Region:Global

Author(s):Shubham

Product Code:KRAA1809

Pages:100

Published On:August 2025

By Type:The market is segmented into various types of training, including Fixed-wing UAV training, Rotary-wing UAV training, Hybrid VTOL/fixed-wing UAV training, Simulator devices, and Payload/mission systems training. Each of these sub-segments caters to different operational needs and user preferences, reflecting the diverse applications of UAVs in various sectors.

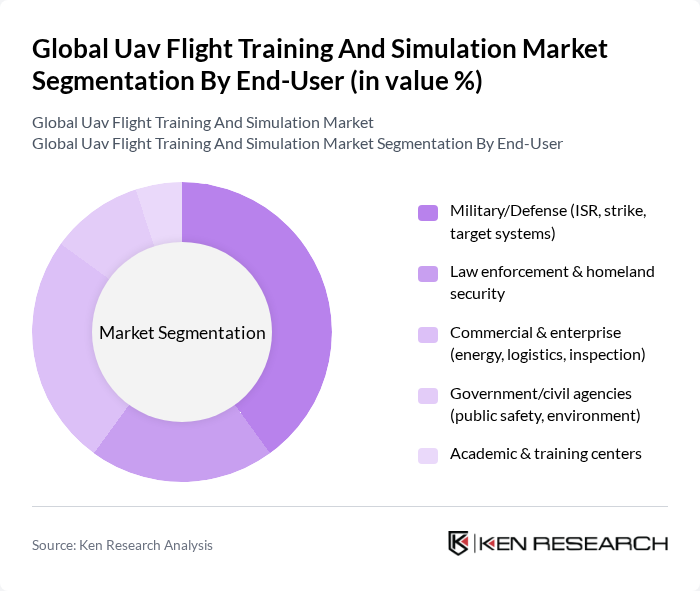

By End-User:The end-user segmentation includes Military/Defense, Law enforcement & homeland security, Commercial & enterprise, Government/civil agencies, and Academic & training centers. Each segment reflects the specific training requirements and operational contexts of different user groups, highlighting the versatility of UAV applications.

The Global UAV Flight Training and Simulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as CAE Inc., L3Harris Technologies, Inc. (including L3Harris Link Training & Simulation), Thales Group (Thales Training & Simulation), BAE Systems plc, Elbit Systems Ltd., Israel Aerospace Industries Ltd. (IAI), Textron Systems (Textron Inc.), General Atomics Aeronautical Systems, Inc. (GA-ASI), Northrop Grumman Corporation, Lockheed Martin Corporation, Simlat Ltd. (UAS simulation), Quantum3D, Inc., Presagis, Zen Technologies Limited, SDS International contribute to innovation, geographic expansion, and service delivery in this space.

The UAV flight training and simulation market is poised for significant growth as technological advancements continue to reshape the industry. The integration of artificial intelligence and machine learning into training programs is expected to enhance training efficiency and effectiveness. Additionally, the increasing focus on safety and risk management training will drive demand for innovative training solutions. As regulatory frameworks evolve, opportunities for collaboration with educational institutions will further expand the market landscape, fostering a new generation of skilled UAV operators.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-wing UAV training (Group 1–5 classes: SUAS, Tactical/MALE, HALE) Rotary-wing (multirotor and helicopter) UAV training Hybrid VTOL/fixed-wing UAV training Simulator devices (desktop, FMS, VR/AR, full-mission simulators) Payload/mission systems training (EO/IR, SAR, EW) |

| By End-User | Military/Defense (ISR, strike, target systems) Law enforcement & homeland security Commercial & enterprise (energy, logistics, inspection) Government/civil agencies (public safety, environment) Academic & training centers |

| By Application | ISR/Surveillance & reconnaissance Logistics & delivery operations Precision agriculture & environmental monitoring Search & rescue, disaster response Inspection & mapping (utility, construction, mining) |

| By Training Method | Instructor-led (in-person) pilot training eLearning/online ground school Blended/hybrid training Simulation-centric training (device-only or device-heavy) Live, virtual, constructive (LVC) integrated training |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Duration | Short courses & micro-credentials Extended courses & advanced operator programs Certification & ratings (Part 107, BVLOS, STS, military quals) Recurrent training & currency |

| By Pricing Model | Subscription/LMS license One-time course/device purchase Pay-per-seat/pay-per-flight hour Managed training services (outsourced) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| UAV Flight Training Schools | 120 | Program Directors, Chief Instructors |

| UAV Manufacturers | 90 | Product Managers, Training Coordinators |

| Simulation Software Providers | 60 | Technical Leads, Sales Managers |

| Government Aviation Authorities | 50 | Regulatory Officers, Policy Makers |

| UAV Training Trainees | 80 | Students, Recent Graduates |

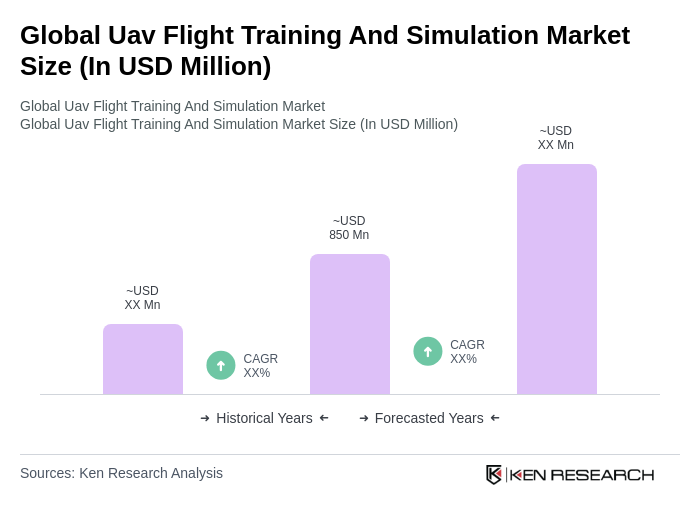

The Global UAV Flight Training and Simulation Market is valued at approximately USD 850 million, reflecting a strong demand for certified training and realistic simulation environments from both defense and commercial operators.