Region:Global

Author(s):Shubham

Product Code:KRAC0665

Pages:86

Published On:August 2025

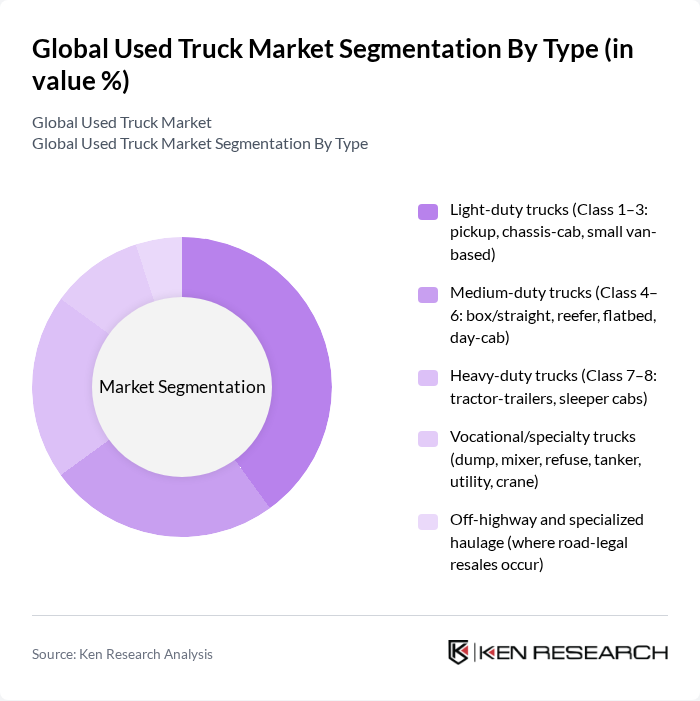

By Type:The used truck market is segmented into various types, including light-duty trucks, medium-duty trucks, heavy-duty trucks, vocational/specialty trucks, and off-highway and specialized haulage. Heavy-duty trucks account for a substantial share of used?truck revenues globally due to their higher unit values and sustained freight demand, while light?duty trucks lead volumes in urban logistics and last?mile applications; both categories are central to market liquidity across regions .

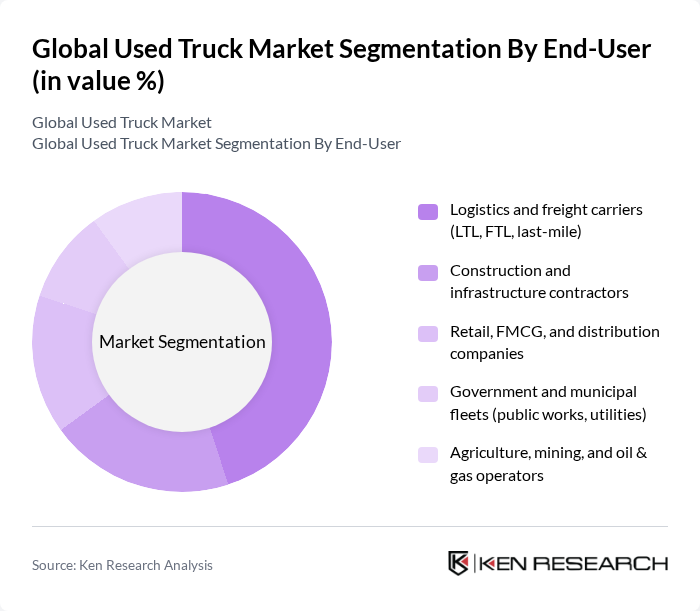

By End-User:The end-user segmentation includes logistics and freight carriers, construction and infrastructure contractors, retail and FMCG companies, government and municipal fleets, and agriculture, mining, and oil & gas operators. Logistics and freight carriers remain the most significant contributors to used?truck demand, underpinned by e?commerce growth, regional distribution build?outs, and fleet optimization cycles; construction and agriculture also support steady purchases of vocational and medium/heavy units .

The Global Used Truck Market is characterized by a dynamic mix of regional and international players. Leading participants such as Volvo Group (Volvo Used Trucks; Arrow Truck Sales), Daimler Truck AG (SelecTrucks; Mercedes?Benz Trucks Used), PACCAR Inc. (Kenworth Certified Pre?Owned; Peterbilt Red Oval), Navistar International Corporation (International Used Truck Centers), MAN Truck & Bus SE (MAN TopUsed), Scania AB (Scania Used Vehicles), Isuzu Motors Limited (Isuzu UTE/Isuzu Used Commercial Programs), Hino Motors, Ltd. (Hino CPO; Toyota Group), Tata Motors Limited (Tata Motors Assured Vehicles), Ford Motor Company (Ford Pro Commercial Vehicle Remarketing), Freightliner Trucks (Daimler Truck; SelecTrucks network), Kenworth Truck Company (PACCAR; CPO), Mack Trucks, Inc. (Mack Certified Used), International Trucks (Navistar; Used Truck Centers), Penske Used Trucks, Ryder Used Trucks, Enterprise Truck Sales, Ritchie Bros. (including IAA and IronPlanet), Manheim Auctions (Cox Automotive), AutoNation USA – Truck & Commercial (select markets), Trucks24/Truck24 (Europe digital marketplace), TruckScout24 (Europe), Mascus (Ritchie Bros. marketplace), Commercial Truck Trader (USA marketplace), OLX Autos (selected LATAM/Asia used commercial) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the used truck market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms for buying and selling used trucks gain traction, the market is expected to see increased transparency and efficiency. Additionally, the growing emphasis on sustainability will likely lead to a rise in demand for eco-friendly used trucks, including electric and hybrid models, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Light-duty trucks (Class 1–3: pickup, chassis-cab, small van-based) Medium-duty trucks (Class 4–6: box/straight, reefer, flatbed, day-cab) Heavy-duty trucks (Class 7–8: tractor-trailers, sleeper cabs) Vocational/specialty trucks (dump, mixer, refuse, tanker, utility, crane) Off-highway and specialized haulage (where road-legal resales occur) |

| By End-User | Logistics and freight carriers (LTL, FTL, last-mile) Construction and infrastructure contractors Retail, FMCG, and distribution companies Government and municipal fleets (public works, utilities) Agriculture, mining, and oil & gas operators |

| By Sales Channel | Direct fleet sales (fleet disposal/renewal) Online marketplaces and digital auction platforms Franchised OEM dealerships (manufacturer-approved used) Independent dealerships and physical auctions |

| By Condition | Certified pre-owned (multi-point inspected, warranty-backed) Non-certified used (as-is, dealer or private) |

| By Price Range | Below $20,000 $20,000 - $50,000 $50,000 - $100,000 Above $100,000 |

| By Fuel Type | Diesel Gasoline Battery-electric Hybrid and alternative fuels (CNG/LNG, hydrogen) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Companies | 120 | Fleet Managers, Operations Directors |

| Used Truck Dealerships | 100 | Sales Managers, Inventory Specialists |

| Logistics and Transportation Firms | 110 | Logistics Coordinators, Procurement Managers |

| Construction Companies | 80 | Project Managers, Equipment Managers |

| Online Auction Platforms | 60 | Marketplace Managers, Customer Service Representatives |

The global used truck market is valued at approximately USD 5055 billion, based on a five-year historical analysis and recent industry estimates. This valuation reflects actual transaction values in the secondary market, driven by demand for cost-effective transportation solutions.