Region:Global

Author(s):Dev

Product Code:KRAB0669

Pages:93

Published On:August 2025

By Type:The market is segmented into various types, including Feed Grade Triticale, Food Grade Triticale, Seed Triticale, Organic Triticale, and Others. Each of these subsegments caters to different consumer needs and preferences, influencing their market dynamics.

The Feed Grade Triticale subsegment is currently dominating the market due to the increasing demand for high-quality livestock feed. This trend is driven by the growing livestock industry, which seeks nutritious and cost-effective feed options. Additionally, the rising awareness of animal health and nutrition has led to a shift towards using triticale as a primary feed ingredient. The Food Grade Triticale segment is also gaining traction as consumers become more health-conscious and seek alternative grains for human consumption.

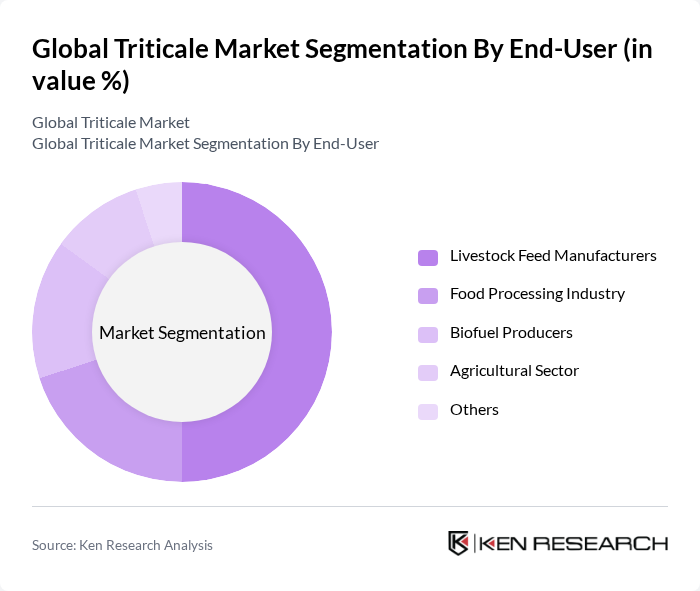

By End-User:The market is segmented based on end-users, including Livestock Feed Manufacturers, Food Processing Industry, Biofuel Producers, Agricultural Sector, and Others. Each end-user category plays a crucial role in shaping the demand for triticale.

The Livestock Feed Manufacturers segment leads the market, driven by the increasing global demand for meat and dairy products. This segment's growth is supported by the nutritional benefits of triticale, which is rich in protein and fiber, making it an ideal feed ingredient. The Food Processing Industry is also expanding its use of triticale as a functional ingredient in various food products, reflecting changing consumer preferences towards healthier and more sustainable food options.

The Global Triticale Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company, Bunge Limited, Syngenta AG, Bayer AG, Corteva Agriscience, Limagrain, KWS SAAT SE & Co. KGaA, AGT Food and Ingredients Inc., GrainCorp Limited, The Andersons, Inc., Trouw Nutrition, Alltech, Inc., BASF SE, Olam International Limited, DSV Deutsche Saatveredelung AG, Saaten-Union GmbH, Secobra Recherches contribute to innovation, geographic expansion, and service delivery in this space.

The future of the triticale market in None appears promising, driven by increasing consumer demand for sustainable and nutritious food options. As awareness of triticale's benefits grows, coupled with advancements in agricultural technology, its adoption is expected to rise. Additionally, the focus on organic farming and health-oriented products will likely create new avenues for growth, positioning triticale as a key player in the evolving agricultural landscape of the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Feed Grade Triticale Food Grade Triticale Seed Triticale Organic Triticale Others |

| By End-User | Livestock Feed Manufacturers Food Processing Industry Biofuel Producers Agricultural Sector Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Animal Feed Human Food Biofuel Production Cover Crop & Soil Improvement Others |

| By Distribution Channel | Direct Sales Online Retail Wholesale Distributors Agricultural Cooperatives Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing Others |

| By Quality Grade | High-Quality Triticale Standard Quality Triticale Low-Quality Triticale Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Triticale Farmers | 120 | Farm Owners, Agricultural Managers |

| Grain Distributors | 80 | Supply Chain Managers, Sales Directors |

| Food Manufacturers Using Triticale | 60 | Product Development Managers, Quality Assurance Officers |

| Research Institutions Focused on Cereal Crops | 50 | Agricultural Researchers, Policy Analysts |

| Exporters of Triticale | 40 | Export Managers, Trade Analysts |

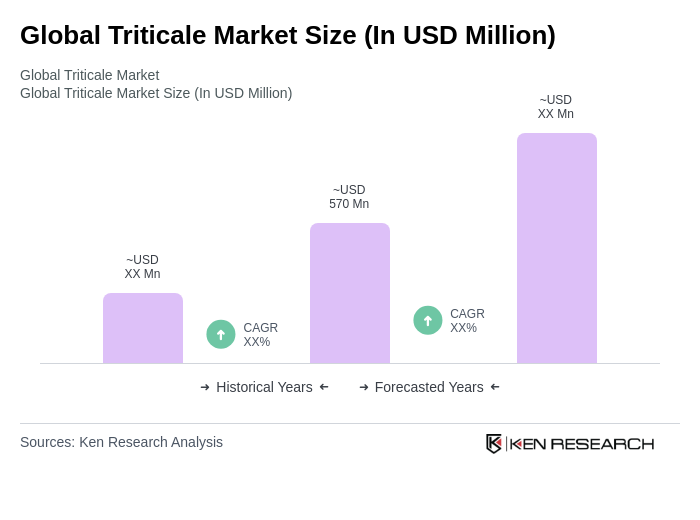

The Global Triticale Market is valued at approximately USD 570 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for high-protein feed and the crop's sustainability as a viable agricultural option.