Region:Global

Author(s):Shubham

Product Code:KRAD0626

Pages:84

Published On:August 2025

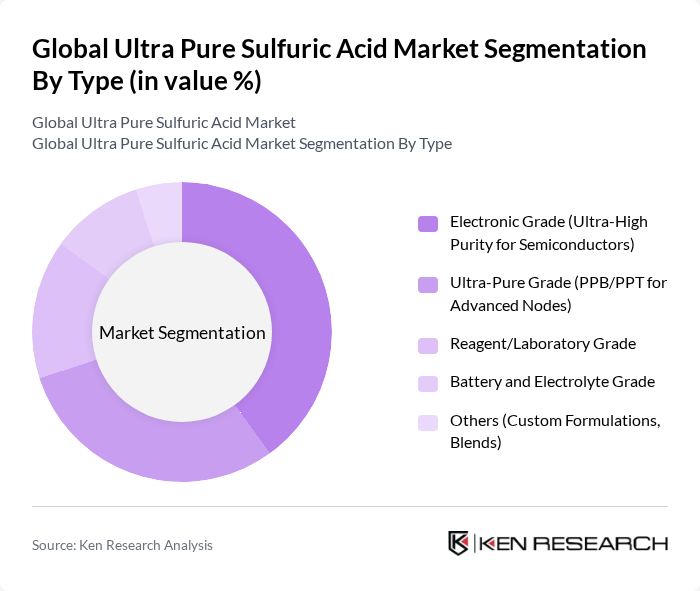

By Type:The market is segmented into various types of ultra-pure sulfuric acid, including Electronic Grade, Ultra-Pure Grade, Reagent/Laboratory Grade, Battery and Electrolyte Grade, and Others. Each type serves specific industrial needs, with Electronic Grade being particularly crucial for semiconductor applications due to its ultra-high purity requirements.

The Electronic Grade segment dominates the market due to the increasing demand for ultra-pure sulfuric acid in semiconductor manufacturing processes. This segment is driven by the rapid growth of the electronics industry, where high-purity chemicals are essential for wafer cleaning and etching. The need for advanced semiconductor technologies, including smaller nodes and higher performance, further propels the demand for Electronic Grade ultra-pure sulfuric acid.

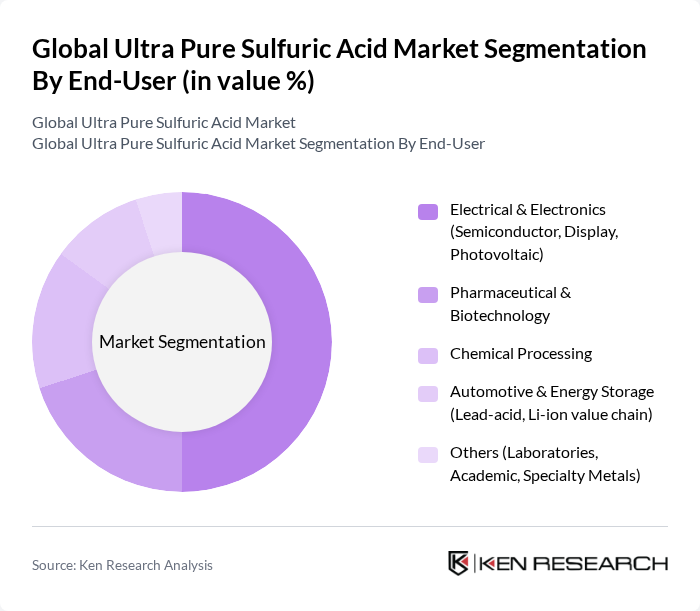

By End-User:The market is segmented by end-users, including Electrical & Electronics, Pharmaceutical & Biotechnology, Chemical Processing, Automotive & Energy Storage, and Others. Each end-user category has distinct requirements for ultra-pure sulfuric acid, with the Electrical & Electronics sector being the largest consumer.

The Electrical & Electronics segment is the leading end-user of ultra-pure sulfuric acid, primarily due to its critical role in semiconductor manufacturing and other electronic applications. The rapid advancements in technology and the increasing production of electronic devices drive the demand for high-purity chemicals, making this segment a significant contributor to the overall market growth.

The Global Ultra Pure Sulfuric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as KANTO KAGAKU Co., Ltd., KMG Chemicals, Inc. (CMC Materials), BASF SE, INEOS Group, Chemtrade Logistics Inc., PVS Chemicals, Inc., Mitsubishi Chemical Group Corporation, Sumitomo Chemical Co., Ltd., Avantor, Inc., FUJIFILM Wako Pure Chemical Corporation, Honeywell International Inc., Solvay S.A., LANXESS AG, OCI Company Ltd., Zhejiang Jihua Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ultra-pure sulfuric acid market appears promising, driven by technological advancements and increasing demand across various sectors. As industries prioritize sustainability, manufacturers are expected to adopt greener production methods, enhancing efficiency and reducing environmental impact. Furthermore, the ongoing expansion of the electronics and renewable energy sectors will likely create new opportunities for growth. Companies that invest in research and development will be well-positioned to capitalize on these trends, ensuring long-term success in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Grade (Ultra-High Purity for Semiconductors) Ultra-Pure Grade (PPB/PPT for Advanced Nodes) Reagent/Laboratory Grade Battery and Electrolyte Grade Others (Custom Formulations, Blends) |

| By End-User | Electrical & Electronics (Semiconductor, Display, Photovoltaic) Pharmaceutical & Biotechnology Chemical Processing Automotive & Energy Storage (Lead-acid, Li-ion value chain) Others (Laboratories, Academic, Specialty Metals) |

| By Application | Wafer Cleaning and Etching (Semiconductor/Foundry) Photolithography and Wet Bench Processes Photovoltaic Cell Manufacturing Pharmaceutical Synthesis and QC Electroplating and High-Purity Metal Processing Others (Reagents, Catalyst Preparation) |

| By Distribution Channel | Direct Sales to Fabs and OEMs Authorized Specialty Chemical Distributors Long-term Supply/On-site Supply Systems Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk (Tankers, ISO Tanks) Drums/IBCs with Cleanroom Handling Cleanroom Bottles/Carboys (Sealed) Others (Returnable Systems) |

| By Purity Level | PPB Grade (Parts Per Billion) PPT Grade (Parts Per Trillion) % and Above (5N/6N) Others (Application-Specific Specs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Production | 100 | Production Managers, Chemical Engineers |

| Industrial Chemical Manufacturing | 80 | Operations Directors, Quality Control Managers |

| Pharmaceutical Applications | 60 | Regulatory Affairs Specialists, R&D Managers |

| Environmental Compliance | 50 | Environmental Managers, Compliance Officers |

| Logistics and Distribution | 70 | Supply Chain Managers, Logistics Coordinators |

The Global Ultra Pure Sulfuric Acid Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the increasing demand for high-purity chemicals in various industrial applications, particularly in electronics and renewable energy sectors.