Region:Global

Author(s):Shubham

Product Code:KRAB0763

Pages:87

Published On:August 2025

By Type:The market is segmented into vital signs monitors, anesthesia monitors, ECG monitors, pulse oximeters, capnometers, infusion pumps, multi-parameter monitors, wearable/remote monitoring devices, MRI systems, and others. Among these, vital signs monitors and multi-parameter monitors are leading the market due to their essential role in providing comprehensive health assessments for animals. Vital signs monitors account for a significant share, reflecting their widespread adoption in both clinical and remote veterinary settings. Anesthesia monitors and ECG monitors are also critical, particularly in surgical and cardiac care .

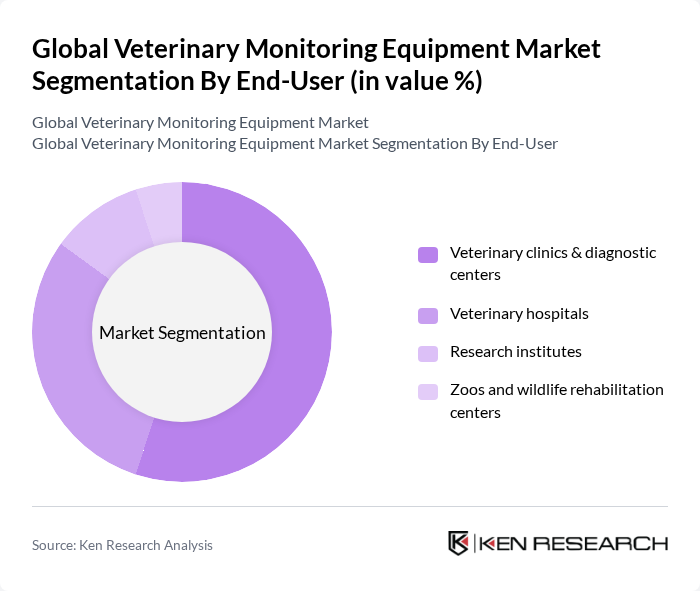

By End-User:The end-user segment includes veterinary clinics & diagnostic centers, veterinary hospitals, research institutes, and zoos and wildlife rehabilitation centers. Veterinary clinics & diagnostic centers hold the largest share, driven by the increasing number of pet owners seeking professional veterinary care and the growing trend of specialized veterinary services. Veterinary hospitals are also significant end-users, particularly for advanced monitoring and surgical procedures .

The Global Veterinary Monitoring Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., IDEXX Laboratories, Inc., Mindray Medical International Limited, Heska Corporation, Bionet America, Inc., Scil Animal Care Company GmbH, Vetland Medical Sales and Services, LLC, DRE Veterinary (Avante Health Solutions), Conmed Corporation, Eickemeyer Veterinary Equipment, Vetoquinol S.A., Neogen Corporation, Midmark Corporation, TSE Systems GmbH, and Trixie Heimtierbedarf GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary monitoring equipment market appears promising, driven by technological advancements and increasing pet ownership. The integration of IoT devices is expected to enhance real-time monitoring capabilities, while the shift towards preventive healthcare will encourage more frequent veterinary visits. Additionally, the expansion of telemedicine in veterinary care will facilitate remote consultations, further driving demand for innovative monitoring solutions. These trends indicate a dynamic market landscape poised for growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Vital signs monitors Anesthesia monitors ECG monitors Pulse oximeters Capnometers Infusion pumps Multi-parameter monitors Wearable/remote monitoring devices MRI systems Others |

| By End-User | Veterinary clinics & diagnostic centers Veterinary hospitals Research institutes Zoos and wildlife rehabilitation centers |

| By Application | Companion animals (dogs, cats, small mammals) Livestock (cattle, swine, poultry) Equine Exotic animals |

| By Distribution Channel | Direct sales Online sales Distributors Veterinary supply stores |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (Japan, China, India, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Price Range | Low range Mid range High range |

| By Brand | Premium brands Mid-tier brands Budget brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small Animal Clinics | 80 | Veterinarians, Clinic Owners |

| Large Animal Practices | 60 | Large Animal Veterinarians, Farm Animal Specialists |

| Veterinary Equipment Suppliers | 40 | Sales Managers, Product Development Leads |

| Animal Hospitals | 70 | Hospital Administrators, Veterinary Technicians |

| Research Institutions | 40 | Veterinary Researchers, Academic Professors |

The Global Veterinary Monitoring Equipment Market is valued at approximately USD 2.5 billion, driven by increasing pet ownership, advancements in veterinary technology, and a growing demand for animal healthcare services.