Region:Global

Author(s):Dev

Product Code:KRAB0438

Pages:86

Published On:August 2025

By Type:The vanilla market can be segmented into various types, including Natural Vanilla Beans, Natural Vanilla Extract, Vanilla Oleoresin and Concentrates, Vanilla Powder, Vanilla Paste, and Vanillin and Vanilla Flavors. Among these, Natural Vanilla Beans, particularly Bourbon and Tahitian varieties, are leading the market for premium applications due to their rich flavor profile and alignment with clean?label preferences. At the same time, vanillin and compounded vanilla flavors remain widely used across mass and value segments for cost and supply stability, while liquid forms (extracts) retain broad industrial use in dairy, bakery, and beverages .

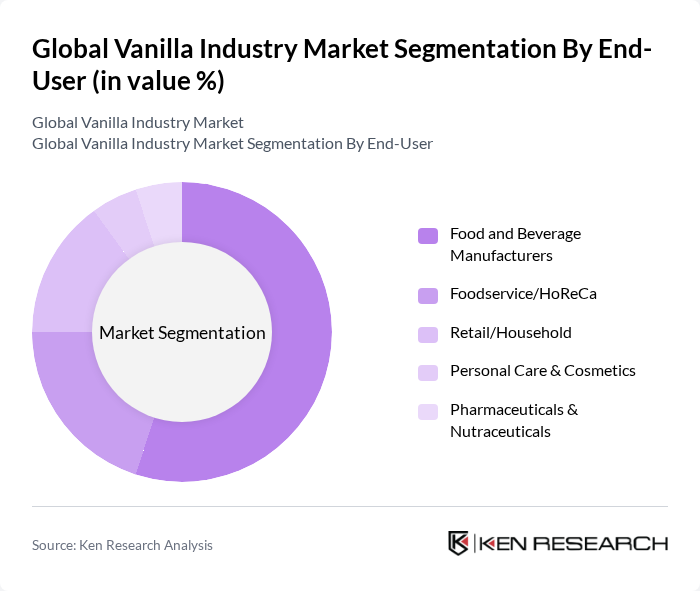

By End-User:The end-user segmentation of the vanilla market includes Food and Beverage Manufacturers, Foodservice/HoReCa, Retail/Household, Personal Care & Cosmetics, and Pharmaceuticals & Nutraceuticals. Food and Beverage Manufacturers remain the largest users, supported by widespread incorporation of vanilla in ice creams, baked goods, chocolates, dairy, RTD beverages, and desserts; growing café culture and artisanal products continue to fuel premium vanilla demand. Personal care and nutraceutical uses are stable but secondary compared with core F&B volumes .

The Global Vanilla Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nielsen-Massey Vanillas, Inc., McCormick & Company, Inc., Aust & Hachmann (Canada) Ltd., Eurovanille, Prova SAS, Symrise AG, Givaudan SA, Sensient Technologies Corporation, Firmenich SA, Frontier Co-op, LAFAZA Foods, Tharakan & Company, Super Africa Products, The Vanilla Company, Synthite Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the vanilla industry appears promising, driven by a growing consumer preference for natural and organic products. Innovations in sustainable farming practices and processing techniques are expected to enhance supply chain efficiency. Additionally, the rise of e-commerce platforms is likely to facilitate broader market access for vanilla producers, enabling them to reach a global audience. As health trends continue to evolve, the integration of vanilla into health products will further solidify its market position.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Vanilla Beans (Bourbon/Madagascar, Tahitian, Indonesian) Natural Vanilla Extract (single-fold, double-fold) Vanilla Oleoresin and Concentrates Vanilla Powder (pure, sugar/dextrose-based) Vanilla Paste Vanillin and Vanilla Flavors (bio-based/biotech, synthetic) |

| By End-User | Food and Beverage Manufacturers Foodservice/HoReCa Retail/Household Personal Care & Cosmetics Pharmaceuticals & Nutraceuticals |

| By Application | Bakery & Baked Goods Ice Cream & Frozen Desserts Confectionery & Chocolates Beverages (dairy, RTD, coffee, alcoholic) Savory, Sauces & Others |

| By Distribution Channel | B2B Direct (ingredient suppliers/flavor houses) Distributors & Importers Supermarkets & Hypermarkets Specialty & Gourmet Stores Online Retail & Marketplaces |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Price Range | Premium/ Gourmet (Grade A beans, pure extract) Mid-Range (Grade B beans, blends) Value/ Budget (synthetic and blended flavors) |

| By Packaging Type | Bulk Industrial (drums, pails, vacuum-packed beans) Retail Packs (glass bottles, pouches, tubes) Foodservice Packs (liter bottles, sachets) Eco-Friendly & Recyclable Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vanilla Farmers | 100 | Smallholder Farmers, Cooperative Leaders |

| Distributors and Wholesalers | 80 | Supply Chain Managers, Sales Directors |

| Food and Beverage Manufacturers | 70 | Product Development Managers, Quality Assurance Heads |

| Cosmetics and Fragrance Companies | 60 | Formulation Chemists, Brand Managers |

| Regulatory Bodies and Trade Associations | 50 | Policy Analysts, Industry Representatives |

The Global Vanilla Industry Market is valued at approximately USD 3.2 billion, reflecting a comprehensive analysis of both natural and synthetic vanilla forms. This valuation highlights the market's growth driven by increasing demand for natural flavors in various sectors.