in None appears promising, driven by technological advancements and increasing globalization. As businesses seek to enhance operational efficiency, the integration of AI and machine learning into trade management solutions is expected to gain traction. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly trade practices, influencing software features and functionalities to meet evolving market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By End-User | Manufacturing Retail Logistics and Transportation Government Healthcare & Life Sciences Aerospace & Defense |

| By Component | Software Services |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Sales Channel | Direct Sales Indirect Sales |

| By Industry Vertical | Automotive Pharmaceuticals Consumer Goods Transportation & Logistics Government & Public Sector |

| By Enterprise Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Trade Management | 120 | Supply Chain Managers, Operations Directors |

| Retail Trade Compliance Solutions | 90 | Compliance Officers, IT Managers |

| Logistics and Freight Forwarding Software | 60 | Logistics Coordinators, Freight Managers |

| Customs Management Software | 50 | Customs Brokers, Trade Compliance Specialists |

| Global Trade Analytics Tools | 70 | Data Analysts, Business Intelligence Managers |

The Global Trade Management Software Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the complexities of global trade regulations and the increasing demand for automation in trade processes.