Region:Global

Author(s):Dev

Product Code:KRAC0522

Pages:91

Published On:August 2025

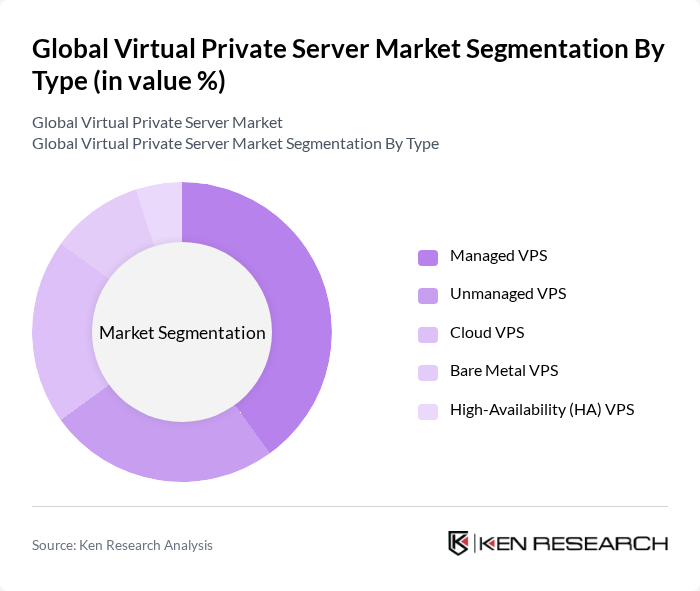

By Type:The market is segmented into Managed VPS, Unmanaged VPS, Cloud VPS, Bare Metal VPS, and High-Availability (HA) VPS. Among these, Managed VPS is gaining traction due to its ease of use and comprehensive support services, making it particularly appealing to small and medium enterprises (SMEs) that may lack in-house IT expertise; recent analyses indicate managed VPS holds a leading share globally. Unmanaged VPS, while cost-effective, is preferred by tech-savvy users who require more control over their server environments. Cloud VPS is also witnessing significant growth, driven by the increasing adoption of cloud computing solutions and demand for scalable resources with predictable pricing.

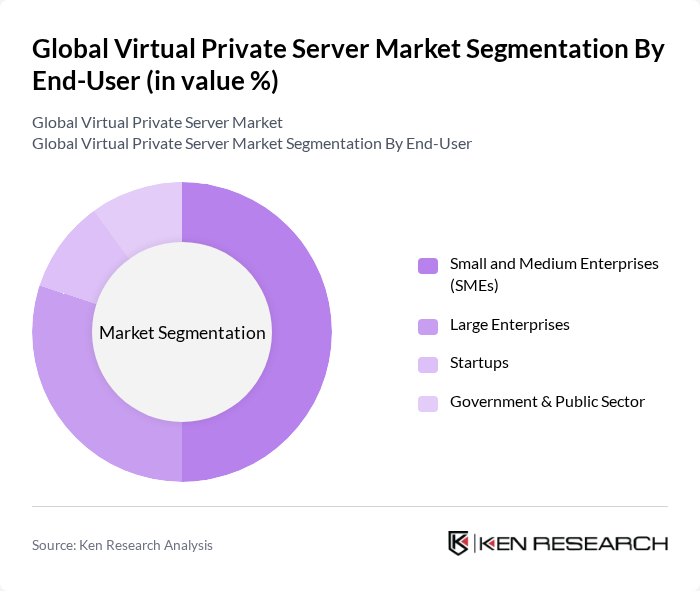

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Startups, and Government & Public Sector. SMEs are the leading segment, driven by their increasing reliance on digital solutions for business operations and their preference for cost-effective, scalable hosting. The flexibility and cost-effectiveness of VPS solutions make them particularly attractive to SMEs, allowing them to scale their IT resources as needed; large enterprises also contribute significantly to the market, leveraging VPS for performance, isolation, and hybrid architectures alongside public cloud.

The Global Virtual Private Server Market is characterized by a dynamic mix of regional and international players. Leading participants such as DigitalOcean, LLC, Linode, LLC (Akamai Linode), Vultr Holdings, LLC, Amazon Web Services, Inc., Microsoft Azure (Microsoft Corporation), Google Cloud Platform (Google LLC), OVHcloud, A2 Hosting, Inc., HostGator.com, LLC, Bluehost, Inc., InMotion Hosting, Inc., Liquid Web, LLC, DreamHost, LLC, GoDaddy Operating Company, LLC, Rackspace Technology, Inc., IONOS SE, Hetzner Online GmbH, Contabo GmbH, Kamatera Ltd., Alibaba Cloud (Alibaba Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the VPS market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt hybrid cloud solutions, the demand for VPS services is expected to rise. Additionally, the integration of automation in server management will streamline operations, enhancing efficiency. The focus on sustainable practices will also shape the market, as providers adopt green hosting solutions to meet environmental standards and attract eco-conscious clients.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed VPS Unmanaged VPS Cloud VPS Bare Metal VPS High-Availability (HA) VPS |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Startups Government & Public Sector |

| By Application | Web & Content Hosting Application & API Hosting Game & Media Streaming Hosting Database & Analytics Hosting Development/Testing & CI/CD |

| By Deployment Model | Single-Tenant VPS Multi-Tenant VPS Hybrid (On?prem + VPS) |

| By Pricing Model | Pay-as-you-go (Usage-based) Subscription-based (Monthly/Annual) Reserved/Committed Use Plans |

| By Service Level Agreement (SLA) | % Uptime SLA % Uptime SLA % Uptime SLA |

| By Customer Type | Individual Developers & Freelancers Businesses Educational & Research Institutions Non-Profit Organizations |

| By Operating System | Linux Windows Other UNIX-like (e.g., FreeBSD) |

| By Industry Vertical | IT & Telecommunications BFSI Retail & E-commerce Healthcare Government & Defense Media & Entertainment Manufacturing Education |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small Business VPS Adoption | 140 | IT Managers, Business Owners |

| Enterprise-Level VPS Solutions | 100 | Cloud Architects, IT Directors |

| VPS for E-commerce Platforms | 80 | eCommerce Managers, Digital Marketing Heads |

| VPS in Educational Institutions | 70 | IT Administrators, Educational Technology Coordinators |

| Managed VPS Services | 90 | Operations Managers, Service Delivery Managers |

The Global Virtual Private Server Market is valued at approximately USD 5.5 billion, reflecting a significant growth trend driven by the increasing demand for scalable and flexible hosting solutions among businesses, particularly small and medium enterprises (SMEs).