Region:Global

Author(s):Rebecca

Product Code:KRAD0285

Pages:92

Published On:August 2025

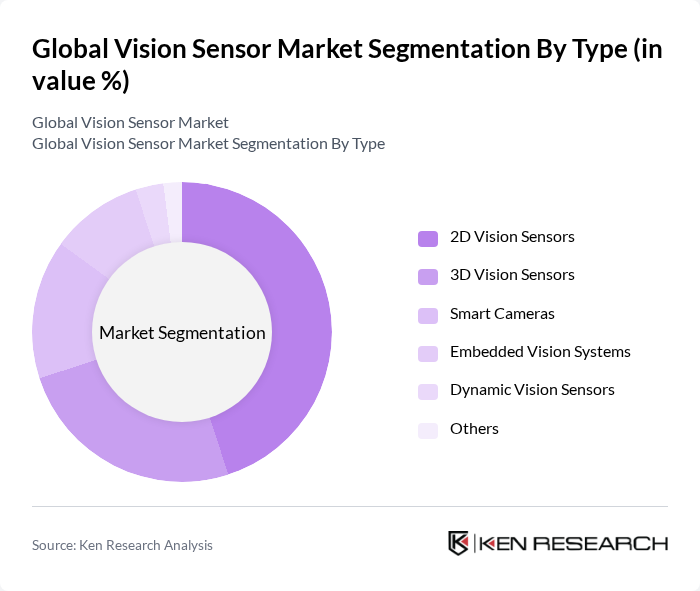

By Type:The vision sensor market is segmented into 2D Vision Sensors, 3D Vision Sensors, Smart Cameras, Embedded Vision Systems, Dynamic Vision Sensors, and Others. 2D Vision Sensors currently lead the market due to their extensive application in quality inspection, assembly verification, and automation processes. Their simplicity, cost-effectiveness, and reliability make them the preferred choice for many industries. However, demand for 3D Vision Sensors is rapidly increasing, driven by the need for more complex and accurate measurements in robotics, automotive, and advanced manufacturing, where depth perception and spatial analysis are critical .

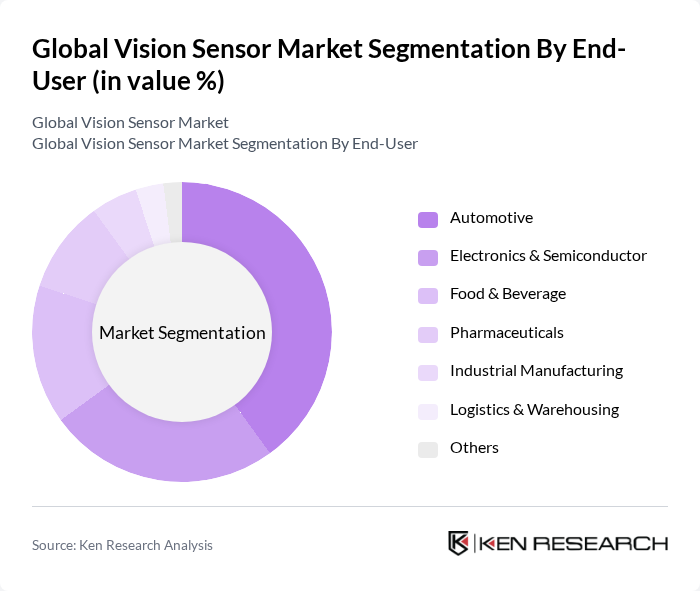

By End-User:The end-user segmentation of the vision sensor market includes Automotive, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals, Industrial Manufacturing, Logistics & Warehousing, and Others. The automotive sector is the leading end-user, driven by the widespread adoption of advanced driver-assistance systems (ADAS), automated inspection, and robotic assembly. Electronics & Semiconductor manufacturers are significant contributors, leveraging vision sensors for defect detection, precision assembly, and quality assurance. The food & beverage and pharmaceutical sectors are also experiencing notable growth due to stringent safety and quality regulations, driving increased adoption of vision sensors for packaging inspection and traceability .

The Global Vision Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cognex Corporation, Keyence Corporation, Omron Corporation, Basler AG, Teledyne Technologies Incorporated, SICK AG, National Instruments Corporation, Datalogic S.p.A., Allied Vision Technologies GmbH, Vision Components GmbH, IDS Imaging Development Systems GmbH, Ametek, Inc., Panasonic Corporation, Zebra Technologies Corporation, FLIR Systems, Inc., Baumer Holding AG, Balluff GmbH, Teledyne Digital Imaging Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the vision sensor market appears promising, driven by ongoing technological advancements and increasing automation across industries. As companies prioritize efficiency and quality, the integration of vision sensors with artificial intelligence and machine learning will enhance their capabilities. Furthermore, the shift towards smart manufacturing will likely accelerate the adoption of vision sensors, enabling real-time monitoring and data analysis. This trend is expected to create a robust ecosystem for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | D Vision Sensors D Vision Sensors Smart Cameras Embedded Vision Systems Dynamic Vision Sensors Others |

| By End-User | Automotive Electronics & Semiconductor Food & Beverage Pharmaceuticals Industrial Manufacturing Logistics & Warehousing Others |

| By Application | Quality Inspection & Control Robotics & Automation Code Reading & Identification Gauging & Measurement Packaging Inspection Surveillance & Security Others |

| By Component | Cameras & Sensors Processors & Controllers Software & Algorithms Lighting & Optics Others |

| By Distribution Channel | Direct Sales Online Retail Distributors & System Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 100 | Production Managers, Automation Engineers |

| Automotive Vision Systems | 80 | Quality Control Managers, R&D Engineers |

| Healthcare Imaging Solutions | 60 | Medical Device Engineers, Hospital Procurement Officers |

| Robotics and AI Integration | 50 | Robotics Engineers, AI Specialists |

| Consumer Electronics Applications | 40 | Product Development Managers, Market Analysts |

The Global Vision Sensor Market is valued at approximately USD 3.8 billion, reflecting significant growth driven by automation demands, advancements in imaging technologies, and the integration of AI and machine learning in vision systems.