Region:Global

Author(s):Shubham

Product Code:KRAC0674

Pages:82

Published On:August 2025

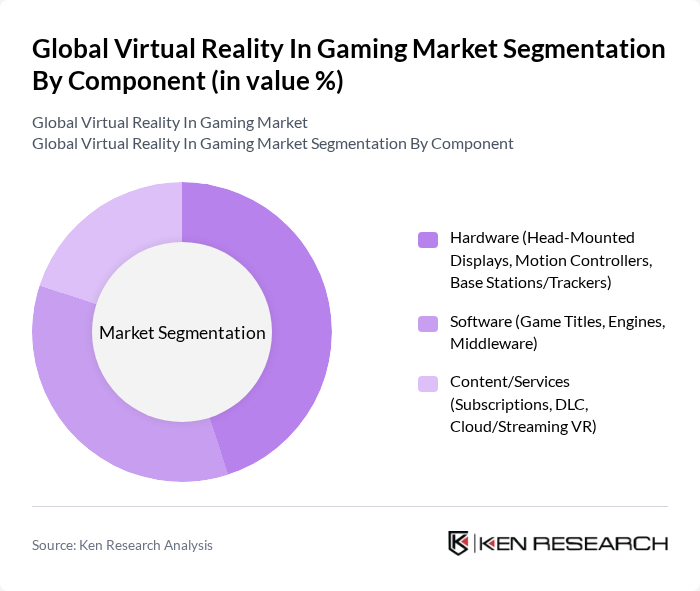

By Component:The market is segmented into Hardware, Software, and Content/Services. Hardware includes head-mounted displays, motion controllers, and base stations/trackers, which are essential for delivering immersive experiences. Software encompasses game titles, engines, and middleware that facilitate game development. Content/Services cover subscriptions, downloadable content (DLC), and cloud/streaming VR services, which enhance user engagement and retention.

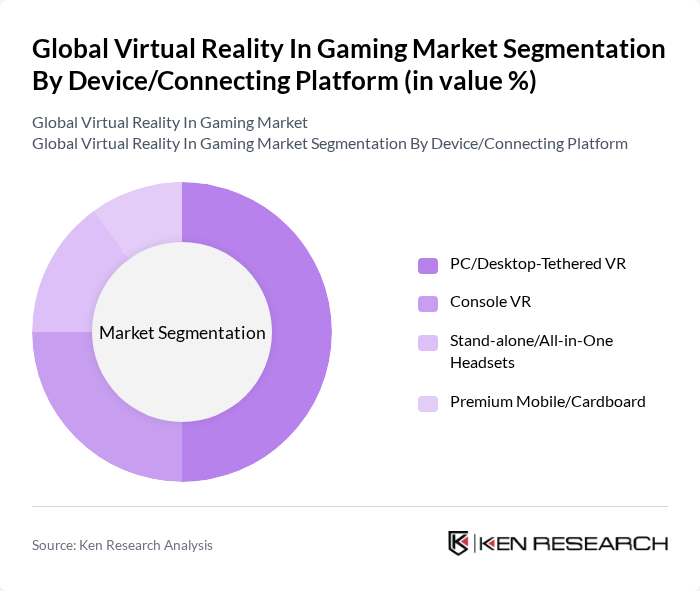

By Device/Connecting Platform:The market is divided into PC/Desktop-Tethered VR, Console VR, Stand-alone/All-in-One Headsets, and Premium Mobile/Cardboard. PC/Desktop-Tethered VR remains popular due to high-performance capabilities, while Console VR is gaining traction with the rise of gaming consoles. Stand-alone headsets offer convenience and accessibility, and Premium Mobile/Cardboard solutions cater to casual gamers seeking affordable options. Recent trends show strong momentum for stand-alone headsets such as the Quest line due to ease of use and price-performance, while console VR interest is supported by platform exclusives and ecosystem integration.

The Global Virtual Reality In Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc. (Oculus/Meta Quest), Sony Interactive Entertainment (PlayStation VR2), HTC Corporation (Vive/Viveport), Valve Corporation (SteamVR/Index), Microsoft Corporation (Windows Mixed Reality/Xbox ecosystem), NVIDIA Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Unity Technologies, Epic Games, Inc. (Unreal Engine), Pimax Technology Co., Ltd., Varjo Technologies Oy, bHaptics Inc., Razer Inc., Virtuix Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the VR gaming market appears promising, with technological advancements and increasing consumer interest driving growth. As VR hardware becomes more affordable and content libraries expand, user adoption is expected to rise significantly. Additionally, the integration of social features and cross-platform capabilities will enhance the gaming experience, attracting a broader audience. The market is likely to witness innovative collaborations between gaming companies and streaming platforms, further solidifying VR's position in the entertainment landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Head-Mounted Displays, Motion Controllers, Base Stations/Trackers) Software (Game Titles, Engines, Middleware) Content/Services (Subscriptions, DLC, Cloud/Streaming VR) |

| By Device/Connecting Platform | PC/Desktop-Tethered VR Console VR Stand-alone/All-in-One Headsets Premium Mobile/Cardboard |

| By User | Individual/Home Commercial Arcades & Location-Based Entertainment (LBE) Esports & Competitive Venues Educational & Training Institutions |

| By Distribution Channel | Digital Stores/Platforms (SteamVR, PlayStation Store, Meta Quest Store, Viveport) OEM/Direct-to-Consumer Online Retailers/Marketplaces Offline Retail (Electronics & Specialty Stores) |

| By Game Genre | Action & Shooter Adventure & RPG Racing & Simulation Sports & Fitness Horror & Puzzle Social/Multiplayer Worlds |

| By Region | North America (U.S., Canada) Europe (UK, Germany, France, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Rest of APAC) Latin America (Brazil, Mexico, Rest of LATAM) Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| VR Game Developers | 90 | Game Designers, Technical Directors |

| VR Hardware Manufacturers | 70 | Product Managers, R&D Engineers |

| Gaming Community Influencers | 50 | Content Creators, Streamers |

| End-User Gamers | 140 | Casual Gamers, Hardcore Gamers |

| Industry Analysts | 40 | Market Researchers, Trend Analysts |

The Global Virtual Reality in Gaming Market is valued at approximately USD 32 billion, driven by advancements in VR technology, increasing consumer demand for immersive gameplay, and the growing availability of VR titles and platforms.