Region:Global

Author(s):Rebecca

Product Code:KRAA1385

Pages:98

Published On:August 2025

By Type:The market is segmented into various types of veterinary drugs, including antimicrobials, vaccines, parasiticides, anti-inflammatory and analgesic drugs, hormonal medications, nutraceuticals and feed additives, and antifungals. Among these, vaccines and antimicrobials are the most significant subsegments, driven by the increasing need for disease prevention and treatment in both companion animals and livestock. The growing regulatory approval of novel drugs and increased focus on preventive healthcare further support the expansion of these segments .

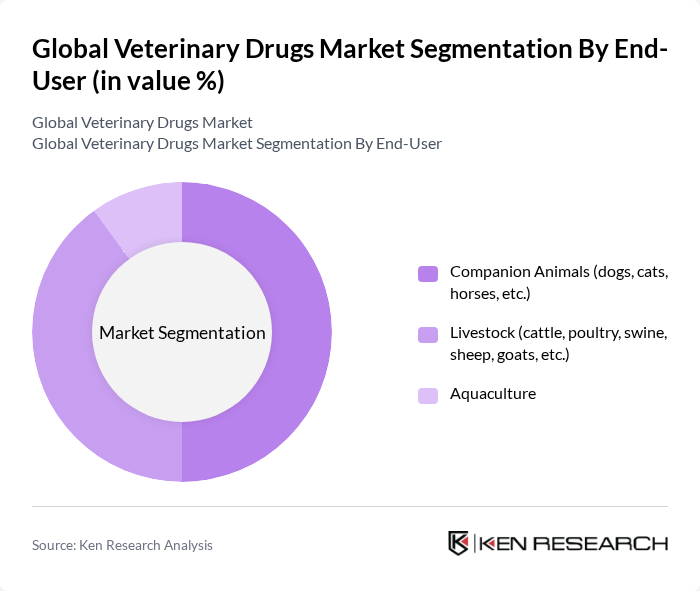

By End-User:The veterinary drugs market is categorized based on end-users, which include companion animals, livestock, and aquaculture. Companion animals, particularly dogs and cats, represent a significant portion of the market due to the increasing trend of pet ownership and the growing willingness of pet owners to spend on healthcare products for their pets. Livestock remains a substantial segment, driven by the need for disease management and productivity in food-producing animals. The aquaculture segment is expanding steadily, supported by the rising demand for fish and seafood .

The Global Veterinary Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (Merck & Co., Inc.), Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac, Dechra Pharmaceuticals PLC, Vetoquinol S.A., Phibro Animal Health Corporation, IDEXX Laboratories, Inc., Neogen Corporation, Bimeda Animal Health, Biogénesis Bagó, Kemin Industries, Inc., and Alltech, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary drugs market appears promising, driven by increasing pet ownership and advancements in veterinary medicine. As the global population continues to grow, the demand for animal protein will likely rise, necessitating improved animal health solutions. Additionally, the integration of telemedicine and e-commerce in veterinary practices is expected to enhance accessibility and convenience for pet owners, further driving market growth. The focus on preventive healthcare will also shape the landscape, encouraging proactive health management for animals.

| Segment | Sub-Segments |

|---|---|

| By Type | Antimicrobials (e.g., antibiotics, antifungals) Vaccines (inactivated, live attenuated, recombinant, subunit, DNA) Parasiticides (endoparasiticides, ectoparasiticides, endectocides, antiprotozoals) Anti-inflammatory & Analgesic Drugs Hormonal Medications Nutraceuticals & Feed Additives Antifungals & Others |

| By End-User | Companion Animals (dogs, cats, horses, etc.) Livestock (cattle, poultry, swine, sheep, goats, etc.) Aquaculture |

| By Distribution Channel | Veterinary Hospitals & Clinics Online Pharmacies Retail Pharmacies & Drug Stores Direct Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (Japan, China, India, Australia, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Animal Type | Dogs Cats Cattle Poultry Swine Horses & Others |

| By Formulation | Oral Injectable Topical Other Routes (e.g., intramammary, intranasal) |

| By Price Range | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Pharmacies | 80 | Pharmacists, Store Managers |

| Animal Hospitals | 60 | Veterinary Technicians, Hospital Administrators |

| Pet Owners | 120 | Pet Owners, Animal Caregivers |

| Veterinary Associations | 40 | Association Leaders, Policy Makers |

The Global Veterinary Drugs Market is valued at approximately USD 50 billion, driven by factors such as the rising prevalence of zoonotic diseases, increased pet ownership, and advancements in veterinary medicine and pharmaceuticals.