Region:Global

Author(s):Dev

Product Code:KRAA1478

Pages:85

Published On:August 2025

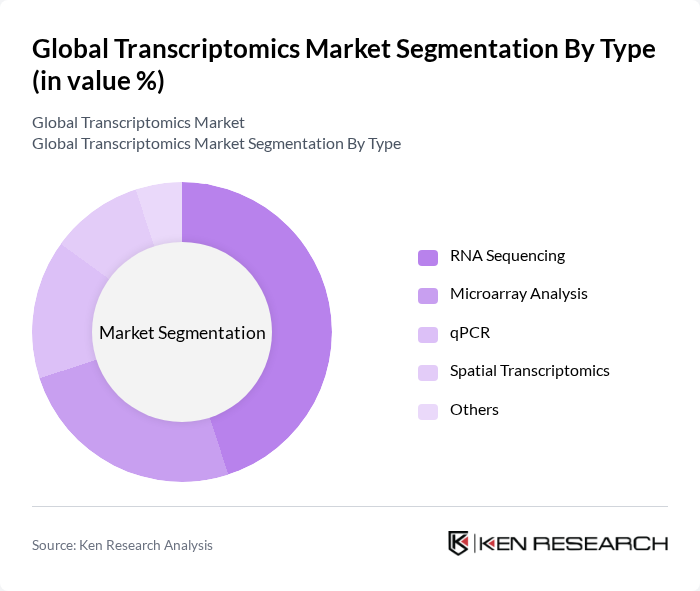

By Type:The market is segmented into RNA Sequencing, Microarray Analysis, qPCR, Spatial Transcriptomics, and Others. Among these, RNA Sequencing is the leading sub-segment due to its high sensitivity, ability to provide comprehensive insights into gene expression profiles, and scalability for large cohort studies. The demand for RNA Sequencing is driven by its applications in cancer research, drug development, rare disease profiling, and personalized medicine. Spatial Transcriptomics is emerging rapidly, enabling researchers to map gene expression within tissue architecture, which is critical for understanding tumor heterogeneity and tissue-specific disease mechanisms .

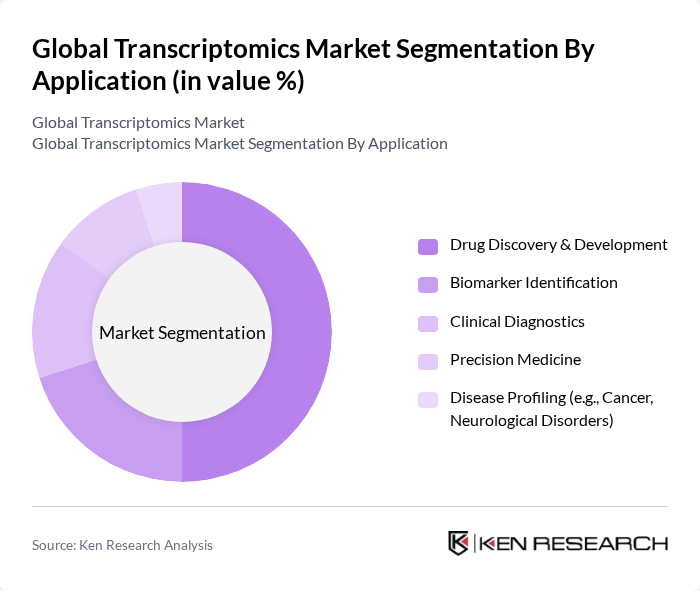

By Application:The applications of transcriptomics include Drug Discovery & Development, Biomarker Identification, Clinical Diagnostics, Precision Medicine, Disease Profiling (e.g., Cancer, Neurological Disorders), and Others. Drug Discovery & Development remains the dominant application area, as transcriptomics is essential for understanding disease mechanisms, identifying therapeutic targets, and validating drug efficacy. Biomarker Identification is increasingly important for early disease detection and patient stratification. Precision medicine and disease profiling are rapidly growing segments, reflecting the shift towards individualized treatment approaches and the need for molecular diagnostics in oncology and neurology .

The Global Transcriptomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Illumina, Inc., QIAGEN N.V., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche AG, PerkinElmer, Inc., BGI Genomics Co., Ltd., Pacific Biosciences of California, Inc., 10x Genomics, Inc., Oxford Nanopore Technologies Ltd., Merck KGaA, New England Biolabs, Inc., Takara Bio Inc., Genomatix Software GmbH, Fluidigm Corporation, NanoString Technologies, Inc., Bruker Corporation, Affymetrix (now part of Thermo Fisher Scientific), GeneTech Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transcriptomics market appears promising, driven by technological advancements and increasing applications in various fields. The integration of artificial intelligence and machine learning is expected to enhance data analysis capabilities, enabling more accurate interpretations of complex datasets. Furthermore, the expansion of transcriptomics applications in drug discovery and development will likely accelerate innovation, fostering collaborations between academia and industry. As emerging markets continue to invest in healthcare infrastructure, the global landscape for transcriptomics will evolve, presenting new opportunities for growth and development.

| Segment | Sub-Segments |

|---|---|

| By Type | RNA Sequencing Microarray Analysis qPCR Spatial Transcriptomics Others |

| By Application | Drug Discovery & Development Biomarker Identification Clinical Diagnostics Precision Medicine Disease Profiling (e.g., Cancer, Neurological Disorders) Others |

| By End-User | Academic & Research Institutes Pharmaceutical Companies Biotechnology Firms Contract Research Organizations (CROs) Hospitals & Clinical Laboratories Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Next-Generation Sequencing (NGS) Digital PCR RNA-Seq Microarrays Single-Cell Transcriptomics Others |

| By Product | Instruments Reagents & Consumables Software & Services Others |

| By Research Type | Basic Research Applied Research Clinical Research Others |

| By Funding Source | Government Grants Private Investments Academic Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biotech Research Institutions | 100 | Research Scientists, Lab Directors |

| Pharmaceutical Companies | 80 | Clinical Research Managers, Product Development Leads |

| Academic Institutions | 70 | Professors, Graduate Researchers |

| Healthcare Providers | 60 | Pathologists, Genomic Medicine Specialists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Transcriptomics Market is valued at approximately USD 5.55 billion, reflecting significant growth driven by advancements in genomic technologies, personalized medicine demand, and the rising prevalence of chronic diseases.