Region:Global

Author(s):Shubham

Product Code:KRAD0705

Pages:96

Published On:August 2025

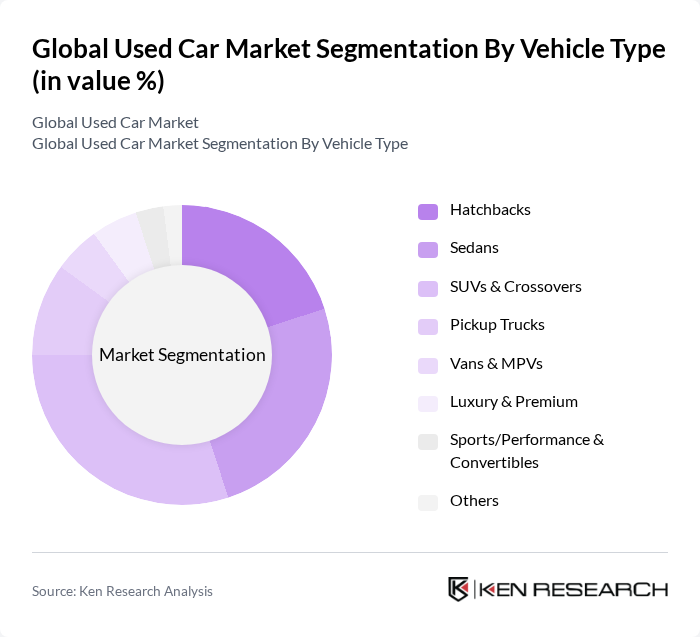

By Vehicle Type:The used car market is segmented by vehicle type, including hatchbacks, sedans, SUVs & crossovers, pickup trucks, vans & MPVs, luxury & premium vehicles, sports/performance & convertibles, and others. SUVs & crossovers have seen sustained popularity due to practicality and perceived safety, while sedans and hatchbacks remain attractive for value and fuel efficiency. Rising digital retailing and certification programs have supported consumer confidence across segments, with organized players emphasizing transparent pricing and warranties that particularly bolster SUV and mainstream passenger categories .

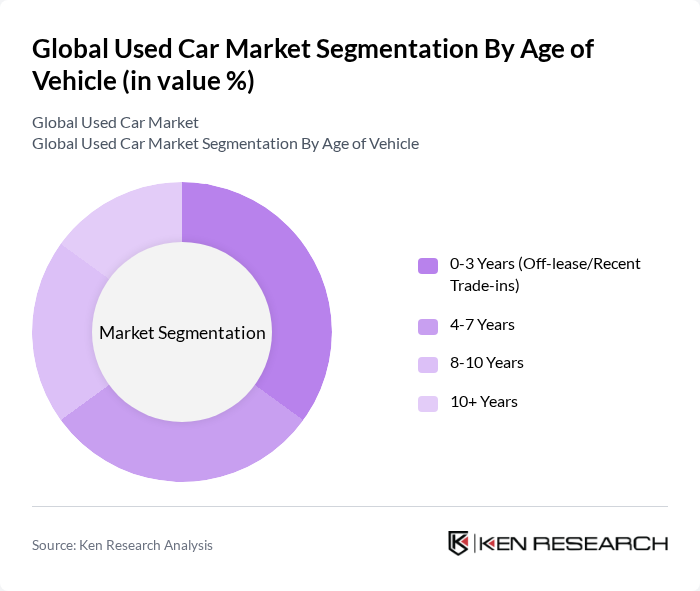

By Age of Vehicle:The segmentation by age of vehicle includes 0-3 years (off-lease/recent trade-ins), 4-7 years, 8-10 years, and 10+ years. The 0-3 years cohort is buoyed by certified pre-owned availability, recent technology/content, and lower perceived risk; strong demand also persists in the 4-7 years band as depreciation advantages meet affordability and wider model choice. Organized players’ inspection standards and warranties underpin buyer trust across these age bands in both offline and online channels .

The Global Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as CarMax, Inc., AutoNation, Inc., Carvana Co., Lithia Motors, Inc. (Driveway), Penske Automotive Group, Inc. (CarShop), Sonic Automotive, Inc. (EchoPark Automotive), Asbury Automotive Group, Inc. (Clicklane), Group 1 Automotive, Inc., Lookers plc, Pendragon plc (Evans Halshaw; CarStore), Auto Trader Group plc, Cazoo Group Ltd., AutoScout24 GmbH, Mobile.de GmbH, Cars.com Inc., TrueCar, Inc., Edmunds.com, Inc., eBay Inc. (Motors), Alibaba Group Holding Ltd. (Tmall Auto; Taobao Used Cars), Copart, Inc., KAR Global (ADESA; OPENLANE), BCA Marketplace Limited (British Car Auctions), Inchcape plc, Maruti Suzuki India Ltd. (True Value), Mahindra First Choice Wheels Ltd., OLX Group (OLX Autos), Droom Technology Pvt. Ltd., Cars24 Services Private Limited, Toyota Motor Corporation (Toyota Certified Used Vehicles), Volkswagen AG (Das WeltAuto) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the used car market appears promising, driven by technological advancements and changing consumer preferences. As online purchasing continues to gain traction, more consumers will likely opt for digital platforms, enhancing convenience and accessibility. Additionally, the growing interest in electric and hybrid vehicles will create new segments within the used car market, appealing to environmentally conscious consumers. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Hatchbacks Sedans SUVs & Crossovers Pickup Trucks Vans & MPVs Luxury & Premium Sports/Performance & Convertibles Others |

| By Age of Vehicle | 3 Years (Off-lease/Recent Trade-ins) 7 Years 10 Years + Years |

| By Condition/Certification | Certified Pre-Owned (CPO) Non-Certified |

| By Sales Channel | Franchised Dealerships Independent Dealers Online-first Platforms (e-commerce) Auctions (Wholesale & Retail) Private Party Sales |

| By Powertrain/Fuel Type | Gasoline Diesel Hybrid (HEV/PHEV) Battery Electric Vehicles (BEV) Others (CNG/LPG/Flex-fuel) |

| By Buyer Type | Personal/Individual Commercial & Fleet (including rental, ride-hailing, corporate) |

| By Financing Method | Cash Purchases Dealer-arranged Loans Bank/Credit Union Loans Buy-Here-Pay-Here (BHPH) Subscription/Other |

| By Geographic Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Price Band (USD) | Under $10,000 $10,000 - $20,000 $20,000 - $30,000 $30,000 - $50,000 Over $50,000 |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 120 | Dealership Owners, Sales Managers |

| Consumer Purchases of Used Cars | 150 | Recent Buyers, Prospective Buyers |

| Online Used Car Platforms | 90 | Platform Managers, Data Analysts |

| Automotive Financing Institutions | 80 | Loan Officers, Financial Advisors |

| Automotive Industry Experts | 50 | Market Analysts, Automotive Consultants |

The global used car market is valued at approximately USD 2.5 trillion, driven by factors such as affordability, improved financing access, and the growth of digital retailing and inspection tools that enhance transparency for consumers.