Region:Global

Author(s):Shubham

Product Code:KRAB0577

Pages:91

Published On:August 2025

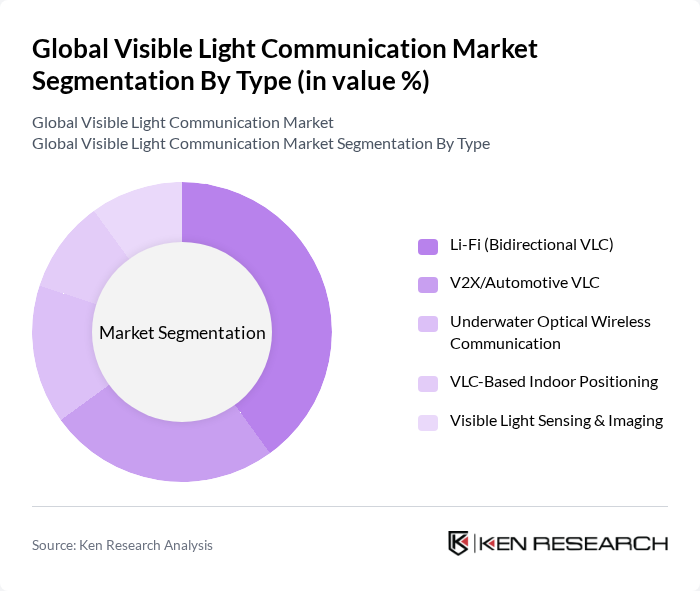

By Type:The types of visible light communication include various technologies that cater to different applications and user needs. The subsegments are Li-Fi (Bidirectional VLC), V2X/Automotive VLC, Underwater Optical Wireless Communication, VLC-Based Indoor Positioning, and Visible Light Sensing & Imaging. Among these, Li-Fi is gaining traction due to its ability to provide high-speed, secure connectivity using LEDs where RF is constrained, and to leverage existing lighting for dual-use communications.

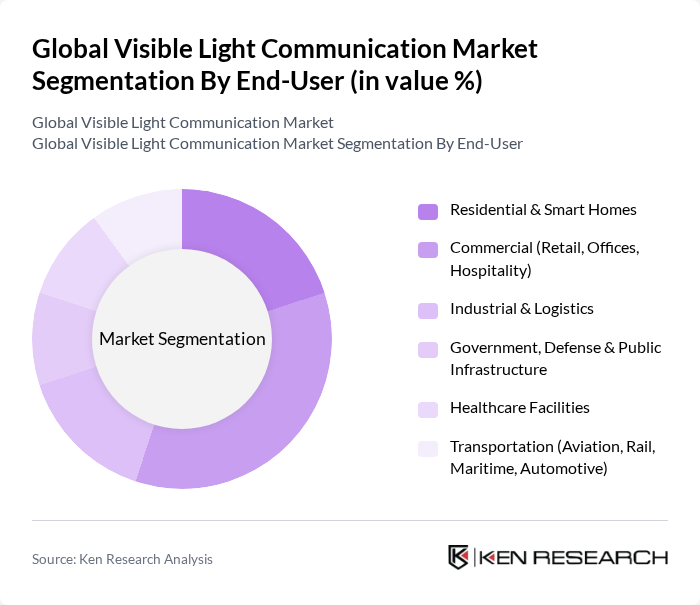

By End-User:The end-users of visible light communication span various sectors, including Residential & Smart Homes, Commercial (Retail, Offices, Hospitality), Industrial & Logistics, Government, Defense & Public Infrastructure, Healthcare Facilities, and Transportation (Aviation, Rail, Maritime, Automotive). The commercial sector is significant due to demand for secure, high-throughput connectivity, indoor positioning in retail/venues, and integration with smart lighting for efficiency.

The Global Visible Light Communication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (formerly Philips Lighting), pureLiFi Ltd., Oledcomm S.A.S., LightBee S.L., LVX System, Qualcomm Technologies, Inc., Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Cisco Systems, Inc., Broadcom Inc., Infineon Technologies AG, NEC Corporation, fSONA Networks Corporation, Acuity Brands, Inc., Nav Wireless Technologies Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the visible light communication market appears promising, driven by technological advancements and increasing integration with existing infrastructures. As industries continue to prioritize energy efficiency and security, VLC is likely to gain traction in various sectors, including healthcare and smart cities. The ongoing development of innovative applications and the potential for collaboration with 5G networks will further enhance the market's growth trajectory, positioning VLC as a key player in the future of wireless communication technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Li?Fi (Bidirectional VLC) V2X/Automotive VLC Underwater Optical Wireless Communication VLC-Based Indoor Positioning Visible Light Sensing & Imaging |

| By End-User | Residential & Smart Homes Commercial (Retail, Offices, Hospitality) Industrial & Logistics Government, Defense & Public Infrastructure Healthcare Facilities Transportation (Aviation, Rail, Maritime, Automotive) |

| By Application | High?Speed Data Communication/Internet Access Indoor Positioning & Location?Based Services Smart Lighting & Building Automation Vehicle?to?Vehicle/Infrastructure Communication Secure Communications in EMI?Sensitive Environments Underwater Communications & Sensing |

| By Component | LED Transmitters/Lighting Fixtures Photodiodes/Photodetectors Modems, Controllers & Drivers Optical Receivers, Lenses & Filters Software/Algorithms (MAC, Modulation, Positioning) |

| By Transmission Mode | Unidirectional Bidirectional Multiuser/Networked Cells |

| By Deployment Environment | Indoor Outdoor/Urban Harsh & EMI?Sensitive (Hospitals, Aircraft, Petrochemical) |

| By Sales Channel | Direct (Projects, System Integration) Indirect (Distributors, OEM Partnerships) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector VLC Applications | 100 | IT Managers, Retail Operations Directors |

| Healthcare VLC Implementations | 80 | Healthcare IT Specialists, Facility Managers |

| Smart City VLC Projects | 70 | Urban Planners, City Infrastructure Managers |

| Automotive VLC Integration | 60 | Automotive Engineers, R&D Managers |

| Education Sector VLC Usage | 90 | IT Administrators, Educational Technology Coordinators |

The Global Visible Light Communication Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing demand for high-speed data transmission and the proliferation of smart LED lighting technologies.