Region:Global

Author(s):Dev

Product Code:KRAA1642

Pages:83

Published On:August 2025

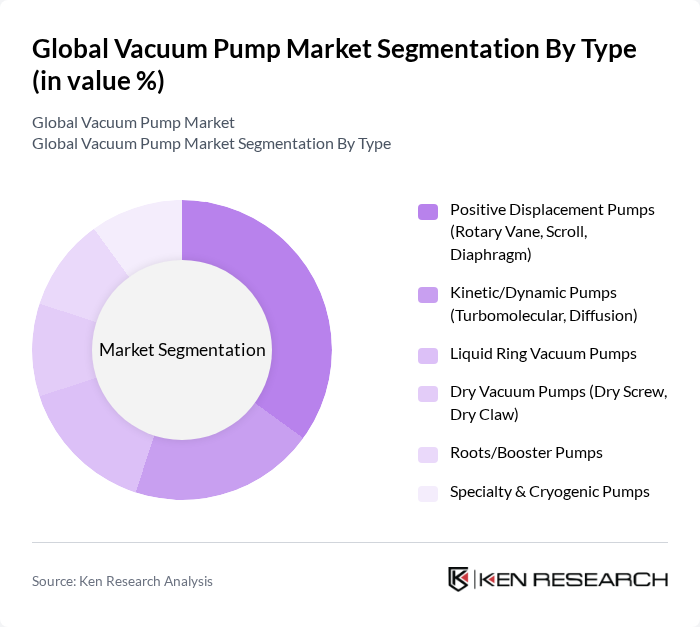

By Type:The vacuum pump market can be segmented into various types, including Positive Displacement Pumps, Kinetic/Dynamic Pumps, Liquid Ring Vacuum Pumps, Dry Vacuum Pumps, Roots/Booster Pumps, and Specialty & Cryogenic Pumps. Among these, Positive Displacement Pumps, particularly Rotary Vane and Diaphragm types, are leading the market due to their reliability and efficiency in various applications .

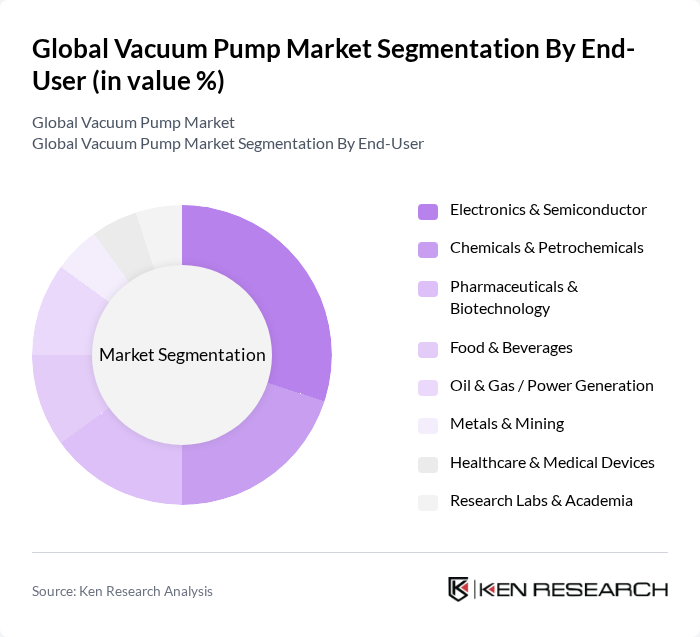

By End-User:The end-user segmentation includes Electronics & Semiconductor, Chemicals & Petrochemicals, Pharmaceuticals & Biotechnology, Food & Beverages, Oil & Gas / Power Generation, Metals & Mining, Healthcare & Medical Devices, and Research Labs & Academia. The Electronics & Semiconductor sector is the dominant end-user, driven by the increasing demand for high-precision manufacturing processes .

The Global Vacuum Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlas Copco AB (Edwards Vacuum), Pfeiffer Vacuum Technology AG, Busch Vacuum Solutions, Leybold GmbH (A Member of Atlas Copco Group), ULVAC, Inc., Ebara Corporation, Kashiyama Industries, Ltd., Shimadzu Corporation, Agilent Technologies, Inc. (Vacuum Products), Tsurumi Manufacturing Co., Ltd. (Vacuum/Liquid Ring), Becker Pumpenfabrik GmbH, Gardner Denver Industrials (Ingersoll Rand), Edwards Korea Ltd., Graham Corporation (Barometric & Ejector Systems), Sterling SIHI GmbH (Flowserve SIHI) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vacuum pump market appears promising, driven by technological advancements and increasing industrial applications. As industries prioritize energy efficiency and sustainability, the demand for innovative vacuum solutions is expected to rise. Additionally, the integration of IoT technologies will enhance operational efficiency and predictive maintenance capabilities. Companies that adapt to these trends and invest in R&D will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Positive Displacement Pumps (Rotary Vane, Scroll, Diaphragm) Kinetic/Dynamic Pumps (Turbomolecular, Diffusion) Liquid Ring Vacuum Pumps Dry Vacuum Pumps (Dry Screw, Dry Claw) Roots/Booster Pumps Specialty & Cryogenic Pumps |

| By End-User | Electronics & Semiconductor Chemicals & Petrochemicals Pharmaceuticals & Biotechnology Food & Beverages Oil & Gas / Power Generation Metals & Mining Healthcare & Medical Devices Research Labs & Academia |

| By Application | Vacuum Drying & Degassing Vacuum Distillation & Evaporation Leak Testing & Helium Recovery Vacuum Packaging Coating & Deposition (PVD/CVD, Sputtering) Vacuum Filtration Others |

| By Distribution Channel | Direct Sales (OEM & Key Accounts) Distributors/Value-Added Resellers Online/Marketplace Service & Aftermarket |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Lubrication: Oil-Sealed (Wet) Lubrication: Dry (Oil-Free) Vacuum Level: Low (1000 to 1 mbar) Vacuum Level: Medium (1 to 10^-3 mbar) Vacuum Level: High/Ultra-High (below 10^-3 mbar) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Vacuum Pump Users | 140 | Plant Managers, Operations Directors |

| Medical Equipment Manufacturers | 100 | Quality Assurance Managers, R&D Engineers |

| Food Processing Sector | 80 | Production Supervisors, Safety Compliance Officers |

| Semiconductor Manufacturing | 70 | Process Engineers, Facility Managers |

| Environmental Applications | 60 | Environmental Engineers, Project Managers |

The Global Vacuum Pump Market is valued at approximately USD 6.7 billion, driven by increasing demand across various industries such as electronics, pharmaceuticals, and food processing, where precise vacuum conditions are essential for production and quality control.