Region:Global

Author(s):Geetanshi

Product Code:KRAA1260

Pages:83

Published On:August 2025

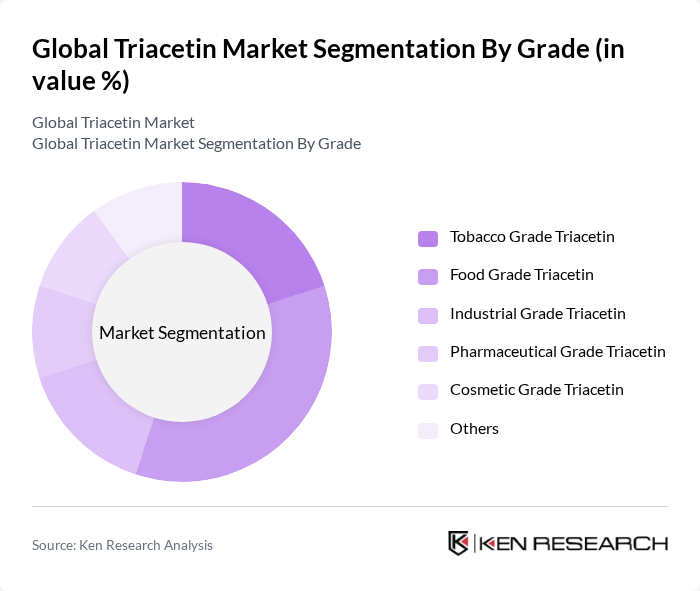

By Grade:The triacetin market is segmented into various grades, including Tobacco Grade Triacetin, Food Grade Triacetin, Industrial Grade Triacetin, Pharmaceutical Grade Triacetin, Cosmetic Grade Triacetin, and Others. Among these, Food Grade Triacetin is the leading subsegment due to its extensive use in the food and beverage industry as a flavoring agent and preservative. The increasing consumer preference for natural and safe food additives has further propelled the demand for food-grade products.

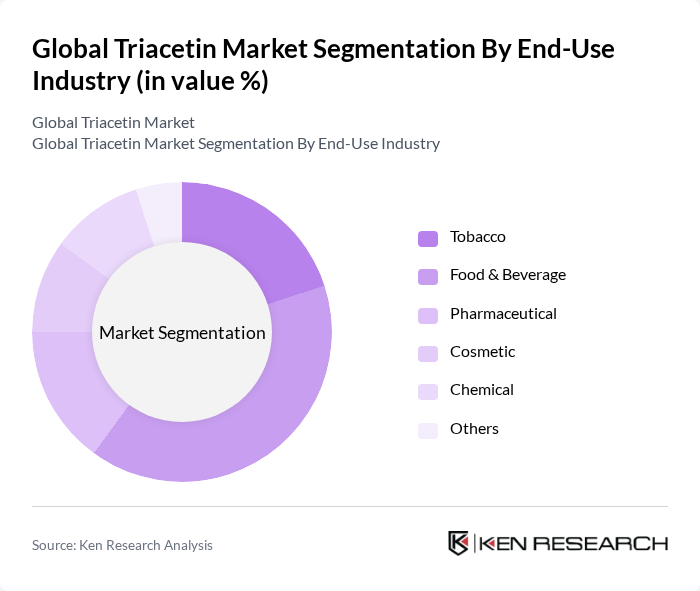

By End-Use Industry:The end-use industries for triacetin include Tobacco, Food & Beverage, Pharmaceutical, Cosmetic, Chemical, and Others. The Food & Beverage industry is the dominant segment, driven by the rising demand for food additives and preservatives. The increasing focus on food safety and quality has led to a surge in the use of triacetin in various food products, enhancing its market position.

The Global Triacetin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eastman Chemical Company, BASF SE, Daicel Corporation, Croda International Plc, Perstorp Holding AB, Lanxess AG, Jiangsu Shuangpai Chemical Co., Ltd., Polynt S.p.A., OXEA GmbH, Glycerin Products, Inc., The Chemical Company, Taminco Corporation, Aekyung Petrochemical Co., Ltd., Hubei Greenhome Chemical Co., Ltd., TPC Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the triacetin market appears promising, driven by increasing consumer awareness regarding health and sustainability. As industries shift towards eco-friendly practices, the demand for bio-based triacetin is expected to rise significantly. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, making triacetin more accessible. The growing trend of strategic partnerships among manufacturers will also facilitate innovation and market expansion, positioning the industry for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Grade | Tobacco Grade Triacetin Food Grade Triacetin Industrial Grade Triacetin Pharmaceutical Grade Triacetin Cosmetic Grade Triacetin Others |

| By End-Use Industry | Tobacco Food & Beverage Pharmaceutical Cosmetic Chemical Others |

| By Product Type | Plasticizer Solvent Humectant Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 100 | Food Technologists, Product Development Managers |

| Cosmetics and Personal Care | 75 | Formulation Chemists, Brand Managers |

| Pharmaceutical Uses | 60 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Applications | 50 | Manufacturing Engineers, Supply Chain Managers |

| Market Trends and Insights | 80 | Market Analysts, Business Development Executives |

The Global Triacetin Market is valued at approximately USD 360 million, driven by increasing demand across food, pharmaceuticals, and cosmetics industries. Its versatility as a plasticizer, solvent, and humectant contributes significantly to market growth.