Region:Global

Author(s):Rebecca

Product Code:KRAD4980

Pages:98

Published On:December 2025

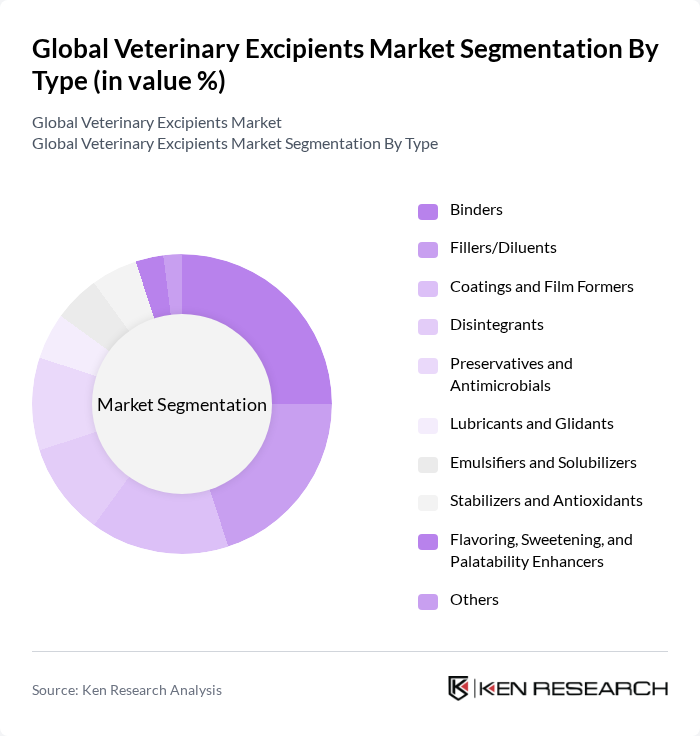

By Type:The market is segmented into various types of excipients, including binders, fillers/diluents, coatings and film formers, disintegrants, preservatives and antimicrobials, lubricants and glidants, emulsifiers and solubilizers, stabilizers and antioxidants, flavoring, sweetening, and palatability enhancers, and others. This structure is consistent with industry analyses that categorize veterinary excipients by function such as binders, disintegrants, lubricants, emulsifiers, preservatives, stabilizers, and palatability enhancers for oral and injectable formulations. Among these, binders and fillers/diluents are particularly significant due to their essential roles in tablet and bolus formation, dose uniformity, and stability of veterinary medicines, especially in oral formulations that lead the market.

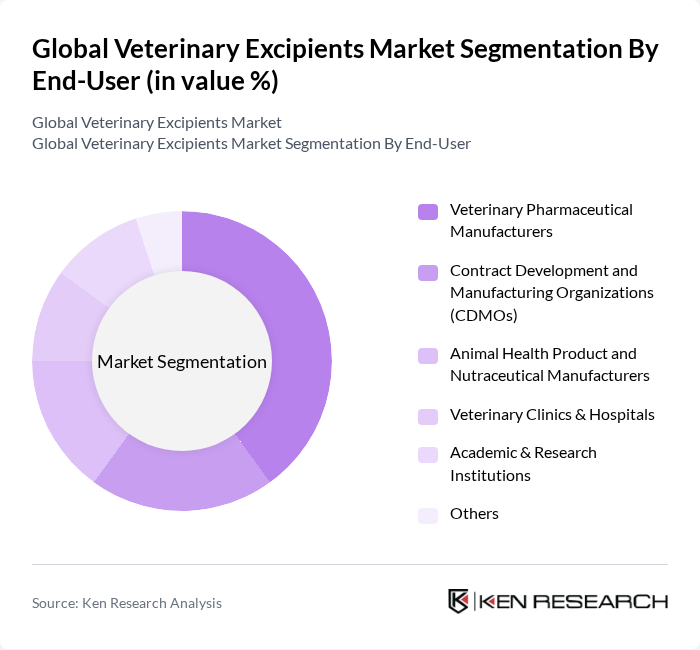

By End-User:The end-user segmentation includes veterinary pharmaceutical manufacturers, contract development and manufacturing organizations (CDMOs), animal health product and nutraceutical manufacturers, veterinary clinics & hospitals, academic & research institutions, and others. This segmentation aligns with industry assessments where pharmaceutical and animal health companies are the primary users of veterinary excipients, supported by CDMOs and nutraceutical manufacturers developing dosage forms for companion animals and livestock. Veterinary pharmaceutical manufacturers are the leading end-users, driven by the increasing demand for innovative veterinary medicines, long-acting injectables, advanced oral formulations, and the need for high-quality, regulatory-compliant excipients in their formulations.

The Global Veterinary Excipients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Ashland Inc., Dow Chemical Company, Croda International Plc, Ingredion Incorporated, Merck KGaA, Roquette Frères, JRS Pharma GmbH & Co. KG, Colorcon Inc., Gattefossé, Lubrizol Corporation, Sensient Technologies Corporation, DFE Pharma, Clariant AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary excipients market appears promising, driven by increasing investments in veterinary research and the growing trend towards personalized medicine. As the industry adapts to evolving consumer preferences, there will be a notable shift towards natural and organic excipients. Additionally, technological advancements in drug formulation and delivery systems are expected to enhance the efficacy of veterinary products, ultimately improving animal health outcomes and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Binders Fillers/Diluents Coatings and Film Formers Disintegrants Preservatives and Antimicrobials Lubricants and Glidants Emulsifiers and Solubilizers Stabilizers and Antioxidants Flavoring, Sweetening, and Palatability Enhancers Others |

| By End-User | Veterinary Pharmaceutical Manufacturers Contract Development and Manufacturing Organizations (CDMOs) Animal Health Product and Nutraceutical Manufacturers Veterinary Clinics & Hospitals Academic & Research Institutions Others |

| By Application | Oral Solid Dosage Forms (Tablets, Boluses, Premix, Powders) Oral Liquid Dosage Forms (Solutions, Suspensions) Parenteral/Injectable Formulations (Including Long-Acting Injectables) Topical and Transdermal Products Intramammary, Intrauterine, and Other Specialty Dosage Forms Biologics and Vaccines Feed Additives and Medicated Feed Others |

| By Source | Synthetic Excipients Natural and Semi-synthetic Excipients Animal-derived Excipients Others |

| By Formulation Type | Solid Formulations Liquid Formulations Semi-solid Formulations Controlled-release and Long-acting Formulations Others |

| By Distribution Channel | Direct Sales to Animal Health Manufacturers Distributors and Traders Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Pharmaceutical Manufacturers | 120 | R&D Managers, Product Development Leads |

| Veterinary Clinics and Hospitals | 90 | Veterinarians, Clinic Managers |

| Regulatory Bodies and Associations | 40 | Regulatory Affairs Specialists, Policy Makers |

| Veterinary Pharmacists | 60 | Pharmacy Managers, Compounding Pharmacists |

| Research Institutions and Universities | 50 | Academic Researchers, Veterinary Science Professors |

The Global Veterinary Excipients Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing demand for animal health products and advancements in veterinary pharmaceuticals.