Region:Global

Author(s):Geetanshi

Product Code:KRAA2274

Pages:87

Published On:August 2025

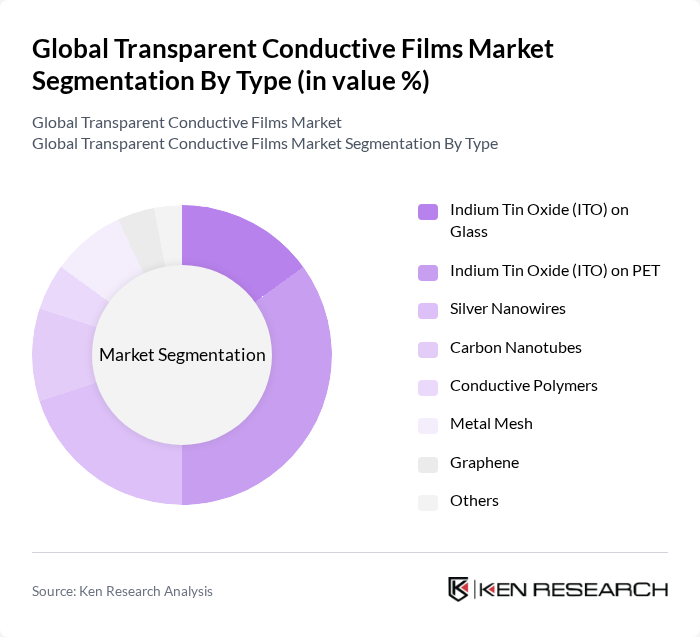

By Type:The market is segmented into various types of transparent conductive films, including Indium Tin Oxide (ITO) on Glass, Indium Tin Oxide (ITO) on PET, Silver Nanowires, Carbon Nanotubes, Conductive Polymers, Metal Mesh, Graphene, and Others. Among these, Indium Tin Oxide (ITO) on PET is currently the leading sub-segment due to its flexibility, lightweight properties, and compatibility with various applications, particularly in consumer electronics and displays. Silver nanowires and graphene are gaining traction due to their superior conductivity and flexibility, making them attractive for next-generation flexible and foldable devices .

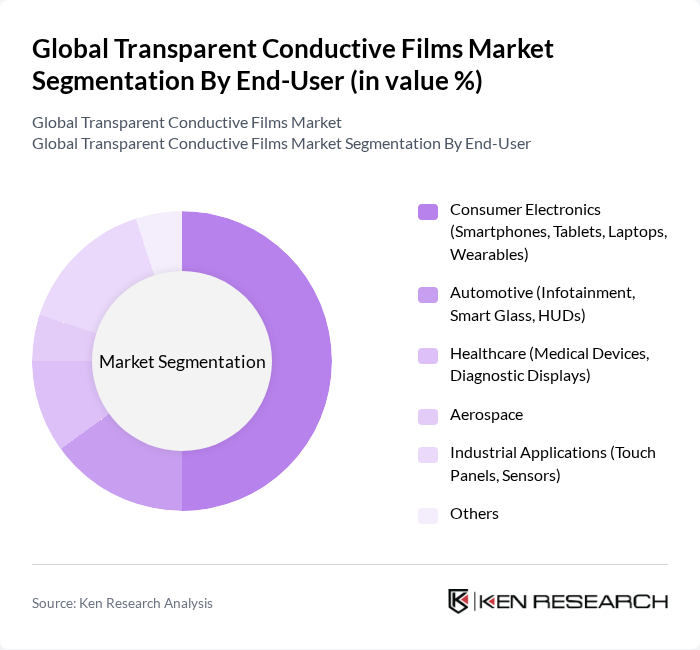

By End-User:The end-user segmentation includes Consumer Electronics (Smartphones, Tablets, Laptops, Wearables), Automotive (Infotainment, Smart Glass, HUDs), Healthcare (Medical Devices, Diagnostic Displays), Aerospace, Industrial Applications (Touch Panels, Sensors), and Others. The Consumer Electronics segment is the most significant contributor to the market, driven by the increasing demand for high-performance displays and touch-sensitive devices. The automotive sector is witnessing rapid adoption of transparent conductive films for infotainment systems, smart glass, and head-up displays, while industrial and healthcare applications are expanding due to the need for advanced touch interfaces and diagnostic equipment .

The Global Transparent Conductive Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, DuPont Teijin Films, AGC Inc., Nitto Denko Corporation, LG Chem Ltd., Heraeus Holding GmbH, Cambrios Technologies Corporation, Toyobo Co., Ltd., TPK Holding Co., Ltd., Samsung SDI Co., Ltd., Canatu Oy, Xinyi Glass Holdings Limited, Eastman Kodak Company, Solvay S.A., Teijin Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transparent conductive films market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of Internet of Things (IoT) technologies into consumer electronics is expected to enhance the demand for innovative transparent conductive solutions. Additionally, the shift towards sustainable materials will likely create new opportunities for manufacturers to develop eco-friendly products, aligning with global sustainability goals and consumer preferences for greener technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Indium Tin Oxide (ITO) on Glass Indium Tin Oxide (ITO) on PET Silver Nanowires Carbon Nanotubes Conductive Polymers Metal Mesh Graphene Others |

| By End-User | Consumer Electronics (Smartphones, Tablets, Laptops, Wearables) Automotive (Infotainment, Smart Glass, HUDs) Healthcare (Medical Devices, Diagnostic Displays) Aerospace Industrial Applications (Touch Panels, Sensors) Others |

| By Application | Touchscreens Displays (LCD, LED, OLED) Solar Photovoltaic Cells Smart Windows Flexible Electronics OLED Lighting Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesalers Others |

| By Region | Asia-Pacific (China, Japan, South Korea, India, Rest of APAC) North America (United States, Canada, Mexico, Rest of NA) Europe (Germany, UK, France, Italy, Rest of Europe) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA) |

| By Price Range | Low Medium High |

| By Technology | Thin Film Deposition Coating Technology Printing Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Procurement Specialists |

| Solar Panel Producers | 70 | Operations Managers, Supply Chain Analysts |

| Automotive Display Manufacturers | 60 | Engineering Managers, Quality Assurance Leads |

| Research Institutions | 40 | Research Scientists, Technical Directors |

| Raw Material Suppliers | 50 | Sales Managers, Market Analysts |

The Global Transparent Conductive Films Market is valued at approximately USD 6.7 billion, driven by the increasing demand for advanced electronic devices, renewable energy applications, and smart technologies across various sectors.