Region:Global

Author(s):Shubham

Product Code:KRAD0688

Pages:92

Published On:August 2025

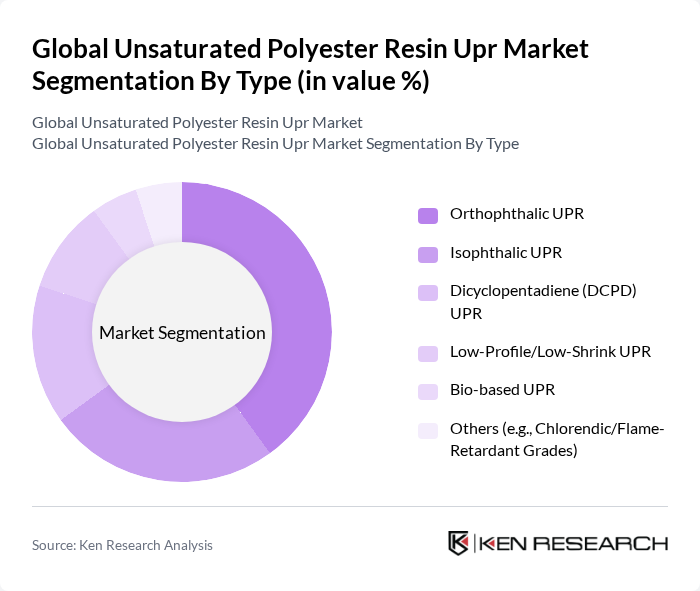

By Type:The unsaturated polyester resin market is segmented into various types, including Orthophthalic UPR, Isophthalic UPR, Dicyclopentadiene (DCPD) UPR, Low-Profile/Low-Shrink UPR, Bio-based UPR, and Others (e.g., Chlorendic/Flame-Retardant Grades). Among these, Orthophthalic UPR is the most widely used due to its cost-effectiveness and versatility in applications ranging from construction to automotive. The increasing demand for lightweight and durable materials in these sectors further drives the growth of this subsegment.

By End-Use Industry:The unsaturated polyester resin market is also segmented by end-use industries, including Building & Construction, Transportation (Automotive, Rail), Marine, Electrical & Electronics, Wind Energy, Pipes & Tanks/Chemical Processing, Consumer Goods & Appliances, and Others. The Building & Construction sector is the leading end-user, driven by the increasing demand for durable and lightweight materials in construction applications, such as roofing, flooring, and insulation.

The Global Unsaturated Polyester Resin Upr Market is characterized by a dynamic mix of regional and international players. Leading participants such as Polynt Group, INEOS Composites, AOC, LLC, Scott Bader Company Ltd., Ashland LLC, Allnex, Reichhold, DSM Composite Resins (now part of Covestro’s Resins & Functional Materials legacy), Sika AG, Swancor Holding Co., Ltd., Tianhe Resin (Guangdong Tianhe Industrial Co., Ltd.), Changzhou New Solar Co., Ltd., DIC Corporation, CCP Composites (legacy brand under Polynt-Reichhold), Showa Denko Materials Co., Ltd. (formerly Hitachi Chemical) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the unsaturated polyester resin market appears promising, driven by increasing demand for eco-friendly products and advancements in manufacturing technologies. As industries prioritize sustainability, the shift towards bio-based resins is expected to gain momentum, with production projected to increase by 15% annually. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and customization, allowing companies to better meet consumer preferences and adapt to market changes effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Orthophthalic UPR Isophthalic UPR Dicyclopentadiene (DCPD) UPR Low-Profile/Low-Shrink UPR Bio-based UPR Others (e.g., Chlorendic/Flame-Retardant Grades) |

| By End-Use Industry | Building & Construction Transportation (Automotive, Rail) Marine Electrical & Electronics Wind Energy Pipes & Tanks/Chemical Processing Consumer Goods & Appliances Others |

| By Application | Fiber-Reinforced Plastics (FRP) Composites Gelcoats Adhesives & Sealants Castings & Encapsulation Filled/Non?FRP Applications Others |

| By Form | Liquid Powder Prepregs/Pastes Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Curing/Initiation Method | Peroxide-Cured (MEKP, BPO) UV-Cured Heat-Cured Others |

| By Processing Technology | Hand Lay?Up & Spray?Up Resin Transfer Molding (RTM/VARTM) Pultrusion Filament Winding Compression/SMC & BMC Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 120 | Product Engineers, Procurement Managers |

| Construction Sector Usage | 90 | Project Managers, Architects |

| Marine Industry Applications | 70 | Marine Engineers, Supply Chain Managers |

| Consumer Goods Manufacturing | 60 | Production Supervisors, Quality Control Managers |

| Specialty Coatings and Adhesives | 80 | R&D Managers, Technical Sales Representatives |

The Global Unsaturated Polyester Resin market is valued at approximately USD 13 billion, based on a five-year historical analysis. This growth is driven by increasing demand from various industries, including construction, automotive, and marine sectors.