Region:Global

Author(s):Dev

Product Code:KRAD0489

Pages:92

Published On:August 2025

By Type:The market is segmented into various treatment types, including Endovenous Laser Ablation (EVLA/EVLT), Ultrasound-Guided Foam Sclerotherapy (UGFS), Radiofrequency Ablation (RFA), Cyanoacrylate Adhesive Closure (e.g., VenaSeal), Mechanochemical Ablation (MOCA; e.g., ClariVein), Surgical Ligation and Stripping/Phlebectomy, Compression Therapy (stockings, wraps), and Others (steam vein sclerosis, endovenous microfoam). Among these, Endovenous Laser Ablation (EVLA) is widely adopted due to its minimally invasive nature, shorter recovery times, and strong clinical success rates relative to traditional surgery; along with RFA, it has seen growing preference in outpatient settings as technology has improved fibers/catheters and ultrasound guidance.

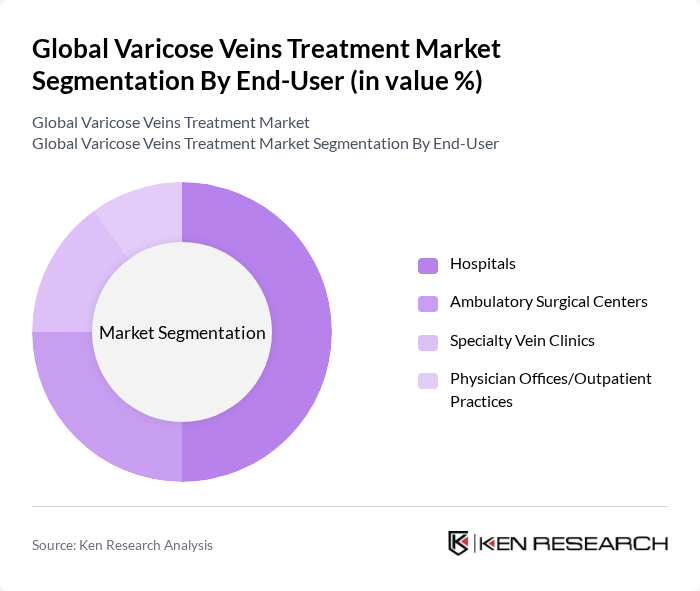

By End-User:The market is segmented by end-users, including Hospitals, Ambulatory Surgical Centers, Specialty Vein Clinics, and Physician Offices/Outpatient Practices. Hospitals are a major end-user due to comprehensive facilities and capacity to manage complex venous disease, while Ambulatory Surgical Centers and specialized vein clinics have expanded as endovenous procedures shift to outpatient settings for efficiency and lower cost.

The Global Varicose Veins Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, AngioDynamics, Inc., Teleflex Incorporated, Cook Medical LLC, Vascular Solutions (a Teleflex brand), Biolitec AG, Alma Lasers Ltd. (Sisram Medical), El.En. S.p.A. (Quanta System/Asclepion brands), Venclose, Inc. (a Becton, Dickinson and Company brand), Sciton, Inc., FCare Systems NV, Synergy Health Concepts (USA Vein Clinics), BTG plc – Varithena (Endovenous microfoam; now part of Boston Scientific), Medtronic – VenaSeal (Cyanoacrylate adhesive closure system) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the varicose veins treatment market appears promising, driven by ongoing technological advancements and increasing patient awareness. As healthcare systems evolve, the integration of telemedicine and personalized treatment plans is expected to enhance patient engagement and satisfaction. Furthermore, the growing geriatric population will likely increase demand for effective treatments, creating a robust market environment. Stakeholders must remain agile to capitalize on these trends and address emerging challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Endovenous Laser Ablation (EVLA/EVLT) Ultrasound-Guided Foam Sclerotherapy (UGFS) Radiofrequency Ablation (RFA) Cyanoacrylate Adhesive Closure (e.g., VenaSeal) Mechanochemical Ablation (MOCA; e.g., ClariVein) Surgical Ligation and Stripping/Phlebectomy Compression Therapy (stockings, wraps) Others (steam vein sclerosis, endovenous microfoam) |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Vein Clinics Physician Offices/Outpatient Practices |

| By Treatment Method | Minimally Invasive Endovenous Procedures Non-thermal, Non-tumescent (NTNT) Techniques Surgical Procedures Conservative/Adjunctive Therapies |

| By Distribution Channel | Direct Sales to Providers Distributors/Medical Device Dealers Group Purchasing Organizations (GPOs) Online/Indirect Procurement Portals |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Age Group Gender Obesity/BMI Risk Category Occupational Risk (standing/sedentary) |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vascular Surgery Clinics | 100 | Vascular Surgeons, Clinic Administrators |

| Patient Experience with Treatments | 140 | Patients who have undergone varicose veins treatment |

| Healthcare Providers' Insights | 80 | General Practitioners, Nurse Practitioners |

| Medical Device Manufacturers | 70 | Product Managers, R&D Specialists |

| Insurance Providers' Perspectives | 60 | Claims Adjusters, Policy Analysts |

The Global Varicose Veins Treatment Market is valued at approximately USD 2.1 billion, reflecting a significant growth driven by the increasing prevalence of venous diseases and advancements in minimally invasive treatment technologies.