Region:Global

Author(s):Shubham

Product Code:KRAC0578

Pages:93

Published On:August 2025

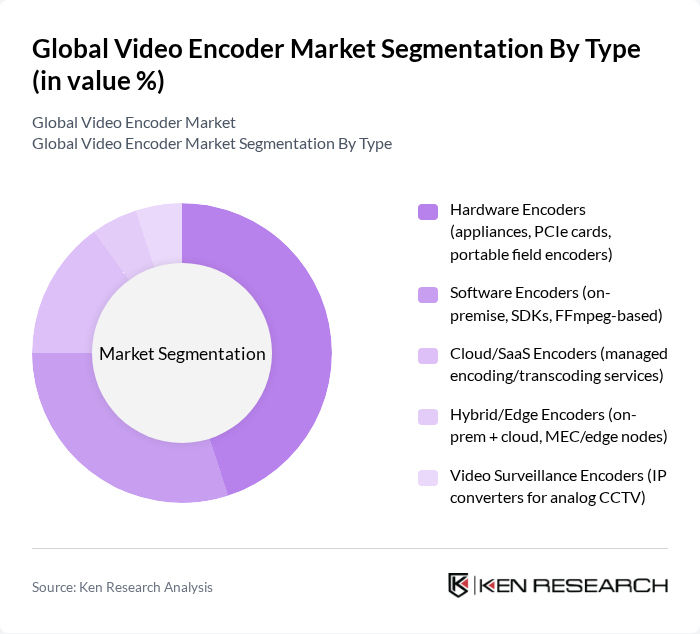

By Type:The video encoder market is segmented into various types, including hardware encoders, software encoders, cloud/SaaS encoders, hybrid/edge encoders, and video surveillance encoders. Among these, hardware encoders are currently leading the market due to their reliability, deterministic performance, and low-latency delivery in high-demand environments such as broadcast contribution and live events. The increasing need for real-time video processing for OTT live sports and remote production has further solidified their position. Software encoders are gaining traction in OTT/VOD due to flexibility, rapid codec updates (e.g., AV1 rollouts), and cost-effectiveness when paired with commodity GPUs/CPUs or cloud instances .

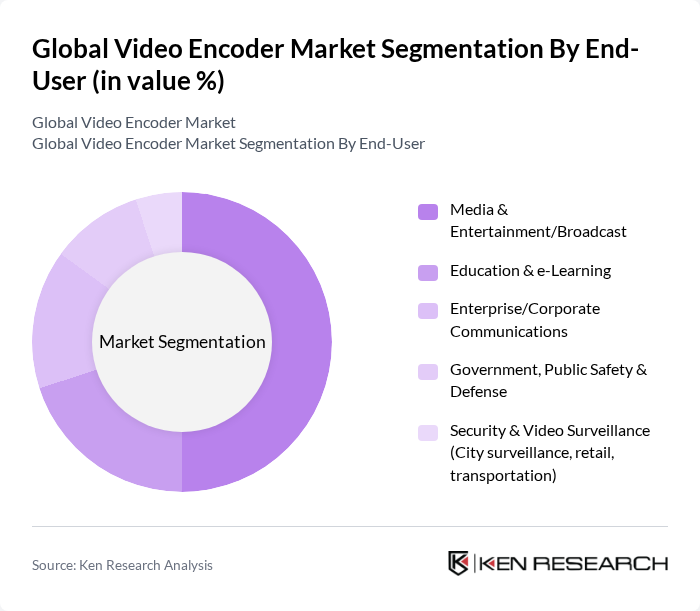

By End-User:The end-user segmentation of the video encoder market includes media & entertainment/broadcast, education & e-learning, enterprise/corporate communications, government, public safety & defense, and security & video surveillance. The media & entertainment sector is the dominant end-user, driven by the increasing consumption of video content across platforms, especially streaming and live sports, which require scalable encoding for high-definition and ultra-high-definition delivery. Continued investments in smart city and security infrastructure also sustain demand for encoders in surveillance backhaul and modernization of legacy CCTV to IP .

The Global Video Encoder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Harmonic Inc., Telestream, LLC (an affiliate of Fortive), Haivision Systems Inc., AJA Video Systems, Inc., Matrox Video (Matrox Electronic Systems Ltd.), Wowza Media Systems, LLC, AWS Elemental (Amazon Web Services, Inc.), Blackmagic Design Pty Ltd, VITEC Group (VITEC Imaging Solutions S.p.A.), Cisco Systems, Inc., Sony Group Corporation, Panasonic Holdings Corporation, Grass Valley (Grass Valley USA, LLC), NVIDIA Corporation, Ateme S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the video encoder market is poised for significant transformation, driven by the increasing integration of artificial intelligence and machine learning technologies. These advancements are expected to enhance encoding efficiency and reduce processing times. Additionally, the shift towards cloud-based solutions will facilitate greater accessibility and scalability for content creators, allowing for more dynamic and flexible video production environments. As consumer preferences evolve, the demand for real-time video processing will also rise, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Encoders (appliances, PCIe cards, portable field encoders) Software Encoders (on-premise, SDKs, FFmpeg-based) Cloud/SaaS Encoders (managed encoding/transcoding services) Hybrid/Edge Encoders (on-prem + cloud, MEC/edge nodes) Video Surveillance Encoders (IP converters for analog CCTV) |

| By End-User | Media & Entertainment/Broadcast Education & e-Learning Enterprise/Corporate Communications Government, Public Safety & Defense Security & Video Surveillance (City surveillance, retail, transportation) |

| By Application | Live Streaming & Contribution Video Conferencing & Unified Communications Video on Demand (VOD) & File-Based Transcoding Broadcasting & OTT Delivery (linear, FAST, IPTV) Remote Production (REMI), Sports & Events |

| By Distribution Mode | Direct Sales (OEM/ODM, enterprise) Online Sales (vendor portals, marketplaces) Distributors/Value-Added Resellers (VARs/SIs) Channel Partners/Telcos/CDNs Retail/Pro A/V Dealers |

| By Pricing Model | Perpetual License (capex) Subscription/SaaS (opex) Usage-Based (per minute/per GB/per channel) Tiered Feature Bundles (basic/pro/enterprise) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Segment | Small Enterprises Medium Enterprises Large Enterprises Broadcasters & OTT Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Broadcasting Industry | 120 | Broadcast Engineers, Technical Directors |

| OTT Platforms | 90 | Product Managers, Content Delivery Network Specialists |

| Enterprise Video Solutions | 70 | IT Managers, Corporate Communication Heads |

| Educational Institutions | 60 | Media Production Coordinators, IT Administrators |

| Video Encoding Software Providers | 80 | Software Developers, Product Marketing Managers |

The Global Video Encoder Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by the increasing demand for high-quality video streaming and advancements in encoding technologies.