Global Veterinary Medicine Market Overview

- The Global Veterinary Medicine Market is valued at USD 52.8 billion, based on a five-year historical analysis. This growth is primarily driven by increasing pet ownership, heightened awareness about animal health, advancements in veterinary technology, and the rising incidence of zoonotic and chronic animal diseases. The demand for effective veterinary medicines, including pharmaceuticals and vaccines, has surged as pet owners and livestock producers prioritize animal welfare and health management. Additionally, government initiatives aimed at enhancing animal welfare and food safety, as well as the expansion of pet insurance, are further contributing to market growth .

- Key players in this market include the United States, Germany, and China, which dominate due to their robust veterinary healthcare infrastructure, significant investments in research and development, and a high prevalence of pet ownership. The presence of leading veterinary pharmaceutical companies in these regions further strengthens their market position, catering to both companion animals and livestock .

- In 2023, the European Union implemented new regulations aimed at enhancing the safety and efficacy of veterinary medicines. This regulation mandates stricter testing and approval processes for veterinary pharmaceuticals, ensuring that products meet high safety standards before reaching the market. The initiative is designed to protect animal health and promote responsible use of veterinary medicines .

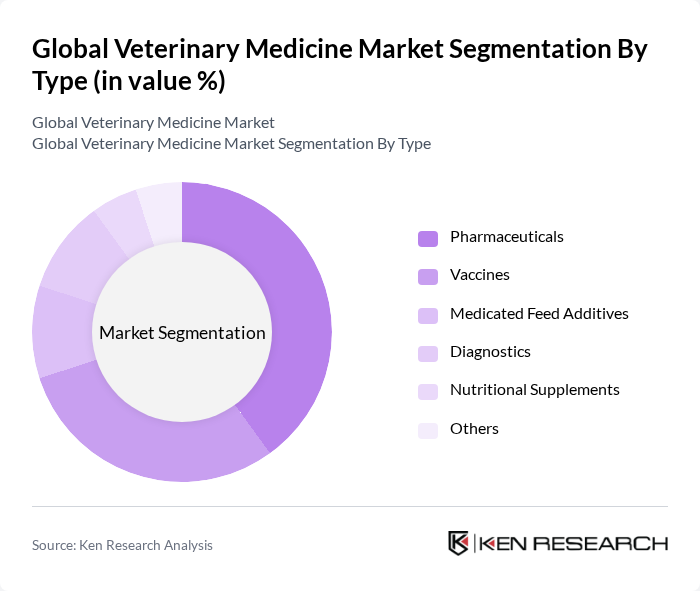

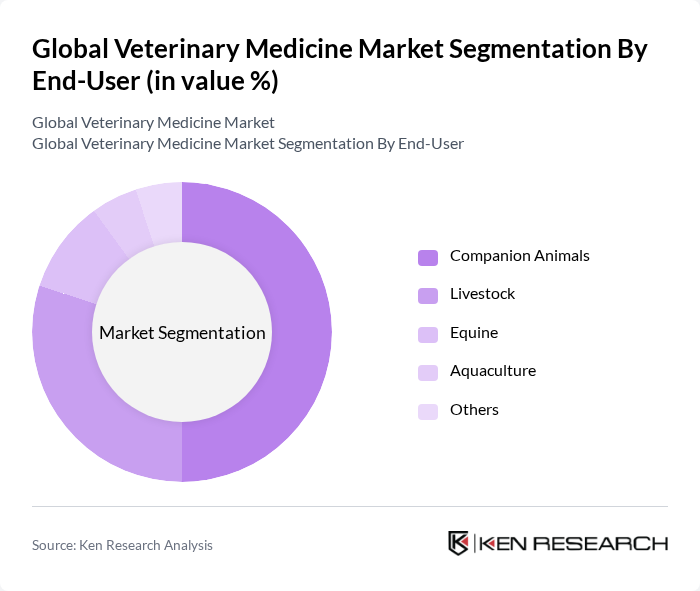

Global Veterinary Medicine Market Segmentation

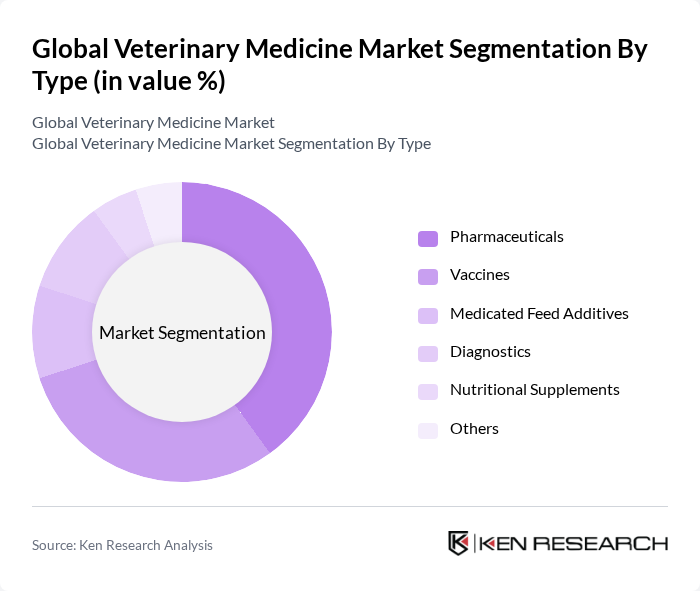

By Type:The veterinary medicine market is segmented into Pharmaceuticals, Vaccines, Medicated Feed Additives, Diagnostics, Nutritional Supplements, and Others. Among these, Pharmaceuticals and Vaccines are the leading segments due to their critical role in disease prevention and treatment in animals. The increasing incidence of zoonotic diseases, the rising prevalence of chronic conditions in companion animals, and the need for effective treatment options are driving the demand for these products. Diagnostics is also gaining significance, supported by technological advancements and the need for early disease detection .

By End-User:The end-user segmentation includes Companion Animals, Livestock, Equine, Aquaculture, and Others. The Companion Animals segment is the most significant due to the growing trend of pet adoption, the increasing willingness of pet owners to spend on healthcare, and the expansion of pet insurance. Livestock also represents a substantial portion of the market, driven by the need for disease management, productivity enhancement in food animals, and the growing demand for animal protein .

Global Veterinary Medicine Market Competitive Landscape

The Global Veterinary Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (Merck & Co., Inc.), Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac, IDEXX Laboratories, Dechra Pharmaceuticals PLC, Phibro Animal Health Corporation, Vetoquinol S.A., Bimeda Animal Health, Biogénesis Bagó, Neogen Corporation, Animal Health International (a Patterson Company), PetIQ, Inc., Kemin Industries, and Alltech contribute to innovation, geographic expansion, and service delivery in this space .

Global Veterinary Medicine Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The global pet population is projected to reach 1.5 billion in future, driven by rising disposable incomes and urbanization. In the United States alone, pet ownership has increased to approximately 66% of households, translating to about 86 million families. This surge in pet ownership directly correlates with increased spending on veterinary services, which is expected to exceed $35 billion in future, highlighting the growing demand for veterinary care and products.

- Rising Awareness of Animal Health:The global focus on animal health has intensified, with expenditures on veterinary services expected to rise to $45 billion in future. This increase is fueled by heightened awareness of zoonotic diseases and the importance of preventive care. Educational campaigns and initiatives by organizations like the World Organisation for Animal Health (OIE) have contributed to this trend, leading to a more informed pet-owning population that prioritizes regular veterinary visits and vaccinations.

- Advancements in Veterinary Technology:The veterinary technology sector is experiencing rapid growth, with investments in telemedicine and diagnostic tools projected to reach $5 billion in future. Innovations such as wearable health monitors for pets and advanced imaging techniques are enhancing diagnostic accuracy and treatment efficacy. These technological advancements not only improve animal health outcomes but also streamline veterinary practices, making them more efficient and accessible to pet owners.

Market Challenges

- High Cost of Veterinary Services:The rising costs associated with veterinary care pose a significant challenge, with average veterinary expenses for pet owners reaching approximately $1,200 annually in future. This financial burden can deter pet owners from seeking necessary medical attention for their animals, leading to untreated health issues. The high cost of advanced treatments and medications further exacerbates this challenge, limiting access to quality veterinary care for many households.

- Shortage of Veterinary Professionals:The veterinary profession is facing a critical shortage, with an estimated deficit of 30,000 veterinarians in the U.S. alone in future. This shortage is attributed to an aging workforce and insufficient enrollment in veterinary schools, which can only accommodate about 3,000 new graduates annually. The lack of qualified professionals can lead to increased wait times for appointments and reduced quality of care, impacting overall animal health.

Global Veterinary Medicine Market Future Outlook

The veterinary medicine market is poised for significant transformation, driven by technological integration and a shift towards preventive healthcare. As telemedicine becomes more prevalent, veterinary practices will enhance accessibility and convenience for pet owners. Additionally, the focus on sustainable and organic veterinary products is expected to grow, aligning with consumer preferences for environmentally friendly options. These trends will likely reshape the market landscape, fostering innovation and improving animal health outcomes in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for veterinary services. With increasing pet ownership and rising disposable incomes, these regions are expected to see a surge in demand for veterinary care, potentially reaching $10 billion in future. This growth will be driven by improved access to veterinary services and a growing awareness of animal health.

- Development of Innovative Products:The demand for innovative veterinary products, including advanced pharmaceuticals and nutraceuticals, is on the rise. The market for pet supplements alone is projected to reach $2 billion in future. Companies that invest in research and development to create effective, safe, and appealing products will likely capture significant market share, catering to the evolving needs of pet owners focused on preventive care.